Paypal Holdings (NASDAQ: PYPL) ended last week down almost 5% following the release of its financial results on Wednesday wherein its first quarter results came in above analysts’ expectations. The company announced its first revenue of $6.03 billion, and a gross margin of 49.2%. Net Income for the quarter was $1.09 billion, or an 18.2% net margin, and earnings per share of $0.92.

A number of analysts changed their price targets off the back of Paypal’s earnings, bringing their average 12-month price target slightly higher from $310.52 to $314.25 from a total of 49 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- Oppenheimer raises target price to $322 from $310

- Credit Suisse raises target price to $315 from $310

- JP Morgan raises target price to $313 from $310

- Evercore ISI raises price target to $313 from $312

- Cowen and Company raises target price to $309 from $300

- RBC raises target price to $300 from $292

- Truist Securities cuts target price to $275 from $285

- Rosenblatt Securities raises target price to $354 from $350

- Compass Point raises target price to $290 from $280

- Morgan Stanley raises price target to $337 from $329

- Raymond James raises target price to $345 from $333

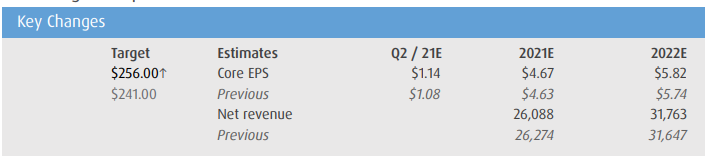

- BMO raises target price to $256 from $241

In BMO’s note to investors, their analyst, James Fotheringham, reiterates his market perform rating and raises their 12-month price target to $256 from $241. BMO also slightly changes their 2021 and 2022 earnings per share and net revenue estimates, saying, “following PYPL’s 1Q21 broad-based beat and encouraging guidance, we raise our estimates by up to 2% (higher revenues and lower costs).”

Paypal broadly beat all BMO’s estimates for the first quarter with core earnings per share coming in at $1.07 versus their $1.02 estimate, while Paypal raised their guidance during the earnings call. Paypal now expects 2021 TPV growth to be +30% year over year, net revenues to be $25.75 billion, operating margin +100bps, and free cash flow to come in at $6 billion.

Fotheringham says that Paypal had an “impressive operating performance,” with volume-driven cost growth only equating to 33% of the rate of revenue growth. He writes, “Core volume and NNA growth exceeded our expectations, implying that pandemic-inspired e-commerce trends are not abating yet. New product initiatives remain on a fast-track (e.g., Venmo credit card, in-store QR codes, BNPL, crypto trading), and the financial super-app will roll-out in 3Q21E, which we expect will accelerate growth even further (via higher engagement and product cross-selling).”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.