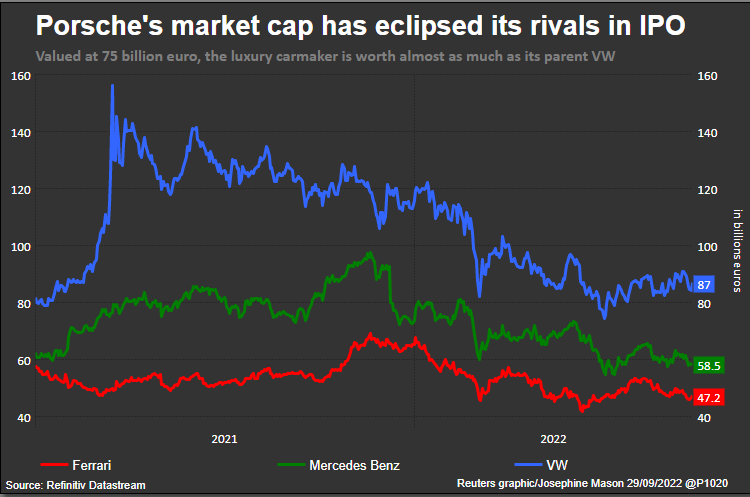

Luxury carmaker Porsche made its stock market debut on Thursday in one of Europe’s biggest initial public offerings. The firm priced the firm’s shares at the top end of the previously announced range, selling at €82.50 per share.

The offering was able to raise €19.5 billion and puts the company’s valuation at around €75 billion, nearly eclipsing its parent company The Volkswagen Group (FSE: VOW). The latter initially announced the IPO plan earlier this month and said the market debut is planned for in late September or in early October, “subject to further capital market developments.”

The IPO is Germany’s biggest listing since Deutsche Telekom in 1996.

Despite weaker stock markets, the luxury car brand is seeing a rise on its share price, peaking at €86.54 on the day. Traders said that the listing won’t be an indicator of how IPOs would perform in the current market, seeing as Porsche with a strong brand in a unique market position.

Some proceeds from the offering are slated to be used in building more electric vehicles, according to the company. Volkswagen will also propose giving its shareholders a special dividend from 49% of the proceeds in the event “of a successful IPO.”

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.