On May 28, Rokmaster Resources Corp. (TSXV: RKR) reported constructive assay results on the first nine of 42 drill holes it plans to complete in 2021 on its Revel Ridge project in southeastern British Columbia. The 42 holes will represent a cumulative 16,400 meters of drilling in a Phase 1 drilling program at the gold-rich, polymetallic sulfide resource. The cost of the drilling program is estimated to be $5 million.

The drilling results indicated significant silver-zinc mineralization, as well as a broadening of the resource.

Revel Ridge Project Details

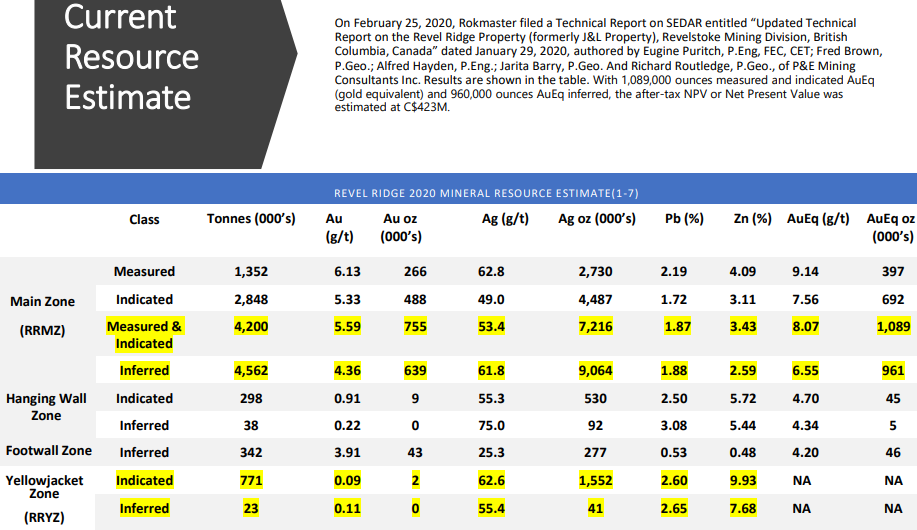

According to a January 2020 Mineral Resource Estimate, the Revel Ridge Main Zone (RRMZ) contains, on a measured and indicated basis, 1,089,000 gold-equivalent (AuEq) ounces at a grade of 8.07 grams of AuEq per tonne of resources (g/t AuEq), and a further 961,000 AuEq ounces with a 6.55 g/t AuEq composition on an inferred basis.

In late December 2019, Rokmaster completed a definitive option agreement with Huakan International Mining Inc. to acquire a 100% stake in the 14,277-hectare Revel Ridge property. To do so, Rokmaster must make a total of $44.2 million in cash payments over a five-year period.

In December 2020, Canenco Consulting Corp. released a constructive preliminary economic assessment (PEA) on Revel Ridge. The project has an after-tax net present value (NPV) of $423 million based on a 5% discount rate and conservative precious metal price assumptions of US$1,561 per ounce of gold, US$20.55 per ounce of silver, and US$1.07 per pound of zinc.

Solid Balance Sheet, But Capital Raises Seems Likely Over Next Few Months

As of March 31, 2021, Rokmaster had cash of $7.9 million and no debt. As the company has increased the pace of drilling at Revel Ridge, its quarterly operating cash flow deficit increased to $2.3 million in 4Q 2020 and $2.1 million in 1Q 2021. Given this rate of cash use, the company will probably have to raise new equity over the next few months.

| (in thousands of Canadian dollars, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($2,185) | ($3,069) | ($1,412) | ($740) | ($228) |

| Operating Cash Flow | ($2,089) | ($2,317) | ($1,135) | ($471) | ($239) |

| Cash | $7,926 | $10,177 | $3,389 | $3,732 | $234 |

| Debt – Period End | $0 | $0 | $0 | $0 | $212 |

| Shares Outstanding (Millions) | 103.9 | 97.3 | 69.4 | 60.1 | 39.7 |

Like any exploration-stage mining company, Rokmaster is dependent on constructive drilling results to advance its projects. If future assay readings prove to be less positive than readings to date, the company could face challenges. In addition, the company seems likely to issue new equity on a regular basis over the next few years to fund its drilling budget plus required option payments to Huakan.

Rokmaster’s Revel Ridge property looks to be a promising, high-grade resource of precious metals and other metals. Further exploration and development work must be completed, but it appears to be attractively valued. More specifically, at a $43 million enterprise value, Rokmaster seems to trade at a discount to comparably positioned junior miners.

Rockmaster Resources Corp. last traded at $0.495 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.