Nova Minerals (NASDAQ: NVA) has been awarded $43.4 million in Defense Department funding to produce antimony trisulfide at its Estelle project in Alaska, an announcement that sent the stock up as much as 20% to a 52-week high of $20.87 and lifted market cap to about $130 million.

The award flows to Nova’s US subsidiary, Alaska Range Resources, which holds an 85% interest in Estelle, and is explicitly earmarked to “extract, concentrate and refine stibnite” into military-grade antimony trisulfide for the US defense industrial base, according to the company’s description of the funding scope.

explorco gets taxpayer funding to produce antimony trisulfide.

— FibSixOne8 (@FibSixOne8) October 1, 2025

Don't you need to build a mine first?

Unserious.

This is all about folks lining pockets and perhaps kickbacks to local politicians. Same with Perpetua. https://t.co/qkgEQ7lz5b

The funding is intended to accelerate ARR’s build-out of a “fully domestic, redundant supply chain” for antimony-based inputs used in munitions and other defense products, Nova CEO Christopher Gerteisen said, adding that the grant “provides further confidence in the quality of antimony mineralization and highlights the potential scale and scope of future antimony production from the Estelle project.”

Antimony remains on the US critical minerals list, and the US has not produced antimony commercially since 2016, a gap the company frames as directly aligned with the current administration’s critical-minerals strategy following an executive order earlier this year.

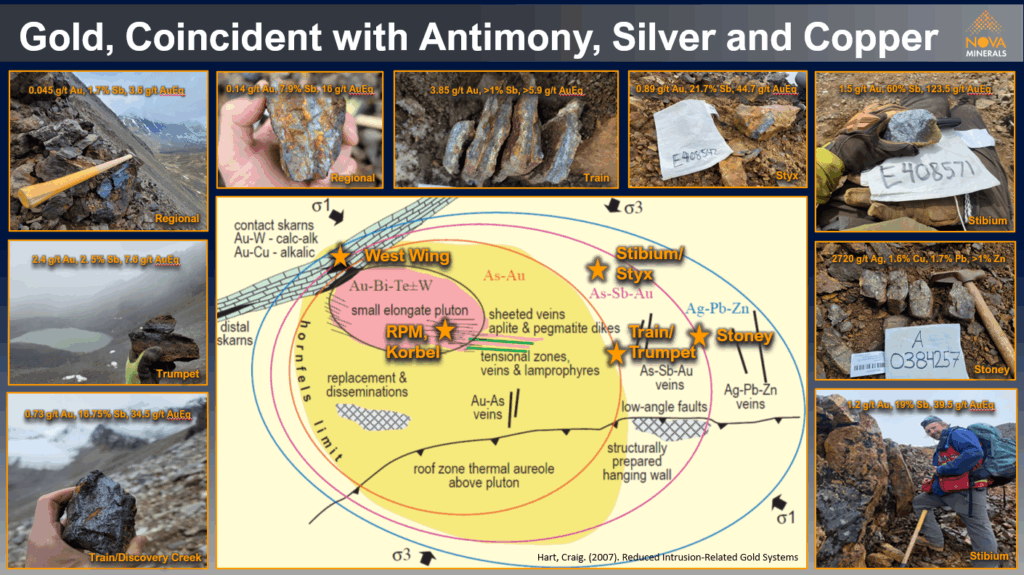

Although Estelle is known primarily for gold, the company says recent surface sampling shows antimony coincident with gold on numerous prospects across the claims.

According to the company, Estelle currently contains “measured, indicated, and inferred resource of 9.9 million ounces of gold, and pit-constrained resource at a US$2,000 oz gold price of 5.2 million ounces gold, with further drilling planned.”

Regarding antimony, the company cited an independent report identifying Estelle as “one of only nine projects globally with the potential for near-term antimony production,” adding that “while no resource has yet been established for antimony, it is the company’s intention to define an MRE for the critical mineral in 2025.”

The grant arrives alongside broader US procurement moves in the metal, including a recent $245 million Pentagon contract with US Antimony Corporation, which operates the only two North American smelters with long-standing antimony processing capacity.

Information for this story was found via Mining.com and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.