According to a groundbreaking report by renowned commercial real estate firm CBRE, Canada is experiencing a shocking surge in office vacancies, reaching its highest level in nearly three decades. The second quarter saw the national office vacancy rate soar to a staggering 18.1%, nearing the worrisome 1994 record of 18.6%.

The country’s economic stability hangs in the balance as a perfect storm brews, combining recession threats, interest rate hikes, weakened tech sectors, tenant downsizing, and a deluge of new office spaces. The remote work revolution only amplifies the uncertainty.

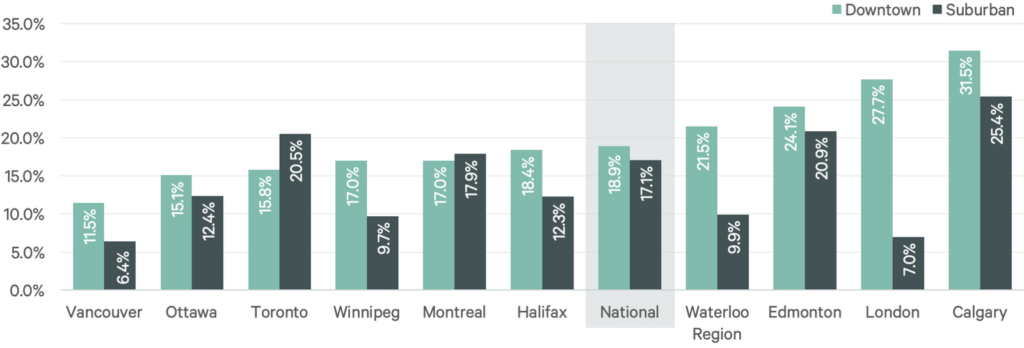

Downtown cores bear the brunt of this crisis, with the second quarter witnessing a disheartening increase in vacancy rates. The downtown office vacancy rate climbed to a concerning 18.9%, up from the previous quarter’s 18.5%. Suburban areas also suffered, with a vacancy rate of 17.1%, marking an alarming rise from the earlier 16.9%.

CBRE’s report highlights a troubling trend across major Canadian cities, where downtown vacancies surged in almost every center, except for Calgary and the Waterloo region. Vancouver’s downtown vacancy rate spiked to 11.5%, up from 10.4%, while Toronto experienced a dismaying increase to 15.8%, surpassing the first quarter’s 15.3%. Montreal, too, saw a rise in its downtown rate, reaching 17.0% from the previous 16.5%.

However, amidst the chaos, there are pockets of hope. Calgary, fueled by expansions in the engineering, construction, and education sectors, saw a slight decrease in downtown vacancy rate, dropping to 31.5% from the previous quarter’s 32.0%. Similarly, the Waterloo Region experienced a modest improvement, with its downtown rate declining to 21.5% compared to the earlier 22.0%.

CBRE emphasizes that Calgary’s situation is further bolstered by ongoing office building conversion projects, which will alleviate the oversupply predicament. Prior to the pandemic, Canada proudly boasted North America’s two lowest-vacancy office markets in Toronto and Vancouver, with downtown vacancy rates lingering around a mere two percent for several years. The current landscape, however, has taken a dramatic turn.

As the nation grapples with these concerning statistics, the construction industry soldiers on, with a whopping 11.5 million square feet of office space currently under development. Toronto claims the lion’s share with 6.2 million square feet, followed by Vancouver at 2.7 million square feet, and Montreal at 1.9 million square feet.

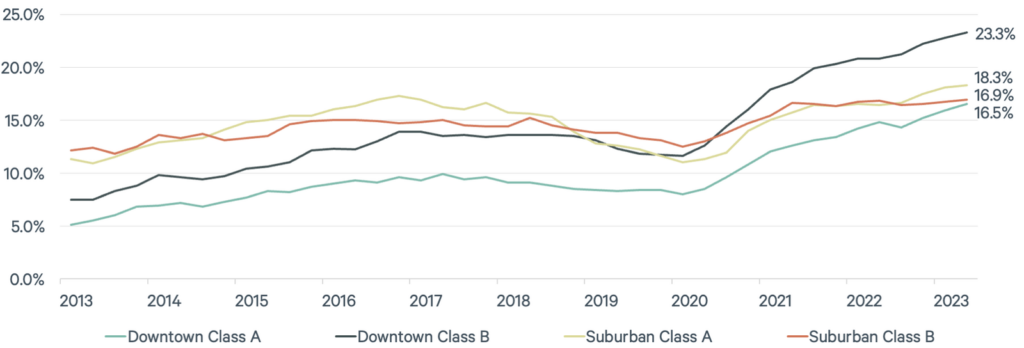

In the office sector, tenant preferences became increasingly evident, with suburban Class A properties demonstrating the strongest rental performance, experiencing a growth rate of 7.8% since Q1 2020. In contrast, downtown Class B office spaces recorded declining rates, indicating a preference for high-quality, well-amenitized buildings that minimize commute times. The overall national office vacancy rate increased to 18.1%, with downtown areas contributing more to the rise. However, the gap between downtown and suburban areas continued to widen, with the suburban vacancy rate being 180 basis points lower than downtown.

