FULL DISCLOSURE: This is sponsored content for Rua Gold.

The gold mining industry in New Zealand is experiencing a resurgence, driven by record gold prices and a new pro-mining stance from the government. Amidst this backdrop, RUA Gold Inc. (CSE: RUA) emerges as an intriguing opportunity, particularly given recent developments in the region.

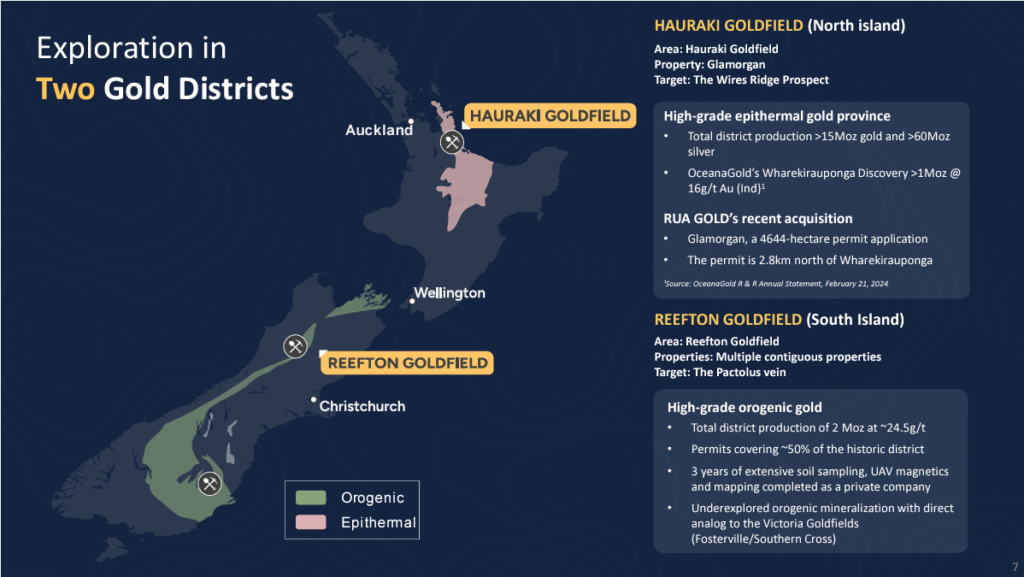

New Zealand’s gold-rich history dates back to the 1860s gold rush, with over 44 million ounces of high-grade gold extracted from both the North and South Islands. Despite this impressive past, significant untapped potential remains, especially in the under-explored North Island and the brownfield opportunities in the South Island’s Reefton Goldfields.

RUA Gold’s strategic positioning amid this backdrop is noteworthy. The company boasts two flagship projects: the Reefton Goldfield Project on the South Island and the Glamorgan project on the North Island. Both projects offer compelling reasons for investors to take notice.

The Reefton Goldfield Project: A High-Grade Historical Haven

RUA Gold’s Reefton Goldfield Project borders the recently sold Blackwater Property to the west. This proximity is significant, considering the recent $30 million all-cash acquisition of the Blackwater Property by Federation Mining from OceanaGold Corp, which closed on June 24. The purchase follows an option agreement that was original entered into back in 2018. The Blackwater Property, home to the historical Blackwater Gold Mine, produced over 700,000 ounces of gold until 1951 and contained a historical gold resource.

