Last week, the Wall Street Journal reported that Peloton Interactive (Nasdaq: PTON) was looking to offer a bundle of the bike and a monthly subscription for one single monthly price. This reported price was estimated to be between $60 and $100 a month.

Peloton currently has 32 analysts covering the stock with an average 12-month price target of $43.41, or a 115% upside to the current stock price. Out of the 32 analysts, 6 have strong buy ratings, 9 have buy ratings, 15 have hold ratings and 2 have sell ratings on the name. The street high sits at US$60 from 3 different analysts, which represents a 200% upside to the current stock price.

In JMP Securities note, they reiterate their market perform rating and have no 12-month price target on Peloton. They say after the WSJ report, they decided to call multiple Peloton stores to help judge the demand for these new subscriptions. They say that the sales associates they talked to noted strong initial demand, though the subscription package remains limited to certain markets.

The subscription package seems to be getting tested out in Texas, Florida, Minnesota, and Denver. They believe that this new subscription package does not come as a surprise, given the new CEO’s background at Netflix and Spotify. They add, “we note price has long been identified as consumers’ primary hurdle to purchase, which we believe the subscription offering addresses in a new way.”

They believe that with this new subscription alongside Peloton’s sub 1% monthly churn, the company could actually accelerate demand in a period, in which people believe demand is weaning off. They also like that after the 12th month of the subscription, the consumer is given an option to purchase the bike for the remaining amount of money. They believe that this will likely help create “sticky” revenue.

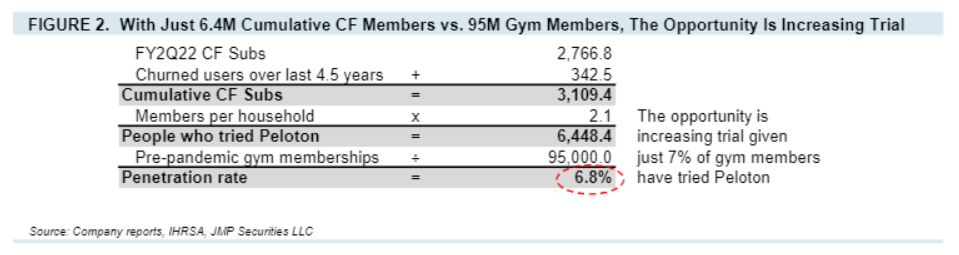

Lastly, JMP points to Peloton’s biggest opportunity, which is converting Peloton users to their connected fitness products. They estimate that only 7% of the customer base has tried a Peloton connected fitness product. They write, “reducing barriers to trial could be a significant catalyst to growth.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.