Today, analyst Rahul Sarugaser from Raymond James sent out a note to investors about Village Farms (TSX: VFF) (NASDAQ: VFF), upgrading their 12-month price target to U$14 from U$11 and reiterating their Outperform 2 recommendation. The headline reads “4-5x Upside from $5 to $17-$27 Under PSF Acquisition Scenarios | Model Update.”

Rahul says that Village Farms has set themselves up to acquire an even larger majority stake, if not a 100% ownership, in the Pure SunFarms joint venture that it currently owns 58.7% of. Therefore Rahul has been proactive and modeled this hypothetical acquisition and states for Village Farm to purchase up to the remaining 41.3% of the company, it would cost them anywhere between $25 and $300 million.

Raymond James says that Pure SunFarms will capture “a 13% share of Canada’s adult-use market through 2024”, which is then stated “as the base case, which, in turn, derives a potential VFF share price of $17.00.” Raymond James then assumes that with this 100% ownership of Pure SunFarms, Village will be more motivated to hit their target of 20% market share of the Canadian cannabis market, which in turn enables the share price of Village to hit a hypothetical $27 per share.

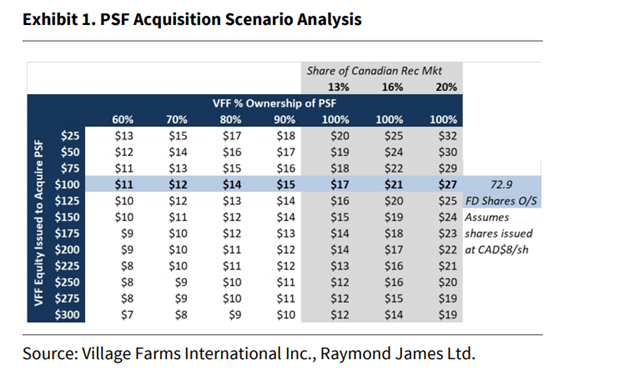

There are a lot of moving parts in this hypothetical situation and for that reason Sarugaser made a matrix to justify the valuation estimates. The matrix shows the estimated share price of Village for every additional 10% they own per every $25 million extra in shares they issue to pay for the purchase of Pure SunFarms.

There are then three different columns for caputring 13%, 16% and 20% of the Canadian cannabis market as a whole. Below you can see the hypothetical matrix. As you can see in Sarugaser’s model, if Village Farms has to pay more than $100 million for the 41.3% additional ownership, Village’s hypothetical share price will go as low as $12 – $19 per share, rather than their much rosier $17-$27.

There are currently six analyst recommendations and price targets on Village Farms. All six analysts have buy ratings. The mean 12-month price target is C$14.96, with the highest target coming from Douglas Cooper of Beacon Securities with a C$28 price target, or a 328% upside. The lowest price target is C$8 from Eric Des Lauriers of Craig Hallum, which represents a 23% upside.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.