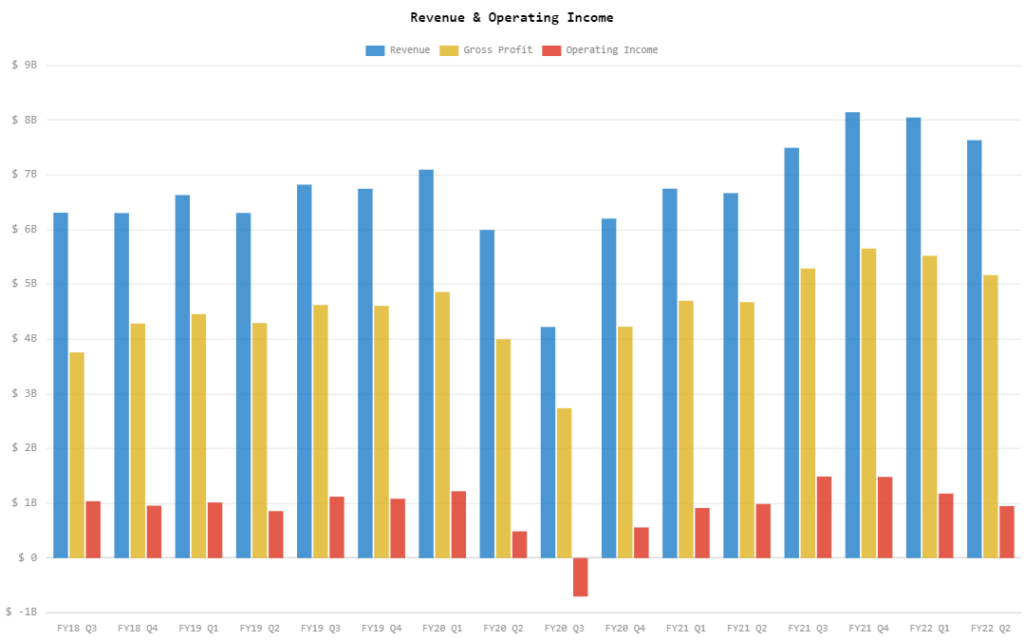

Starbucks(Nasdaq: SBUX) released on Tuesday its fiscal Q2 2022 financial results. The company posted US$7.64 billion in revenue, an increase from Q2 2022’s revenue of US$6.67 billion and also in-line with the estimates.

Following the earnings release, the beverage firm’s shares spiked as much as 5% pre-market.

While North America store sales increased by 12%, international store sales dipped by 8%, mostly driven by a 23% decline in China store sales.

“I say that with great pride having been to China so often, building confidence, trust and respect for relationships with government officials and working closely with our Chinese team,” said interim CEO Howard Schultz in the earnings call. “However, the situation in China is unprecedented… Conditions in China are such that we have virtually no ability to predict our performance in China in the back half of the year.”

Shanghai is still on lockdown due to China’s zero-tolerance policy on COVID.

Given the situation, the firm believes the best course of action is not to provide any business outlook for the next two quarters.

“Given the materiality and the high level of ongoing uncertainty around China, accelerating inflation and the significant investments we are planning, the only responsible course of action for us to take is to suspend guidance for Q3 and Q4,” Schultz said.

However, the firm’s operating income declined to US$948.9 million from US$987.6 million last year.

“Inflationary pressures have outpaced our price increases, resulting in several points of margin compression in the short term,” Schultz added.

But the firm ended with net earnings of US$675.0 million, up from last year’s US$659.4 million. This translates to US$0.58 earnings per diluted share; US$0.59 on a non-GAAP basis, which missed the estimates by US$0.01.

On the earnings call, the firm also announced its proposed strides regarding its employees amid labor issues.

“As we’ve made the move on wage for the majority of our hourly partners, our baristas and we’ve also committed to addressing compression in tenure in its most recent move as well. So that will mean that every one of our partners will also have an increase this summer,” said CFO Rachel Ruggeri.

“Can I just repeat that? Every Starbucks person who is a non-manager at Starbucks will be getting an increase in pay,” Schultz seconded.

After stepping back as interim CEO, Schultz halted share repurchases as he moved to visit Starbucks stores and talk with the employees directly. The chief also announced around US$1 billion in wage hikes for fiscal 2022.

“The decision to suspend the buyback was not symbolic… We’re making strategic decisions that we think are the best interest of our shareholders,” said Schultz. “And the investments that we’re currently making are going to drive a better return than the current way in which we look at buybacks, which is 10%, 11%. And for example, if we increase retention at 10%, 20%, the investments we’re making are going to be significantly greater than that.”

The firm ended with cash and cash equivalents balance of US$3.91 billion, putting current assets balance at US$7.54 billion. Current liabilities ended at US$9.10 billion.

Starbucks last traded at US$74.33 on the Nasdaq.

Information for this briefing was found via Edgar, Seeking Alpha and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Bitter Brew: Why Coffee Prices Are Hitting All-Time Highs

If your morning coffee run has felt a little more expensive lately, it’s not just...