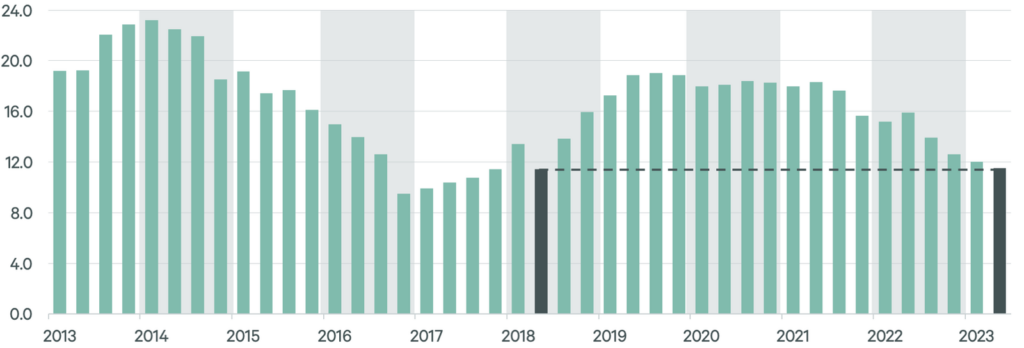

Construction activity in the office market has been steadily declining since Q2 2022, resulting in a decrease in the construction pipeline. Anticipated deliveries in the third and fourth quarters of 2023 are expected to lower the pipeline to its lowest level since 2005, with only 4.2 million square feet remaining. This decline in construction is mainly due to more projects being completed than new ones starting. The downtown Class A segment experienced an increase in vacancy rates as new supply deliveries outpaced demand, while the suburban Class A segment witnessed a gradual increase in rental rates.

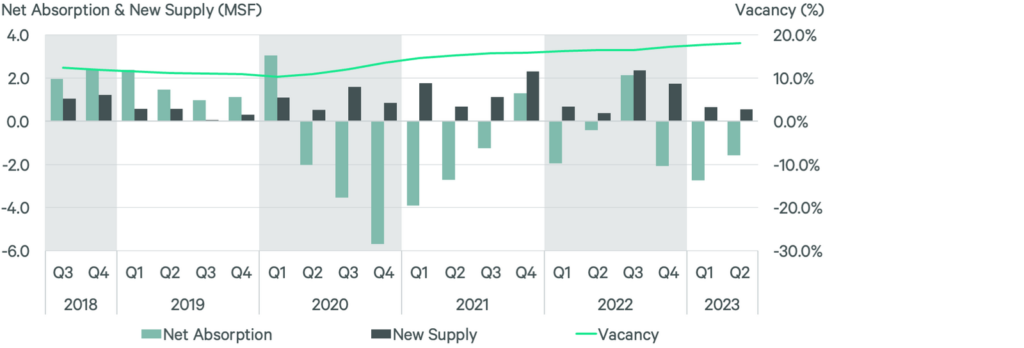

In the industrial sector, net absorption rebounded from its post-pandemic low in the previous quarter, reaching 3.4 million square feet of positive net absorption in Q2 2023. The Toronto and Edmonton markets were the primary drivers of this activity, benefiting from strong levels of pre-leased new supply. However, the Montreal market recorded negative net absorption for the second consecutive quarter. The national availability rate increased slightly to 2.1%, reflecting the rise in new supply. Despite the increase, market conditions remained tight, well below the historical average rate of 4.8%.

Construction activity in the industrial sector began to moderate from its peak levels, with the national development pipeline decreasing to 44.4 million square feet. Vancouver, Toronto, and the Waterloo Region accounted for the majority of new construction projects initiated in Q2 2023. The pace of industrial construction remained healthy, with 6.6 million square feet of net new projects breaking ground during the quarter. Rent growth in the industrial market continued to normalize, with the national average asking rent increasing by 19.3% year-over-year to $16.35 per square foot.

Overall, the Canadian office and industrial real estate markets showed varying trends in Q2 2023. While the office market experienced softening conditions, the industrial market demonstrated resilience, supported by positive net absorption and new supply.

Information for this briefing was found via CP24 and the sources mentioned. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.