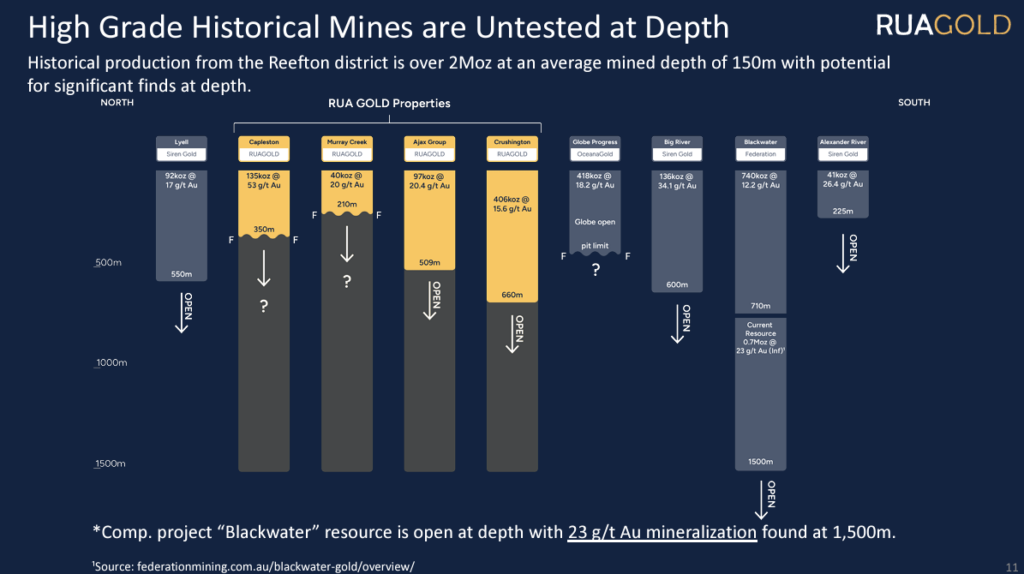

What makes RUA Gold’s position particularly interesting is that all of the historical gold workings in their Reefton Goldfield Project have yielded higher grades of gold than Blackwater. For comparison, the Blackwater project previously produced 740,000 ounces of gold at a grade of 12.2 g/t, while historic production at the Reefton property was as high as 135,000 ounces at 53 g/t gold at the Capleston zone. Moreover, these workings remain unexplored at depth, presenting an enormous window of potential for new high-grade gold discoveries.

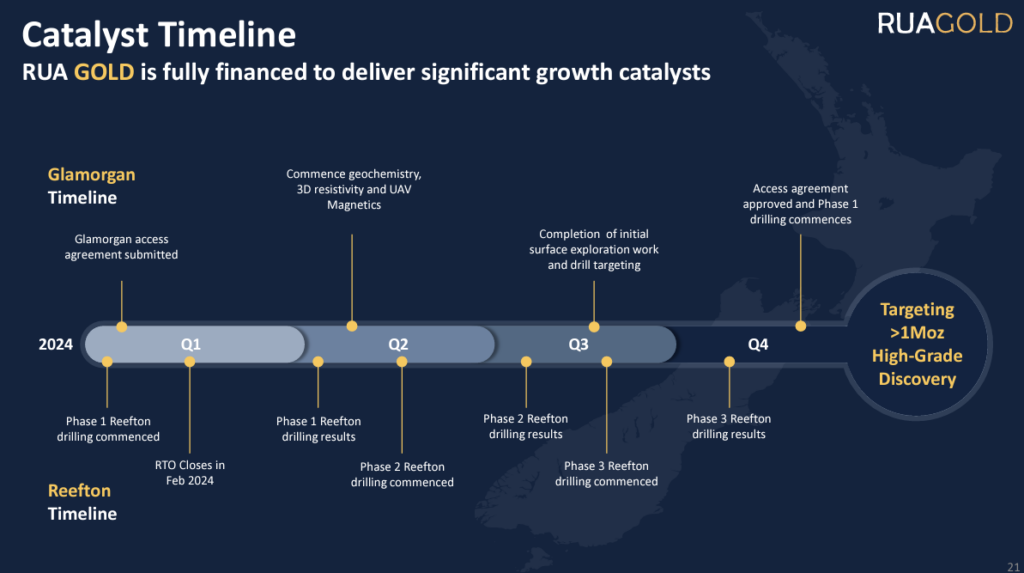

The Blackwater Property has confirmed gold mineralization at depths of up to 1,500 meters, while none of the historical operations in RUA Gold’s project have been explored below 660 meters. This untapped potential, combined with the company’s ongoing 2,500-meter drill program, positions RUA Gold favorably for potential significant discoveries.

