As the war between Russia and Ukraine gets underway, it appears that supply chains globally are changing at a rapid pace. The uranium sector is not immune to this, with changes already being announced by uranium consumers as they look to avoid potential oncoming sanctions, or broadcast their ethical values.

Vattenfall, a Sweden-based multinational firm that is actually owned by the Swedish government, was one of the first such uranium consumers to announce changes to its supply chain this morning. The energy producer issued a brief press release, wherein they plainly stated, “No deliveries of nuclear fuel from Russia to Vattenfall’s nuclear power plants will take place until further notice.”

It appears that the company has halted both future orders from occurring as well as in-transit deliveries as a result of the invasion of Ukraine by Russia only hours ago. The firms operations are not expected to be impacted by the decision, with the company having multiple suppliers.

Vattenhall is heavily focused on its supply chain, and how ethical it is, with the company closely screening its nuclear fuel suppliers for a number of items, including mine worker health and safety, site remediation, rights of local indigenous groups, and more. The company sources its nuclear fuel under normal circumstances from Russia, Canada, Namibia, Australia and Khazakhstan, with ongoing evaluations of country frequently occurring. Given its screening process, the halting of any orders related to Russia is not unexpected of the firm.

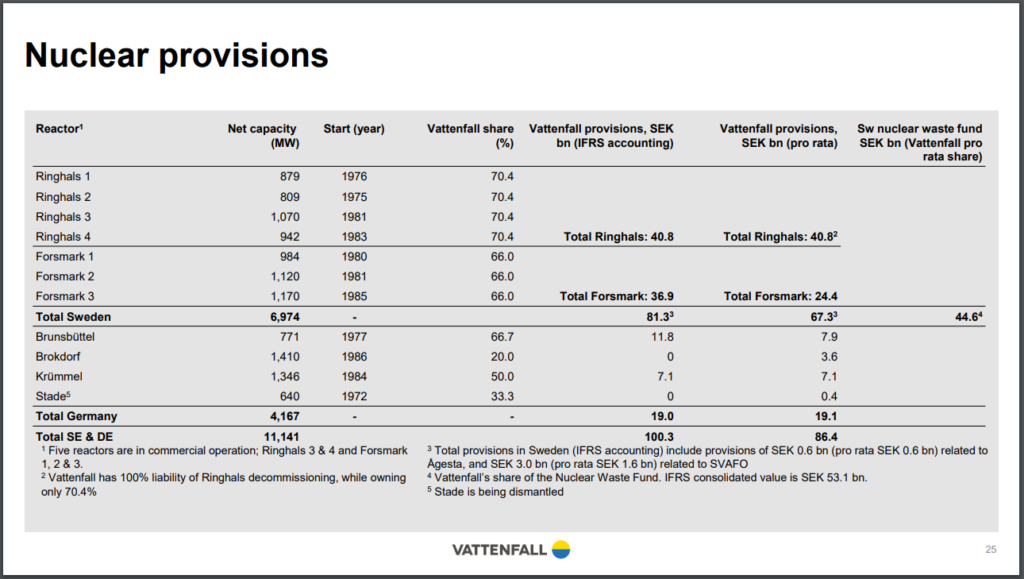

In terms of significance, Vattenfall is a rather large nuclear power producer. The firm operates seven nuclear facilities in Sweden, as well as has ownership in four Germany-based operations as well. It’s not entirely clear at this time what their annual consumption of uranium is however, or how much specifically was sourced via Russia.

According to the World Nuclear Association, Russia in 2020 produced 2,846 tonnes of uranium, the seventh largest producer globally, while having the fourth largest reserves of uranium at 8% globally. Ukraine, largely in the Donbas region where Russia is looking to stake its claim, meanwhile as per Forbes leads Europe in proven reserves of uranium.

Uranium last traded at $43.00, up 0.58% on the day.

Information for this briefing was found via Vattenfall and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.