PacWest Bancorp (NASDAQ: PACW), one of the most embattled U.S. regional banks, made an interesting disclosure on March 17 which suggests its depositors have not abandoned ship as quickly as many had anticipated. A much more significant level of departures seems to be reflected in its collapsing stock price. PacWest serves customers in California, North Carolina and Colorado.

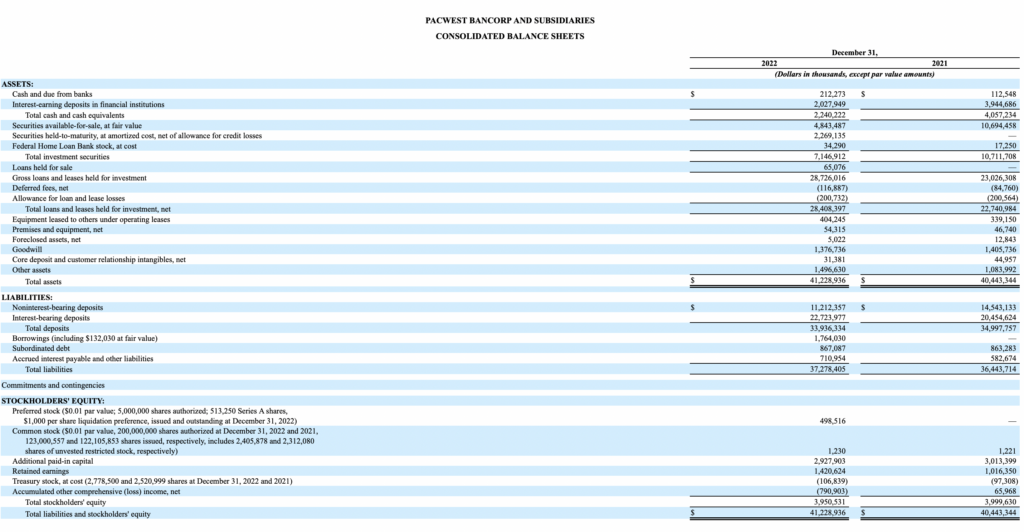

Specifically, PacWest said that it had US$10.8 billion in available cash as of March 17, a sum which exceeds its total uninsured deposits. Furthermore, the bank noted that uninsured deposits were less than 38% of its total deposits. Putting all this together, this implies that PacWest’s total deposits, about a week after the collapses of SVB Financial Group (NASDAQ: SIVB) and Signature Bank (NASDAQ: SBNY), are around approximately US$26 billion.

As of December 31, 2022, PacWest’s total deposits were US$33.9 billion. While having US$7+ billion in net deposits (or about 20% of year-end 2022 deposits) leave the bank is certainly not ideal, the magnitude of the decline is smaller than feared. After all, many banking industry observers questioned early last week why large depositors in regional banks would not transfer most or all their funds to money center banks for safety reasons after the SIVB panic.

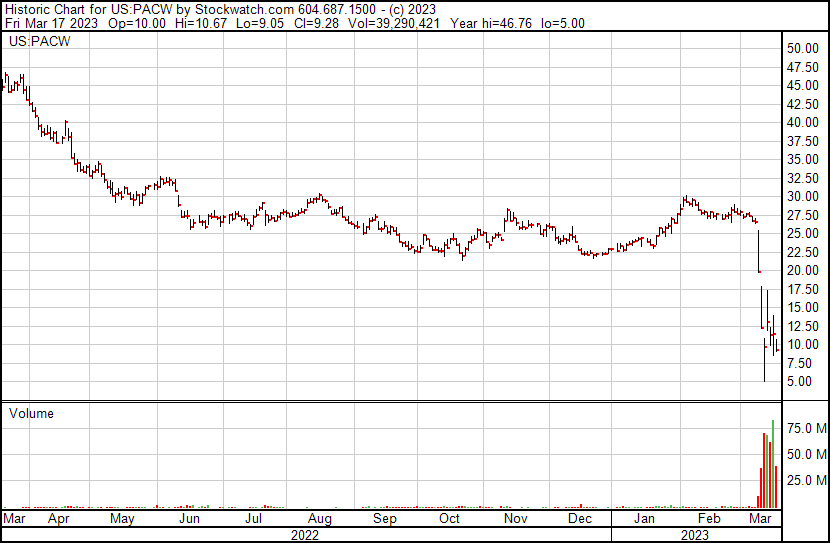

PacWest’s share price seems to reflect such outsized fears. Since news of SIVB’s difficulties began to be reported on March 9, PacWest’s stock has lost about two-thirds of its value. Furthermore, and quite surprisingly, the stock is even lower now than its weekly close on March 10 — before the Biden Administration de facto guaranteed the deposits of all regional banks in hopes of shoring up confidence in the banking system.

Clearly, regional banks and investors fear that depositors will transfer substantially more funds to larger banks. According to various media reports, a coalition of mid-sized banks have asked federal regulators to formally extend FDIC deposit insurance to all deposits, regardless of size, for two years. The FDIC currently insures bank deposits up to US$250,000 per account (US$500,000 per joint account).

Some politicians are warming to a similar idea. Supposedly, a Democratic Congressman plans to introduce legislation next week that will remove any cap on FDIC insurance. It is too early to gauge whether this legislation has sufficient support for passage.

Given all the political effort designed to make depositors in regional banks confident, plus PacWest’s better-than-expected success in holding on to its depositors and the dramatic correction in the company’s stock price, speculative-minded investors may consider PacWest shares.

PacWest Bancorp last traded at US$9.28 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.