Glamorgan: A North Island Gem

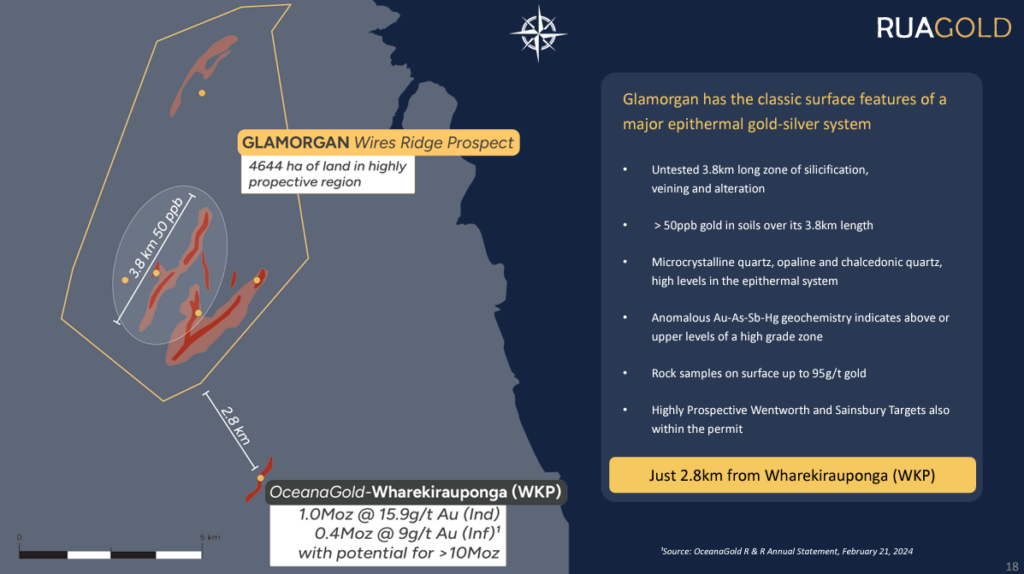

RUA Gold’s other flagship project, Glamorgan on the North Island, adds another opportunity to the company’s portfolio. Glamorgan is considered a geological twin to OceanaGold’s high-grade WKP Project, which boasts a maiden gold resource of 1.4 million ounces grading at over 10 g/t gold.

This comparison gains credibility from the involvement of geologist Simon Henderson, RUA Gold’s COO. Henderson not only staked both the WKP and Glamorgan properties but was also part of the team that drilled out the 10-million-ounce Waihi gold deposit. His expertise and intimate knowledge of the geology provide RUA Gold with a significant advantage in exploring and developing the Glamorgan project.

Market Valuation: A Potential Bargain

As of July 3 2024, RUA Gold’s market capitalization stood at $37.8 million, slightly higher than the $30 million paid for the Blackwater Property. This valuation discrepancy, considering RUA Gold’s two promising projects and ongoing exploration activities, suggests that the company could be undervalued in the current market.

The broader context of undervalued mining stocks in a strong gold market further supports the case for RUA Gold. With gold prices at record levels and even noted short-sellers taking long positions in mining stocks, the timing could be opportune for investors to consider companies like RUA Gold.

RUA Gold presents an compelling opportunity in the context of New Zealand’s rejuvenated gold mining sector. With its strategic land position in the historically productive Reefton Goldfields, the promising Glamorgan project on the North Island, and a market valuation that appears conservative relative to recent transactions, the company offers an intriguing opportunity for investors bullish on gold and willing to take on the risks associated with junior miners.

As New Zealand aims to double its mining export value and global interest in gold remains strong, RUA Gold is well-positioned to capitalize on these favorable trends. For investors seeking exposure to high-grade gold projects with significant exploration potential, RUA Gold warrants consideration.

FULL DISCLOSURE: Rua Gold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rua Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.