On November 9th, Plug Power (NASDAQ: PLUG) reported its third quarter financial results. The company announced that it delivered 4,559 GenDrive units and had 16 hydrogen infrastructure systems operational for this quarter, which boosted revenues to $143.9 million for the period, up 15.5% quarter over quarter.

The company reported another quarter of negative gross margins as the cost of goods sold totaled $175 million this quarter, giving the company a negative $31.02 million gross profit. Because of this, the company reported net losses of $106.67 million, or an earning per share of negative $0.19. Additionally, the company raised full-year 2022 guidance to $900-$925 million.

A number of analysts raised their 12-month price targets on Plug Power after the results, bringing the 12-month average to US$46.59 or a 16% upside. Plug Power currently has 27 analysts covering the stock with 6 analysts having strong buy ratings, 14 have buy ratings and 7 have hold ratings on the stock. The street high sits at US$78 from H.C Wainwright while the lowest price target comes in at US$35.

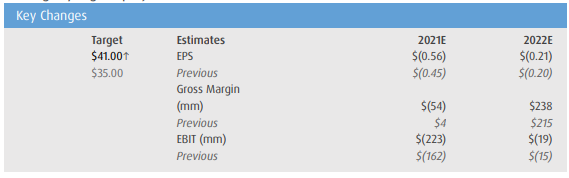

In BMO Capital Market’s third quarter review, they reiterate their market perform rating and raised their 12-month price target to $41 from $35 saying that the company is continuing its “Brisk Pace on Hydrogen Development.”

BMO is less focused on the company’s quarterly results and more focused on the company’s guidance and partnerships. They do highlight that the companies margins came in below their consensus, which they believe to reflect the challenges of sourcing hydrogen. Although they note, “we do not view this as a significant focus area for investors who remain focused on the ability of the company to become a leader in green hydrogen production and distribution.”

On the company updated 2022 guidance, they suspect that the company could further increase revenue guidance “as its confidence in electrolyzer sales is very strong.” They additionally believe that the company should have positive margins during the second half of 2022 going into 2023.

Lastly, the company expects to reduce its service costs on a per-unit basis by 30% over the next twelve months, BMO points out that the fuel business has been a drag on results/gross margins and they believe that this segment should be in “a decidedly different position 2H 2022 and 2023,” after its hydrogen production facilities come online.

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.