As a result of the unprecedented crisis stemming from the coronavirus pandemic, the government of Norway is planning to sell off some of its wealth fund assets to generate enough cash flow as a means of offsetting the negative economic impacts.

Norway, which is considered to be one of the biggest soverign investors in the world, has no choice but to resort to withdrawing nearly $37 billion from its wealth fund in order to prop up its economy. The country’s wealth fund is comprised mainly of petroleum income in the form of dividends from Equinor ASA, offshore field stakes, and tax revenue. However, due to the recent oil market crisis, that incoming revenue has significantly dwindled, causing a depletion in Norway’s wealth fund.

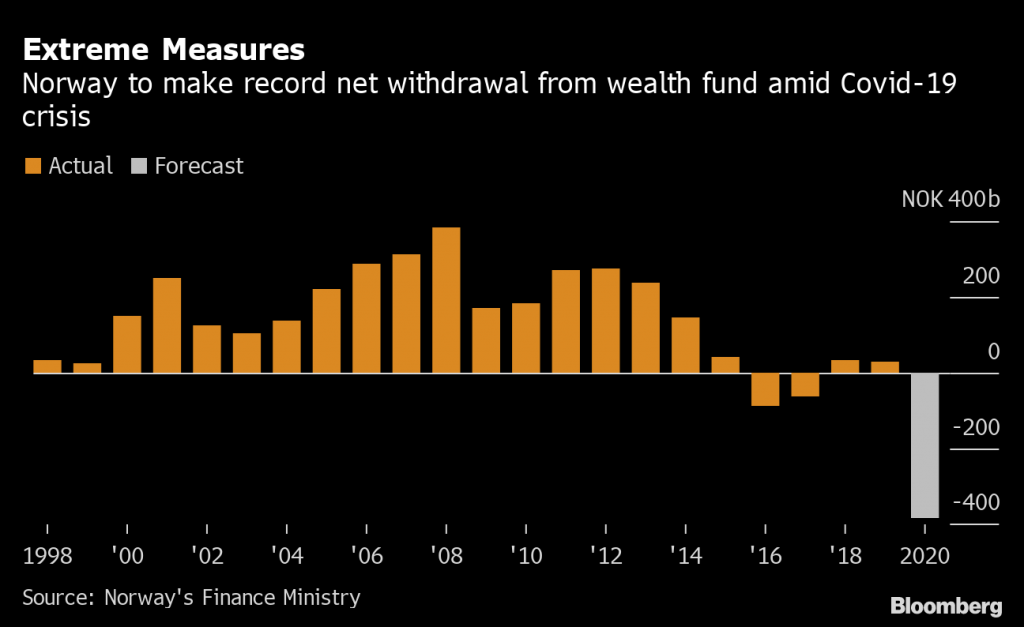

Up until the coronavirus chaos, Norway’s wealth fund was used to eliminate budget deficits, and then was replenished when the government generated a surplus revenue. However, due to lack of global oil demand stemming from the coronavirus pandemic, the withdrawals become more frequent, and oil revenue became scarce. Now, there is not enough cash flow to cover the $37 billion needed to address the country’s current economic turmoil, so the government has no choice but to begin selling assets in its bond portfolio, in addition to seizing some of the cash from bonds maturing.

As a consequence of both the oil market crash and the coronavirus crisis, it may be awhile before Norway’s wealth fund is restored to positive levels. The government has a self-imposed rule where no more than 3% of the wealth fund’s annual value is to be withdrawn. However, the current unprecedented economic turmoil is set to increase spending to 4.2%, all while the fund’s petroleum revenues are expected to drop 62% this year.

Information for this briefing was found via Bloomberg and Norway’s Finance Ministry. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.