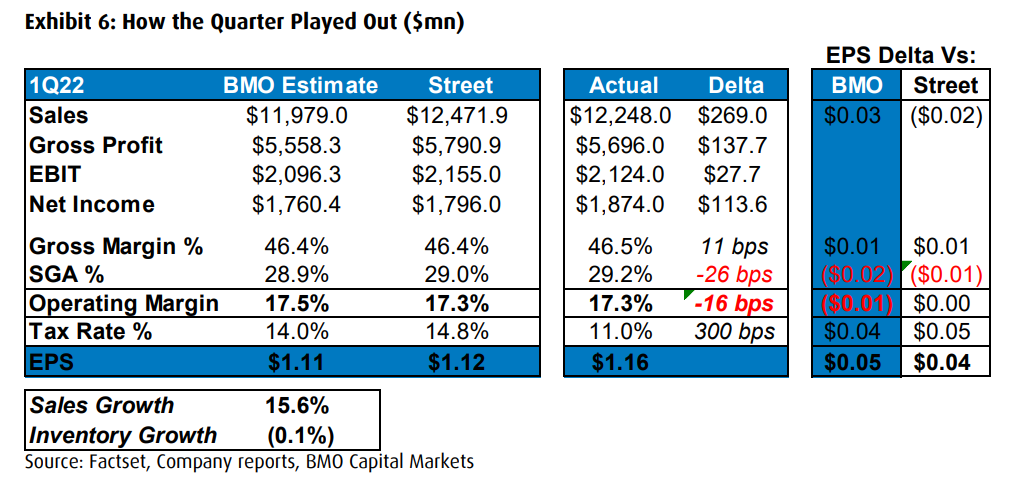

Earlier this week, Nike Inc (NYSE: NIKE) reported its fiscal first quarter of 2022. The company reported revenues of $12.2 billion, up 16% year over year. NIKE Direct sales came in at $4.7 billion for the quarter, up 28% while their digital brand sales increased 29%. The company reported gross margins of 46.5% higher than the 44.8% last year. The company had a 17.3% operating margin while net income was $1.87 billion, or earnings per share of $1.16.

A number of analysts changed their 12-month price target off the back of the results. This brought the average 12-month price target down from $184.37 to $181.13, or a 24% upside. There are currently 34 analysts covering the stock, with 10 having strong buy ratings, 19 having buys, 4 have holds and 1 analyst has a strong sell on Nike. The street high sits at $213 from Stifel, while the lowest comes in at $134.

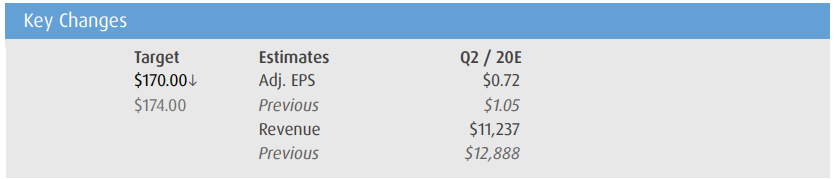

BMO Capital Markets sent out an analyst note shortly after the company reported earnings, reiterating their outperform rating but lowering their 12-month price target to $170, down from $174, saying that there is a compelling long-term competitive advantage Nike has gained but the macro headwinds shouldn’t be ignored.

For the quarter, the company beat slightly on many of BMO’s estimates, with BMO forecasting $11.979 billion in revenue with an $1.11 EPS. This beat was mainly driven by Nike’s direct sales growing at a faster pace than estimated. Although direct sales were the larger performer of revenue, BMO says that the companies digital sales grew the most at 29% year over year.

BMO says that they are forecasting fiscal 2022 revenue growth to be +MSD, as management noted that there are some severe supply chain impacts which equate to about 10 weeks of lost production in Vietnam.

Below you can see BMO’s updated second quarter estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.