After threatening a veto, U.S. President Trump finally signed a massive US$2.3 trillion COVID-19 relief and government funding bill on December 27, 2020. The headlines of the legislation included US$600 in direct payments to most Americans and an extension of federal unemployment benefits to the long-term unemployed. Also included in the spending bill is the most constructive development for U.S.- and Canadian-based uranium miners in some time – a US$75 million provision to establish a national strategic uranium reserve.

The law mandates that the U.S. Department of Energy buy uranium from facilities licensed by the U.S. Nuclear Regulatory Commission. Companies owned or controlled by China or Russia can be banned from participation if they “pose a threat to the national security of the United States.”

Establishment of this reserve could signal improving times for uranium miners with mines on American or Canadian soil, such as Ur-Energy Inc. (TSX: URE), Cameco Corp (TSX: CCO) or Denison Mines Corp. (TSX: DML). Even micro-cap miners like Western Uranium & Vanadium Corp. (CSE: WUC) or Anfield Energy Inc. (TSXV: AEC) could eventually begin to produce uranium and sell it into the reserve, as funding for the reserve could continue through the tenure of the Biden Administration. President-elect Biden’s Democratic Party platform specifically cited nuclear technologies as one means to de-carbonize the U.S. electric power sector.

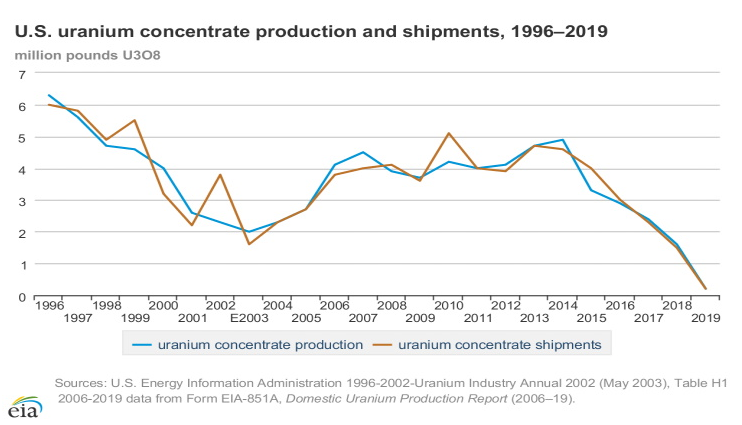

Very Little Uranium is Currently Produced in the U.S.

According to the U.S. Energy Information Administration, over 90% of uranium purchased by U.S. nuclear power plant reactors comes from outside the country. Uranium is imported into the U.S. primarily by producers in Canada, Kazakhstan, Australia, and Russia. Uranium producers in Australia and Canada are not state subsidized, but those in Kazakhstan and Russia are generally thought to be. Very little uranium is produced in the U.S.; this represents a sharp contrast to the fairly robust domestic mining industry as recently as five years ago. One goal of the strategic reserve is to reverse this trend.

Long-Term Underperformance of Stocks of Many Uranium Miners

Over the last four years, most uranium miners have significantly underperformed the broad market as measured by the S&P 500. However, as news of the constructive uranium mining legislation has filtered out, many of these stocks have turned noticeably higher over the past few weeks. We specifically show the relative performance of Ur-Energy, Uranium Energy Corp., Denison Mines, Western Uranium & Vanadium, and Anfield Energy in the graph below.

Note that the prices of Ur-Energy, Denison Mines, Western Uranium & Vanadium, and Anfield Energy are shown in Canadian dollars, and Uranium Energy Corp in US dollars. These prices are displayed on the left axis. The progression of the S&P 500 Index over the four-year period is displayed on the right axis of the graph.

As positive news regarding the resumption of uranium mining is released over the short to intermediate terms, we would expect more investors to turn their attention to the uranium mining sector. Phrased another way, the sector has underperformed for a lengthy period and speculative, or revision-to-the-mean, buyers may begin to look closely at the stocks of the miners noted above.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.