Rivian Automotive, Inc. (NASDAQ: RIVN) is having much more success selling its R1S SUV than its R1T electric pickup truck. A customer which places an order for a new pickup today may receive the vehicle in one to two weeks. Conversely, a similar order for a new SUV might not be filled for up to 18 months. Not long ago, the wait for an R1T was about the same as that for an SUV.

Indeed, the buildup of pickup truck inventory has grown so problematic that Rivian held a sale of a “few dozen” pickup trucks on a lot in front of its factory in Normal, Illinois on June 17, per The Wall Street Journal. Customers could purchase a pickup and drive it away that day.

There is no data on how many customers actually did so last Saturday.

Such an event in the small town of Normal, Illinois, is highly unusual for Rivian, which has chosen to sell cars the way Tesla, Inc. (NASDAQ: TSLA) does: direct to consumers. Rivian does have some physical showrooms; however, those setups allow a customer to see a vehicle and perhaps test drive it, but not to purchase it on site and drive it home that day.

READ: Rivian Loses Access To New U.S. EV Tax Credits

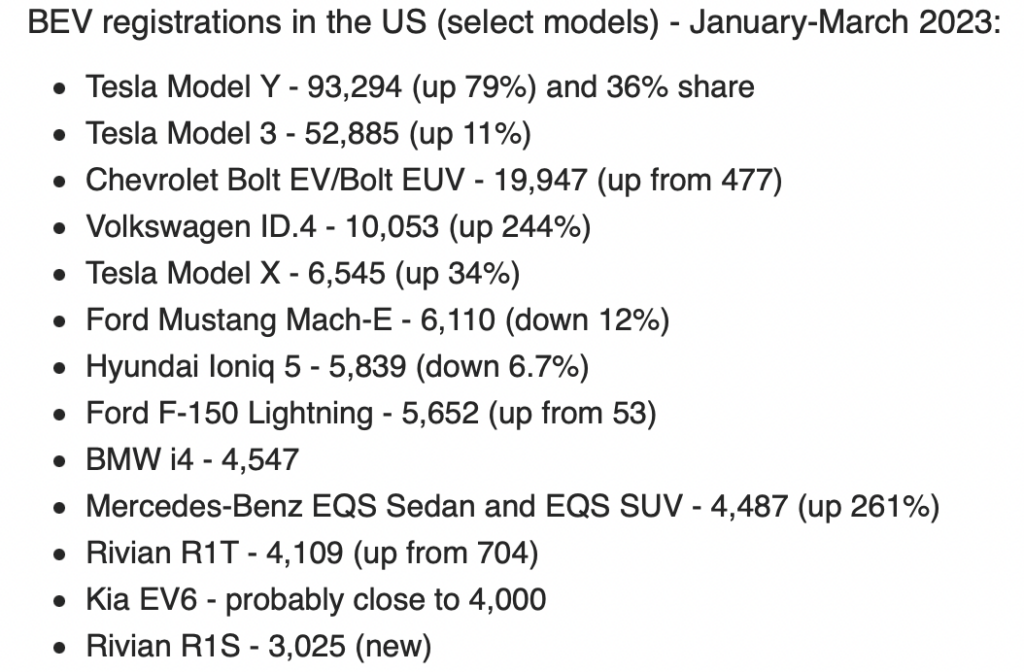

According to S&P Global Mobility, the number of monthly vehicle registrations for the R1T pickup truck have declined markedly. The number of registrations peaked in September 2022 at 1,829; the April 2023 total was only 950. The number of R1S SUV reservations, on the other hand have been generally increasing; they totaled 3,025 in the first quarter of 2023, according to InsideEVs.com.

At a recent investor presentation, Rivian CFO Claire McDonough stated that over 70% of Rivian’s existing pre-orders are for its SUV model. Rivian has not disclosed aggregate pre-order data since early November 2022; but, based on the above information about the two models, particularly the rapid delivery times for a pickup truck versus for an SUV, this percentage could actually be well above 70%.

What appears to be decreasing demand for the R1T represents a risk to Rivian’s stated goal of producing 50,000 total vehicles this year and could mean that 2024 production will not grow as rapidly as bullish investors hope. The company reaffirmed its 50,000 production goal for 2023 when it reported 1Q 2023 earnings in early May 2023, but Rivian has not announced a specific 2024 production target.

READ: Tesla: Guy Discovers ‘Elon Mode,’ Enabling Nag-Free Hands-Free Driving

Separately, on June 20, Rivian announced that it had reached a constructive deal with Tesla which allows Rivian vehicle owners to access Tesla’s Supercharging system in the U.S. and Canada beginning in 2024. Starting in 2025, future Rivian models will be configured with Tesla’s charging port configuration. The Rivian accord follows the template of recent agreements that Tesla reached with Ford Motor Company (NYSE: F) and General Motors Company (NYSE: GM).

Rivian, which has an enterprise value (EV) of about US$6.75 billion, is a difficult-to-value stock. Its revenue was just over US$2.2 billion for the twelve months ended March 31, 2023. Consequently, the stock trades at a reasonable 3x EV-to-revenue multiple. However, Rivian’s US$6.75 billion valuation is much tougher to square with a projected US$4.3 billion adjusted EBITDA shortfall this year.

Rivian Automotive, Inc. last traded at US$14.15 on the NASDAQ.

Information for this story was found via Edgar and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.