NioCorp Developments (NASDAQ: NB) is a step closer to funding the development of its Elk Creek Critical Minerals Project in Nebraska. The company late yesterday revealed it is in the process of obtaining financing from the Export-Import Bank of the United States.

To that end, the company has received a preliminary non-binding indicative financing term sheet from the bank, which indicates that the bank is in the process of conducting due diligence. The term sheet was provided as part of a preliminary project letter, in response to an application for $800 million in debt financing to develop the Elk Creek project.

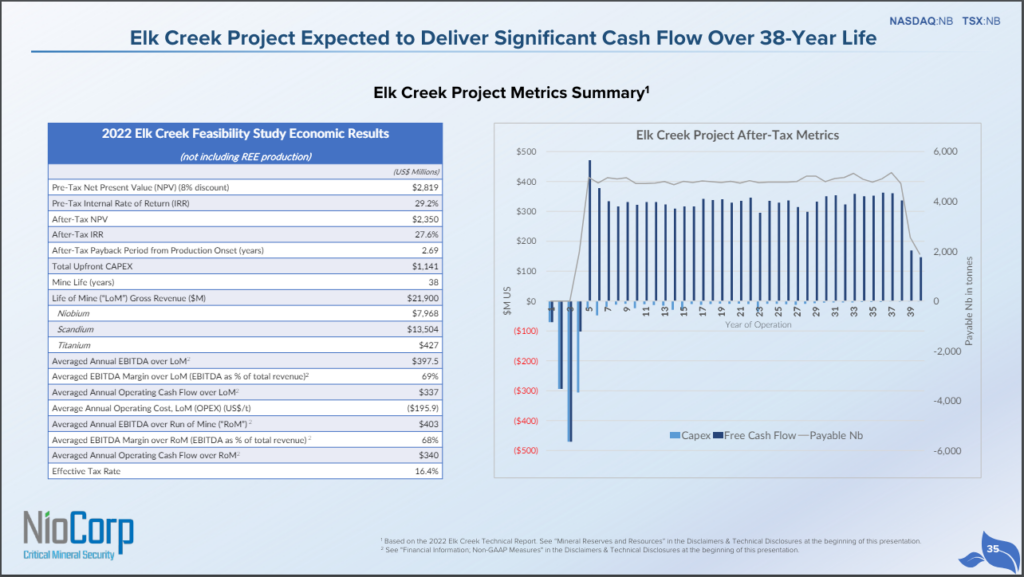

The proposed project, found 3 miles west of Elk Creek, Nebraska, consists of a proposed niobium, scandium, titanium mine that boasts an after-tax net present value of US$2.35 billion and an IRR of 27.6% based on a feasibility study released in 2022. Once operational, the mine is expected to generate average annual EBITDA of US$397 million and annual average operating cash flow of US$337 million

The project, with an estimated life of mine of 38 years, is expected to need upfront CapEx of approximately US$1.14 billion. If NioCorp were able to secure $800 million in debt financing from the Export-Import Bank, it would resolve a significant portion of the funding the project requires to advance to development, leaving an estimated $400 million to be raised via its equity.

“While it is not possible to estimate how long the application process will take, I remain very pleased and appreciative of the very focused engagement and constructive feedback that EXIM is providing to us in order to continue advancing our application for financing from the bank,” commented NioCorp CEO Mark A. Smith.

Management is said to be in the process of working with the bank to continue to advance the potential funding, pushing the application through the next stages of due diligence.

NioCorp last traded at $2.59 on the Nasdaq.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Nice article, since the 22 fs they have proved out over double the titanium as well as higher recovery on niobium, they will be adding the rareEarths as well.

My guess is the new feasibility study will be done in the next several months.

It’s looking very good for the niocorp mine in Elkcreek Nebraska.