NexGen Energy (TSX: NXE) has updated the economics of its flagship Rook I project, found in the Athabasca Basin of Saskatchewan. The updated economics include updates to estimate initial and sustaining capital, as well as operating cost estimates.

Under the revised estimates, pre-production capital costs for the Rook project are now estimated at C$2.2 billion, as compared to the $1.3 billion estimated as part of the 2020 feasibility study, a 69% increase. The substantial increase is said to have $310 million in direct and attributable inflationary increases, while $590 million is related to enhancements identified as advanced engineering occurs.

Sustaining capital has also increased dramatically, jumping from $432 million to $785 million, averaging $70 million per year.

Cash operating costs meanwhile increased to $13.86 per pound of U3O8, an increase of 82% from the $7.58 per pound estimate in 2020. Of that increase $2.65 per pound is said to be attributable to inflation, while $3.63 per pound is related to design developments and operational enhancements among other items.

READ: NexGen Reports 10.0% U3O8 Over 0.5 Metres At New Discovery

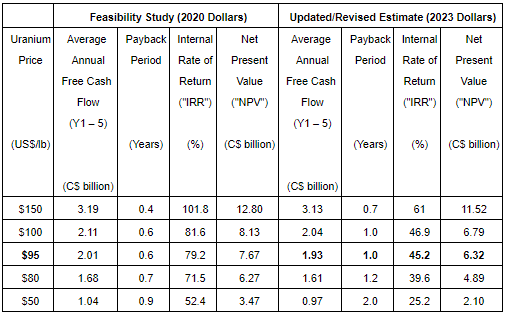

The substantial boost in the price of uranium however has helped NexGen offset the increased cost of the project. Whereas the feasibility study identified a net present value (8% discount) of C$3.47 billion based on US$50 per pound U3O8, the revised economics suggest an NPV8 of C$6.3 billion, based on US$95 per pound U3O8. Average annual free cash flow is estimated at $1.93 billion, with a payback period of 12 months and an IRR of 45.2%.

The figures are based on annual production of 30 million pounds of U3O8.

The updated costing is said to reflect the advancement of procurement from 18% complete at the time of the feasibility study being conducted, to 45% complete today.

The Rook project is now said to be ready to commence major construction activities upon final federal environmental assessment approval. Discussion with financing entities meanwhile is said to be progressing, with significant new sources of potential financing currently being received that would satisfy capital requirements for the project.

NexGen Energy last traded at $9.20 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.