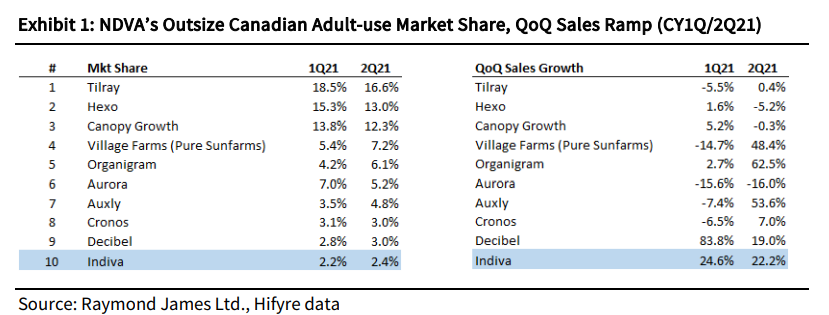

This week, Raymond James initiated coverage on Indiva Limited (TSXV: NDVA) with a $1.75 price target, or 243% upside, and a strong buy rating. They become the only firm to have coverage on the name.

Indiva is a Canadian licensed producer of “cannabis 2.0” products such as pre-rolls, flower, capsules, and edible products and provides production and manufacturing services to peer entities. They sell under the product names of Bhang Chocolate, Wana Sour Gummies, Ruby Cannabis Sugar, Sapphire Cannabis Salt, and Artisan Batch.

Raymond James believes that Indiva is an “M&A target if we’ve ever seen one,” and calls the stock 75% undervalued. With the ~11% run earlier this week, it brings their market cap to ~$70 million. This $70 million dollar company has a >50% market share in the Canadian edible segment, which equates to roughly 2.5% of the total Canadian market.

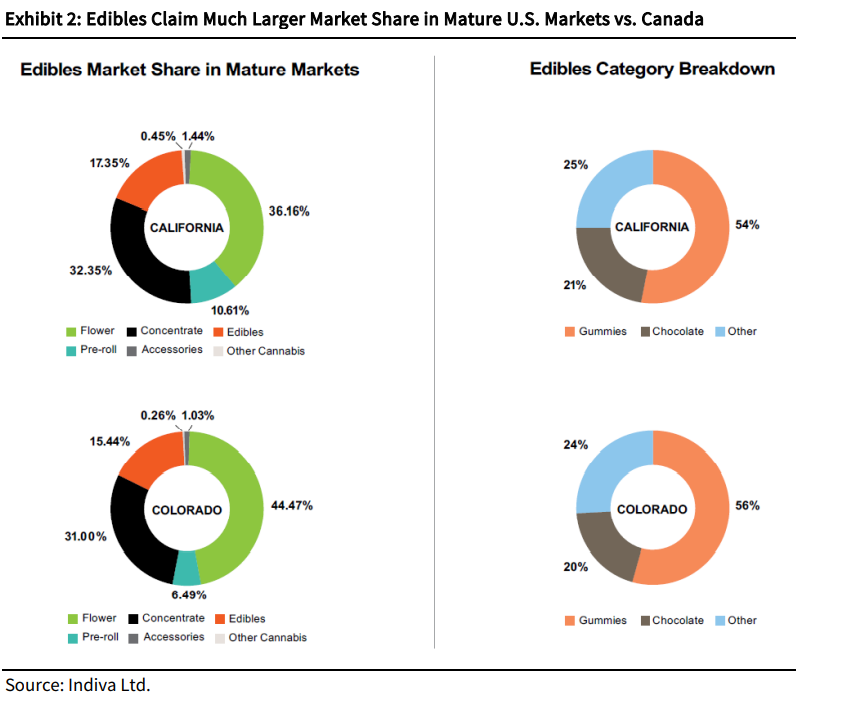

Raymond James says that the edible market is only 5% of the total Canadian adult-use market, but expects it to grow to 15% as that is what share they have in mature U.S markets. Of the 15%, 75% of it comes from gummies and chocolates, which are Indiva’s keystone product offerings. They believe that this is one of the larger tailwinds for the company and point to the weakness in the whole Canadian market as one reason edibles have not caught up to its U.S peers.

They give 3 reasons for how the edibles market has played out. The first being, the limited operating history of edibles as they only became legal two years ago. The second point is that Quebec, which is a prime market for companies, does not permit the sale of edibles. And as the third point, they say that the inaugural set of rules around the sale of edibles were much more restrictive than in the U.S.

For the forecasts, Raymond James believes that Indiva will have revenue of $37.9 million or 2.3%, ramping up to $128.1 million or 3% of the total market share by 2025. They also assume that in the long term, Indiva will drift to only capturing 20% of the edibles market.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.