Yesterday morning, Beacon Securities raised their price target on NG Energy (TSXV: GASX) from C$2.50 to C$2.70 and reiterated their buy rating on the company. This raise comes after the company closed a C$9.8 million private placement. Beacon now estimates that NG Energy will have net cash of U$11 million or higher by the end of the first quarter.

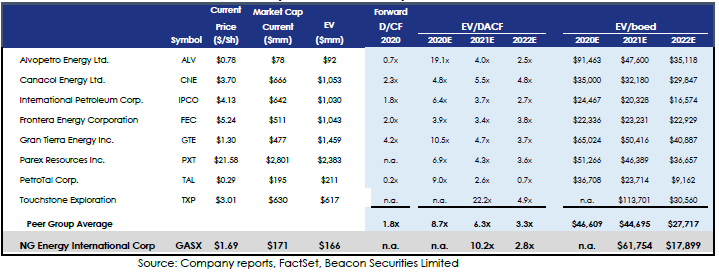

Beacon’s analyst Kirk Wilson writes, “Based on the proceeds from the financings and the encouraging technical data on the Maria Conchita Block, we have updated our risked exploration NAV, along with a 3.5x EV/DACF multiple of our 2022 forecasts.”

Wilson also adds that the companies Istanbul-1 re-entry is moving forward. As announced, it has contracted CPVEN for all the work associated with the re-entry. Wilson writes, “The re-entry of Istanbul-1 is also important in terms of proving a regional Jimol sandstone play that could lead to 3 new wells to be drilled on the Maria Conchita Block where the company’s best estimate is 200 bcf of recoverable natural gas.”

Alongside Beacon updating their price target based on this raise, Wilson has also updated their risk profile regarding exploration net-asset-value to include both the equity financings and a larger potential for the Maria Conchita Block.

Wilson believes that on an unrisked basis, the exploration potential for NG Energy is C$15 a share, and even after “applying reasonable risking parameters (considering the success/location of its properties), the potential on a risked basis is C$4.71 per share for 2P reserves.”

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive has been compensated to provide coverage on this company. The company has been compensated to cover this story on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.