In a response to the mounting sanctions imposed by the global community, Russian President Vladimir Putin decided to weaponize its energy exports by demanding gas buyers to pay in rubles. Thing is, it seems to be working.

German utilities business organization Bundesverband der Energie- und Wasserwirtschaft (BDEW) said the country’s gas supply situation “is about to deteriorate” following Putin’s new rule on currency payments.

“There are concrete and serious indications that the gas supply situation is about to deteriorate,” said BDEW Chair Kerstin Andreae. “With Putin’s announcement that future gas deliveries will have to be paid for in rubles, an impact on gas deliveries cannot be ruled out.”

The group called on Berlin to issue a first-level warning for the possibility of an energy crisis and work with operators and local government units to mitigate the foreseen eventuality of gas shortage.

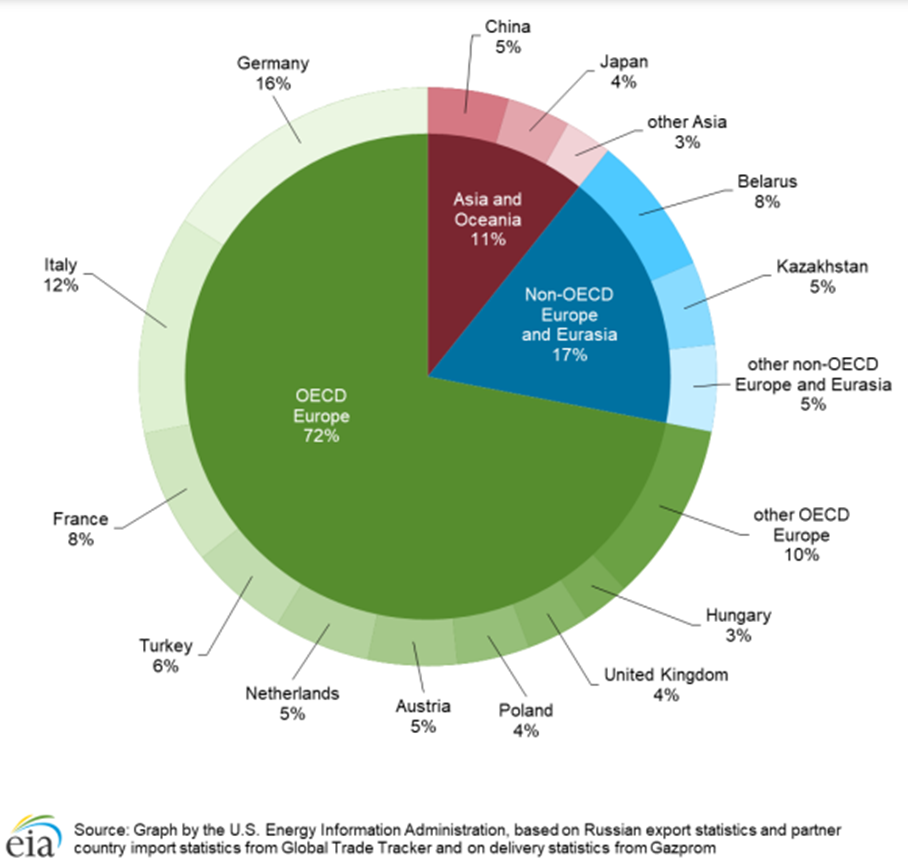

German Economy Minister Robert Habeck also said that this ruble payment demand would mean a breach of contracts for major energy buyers but claimed there was no need for an early warning mechanism yet. Habeck added that the country, one of Russia’s biggest energy customers, plans to speak with its European partners on how to respond.

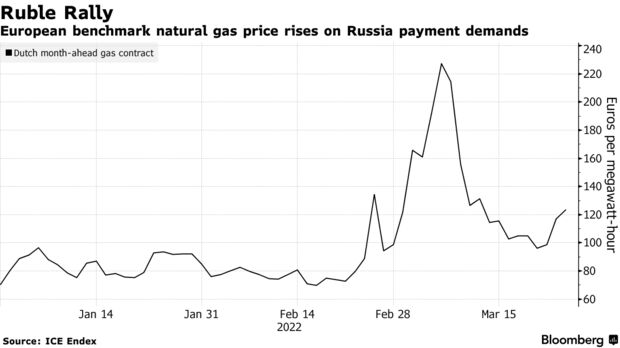

Following Putin’s announcement, the European benchmark price for natural gas rose as high as 30%.

The Russian leader made the announcement on Thursday, saying “natural gas supplies to so-called unfriendly countries” should be paid in Russia’s currency.

“It makes no sense whatsoever to supply our goods to the European Union, the United States and receive payment in dollars, euros and a number of other currencies,” said Putin.

Many see the move as an attempt to breathe life to the free-falling ruble. Moscow already imposed a 20% interest rate hike to control the currency’s depreciation.

International Energy Agency Executive Director Fatih Biro called Putin’s ruble payment demand a “security threat,” calling into question Russia’s claim as a reliable energy supplier.

The gas-for-ruble scheme, which currently has no mechanism yet in place, also spells confusion and trouble for other importers of Russian gas. Japan said it is still unclear for them how the payment switch would operate, with two of its biggest local suppliers saying they’re studying the requirement.

South Korea plans to do whatever is necessary to continue the imports of natural gas. But in Poland, PGNiG CEO Pawel Majewski said the company–a customer of Russia’s Gazprom–would not be able to easily switch to ruble, claiming that its “contract partner can’t freely change the payment method stipulated in the contract.”

Denmark’s Orsted said the effect of the demand is still unclear while Italy and Austria shunned Putin’s demand and plans to continue paying in euros.

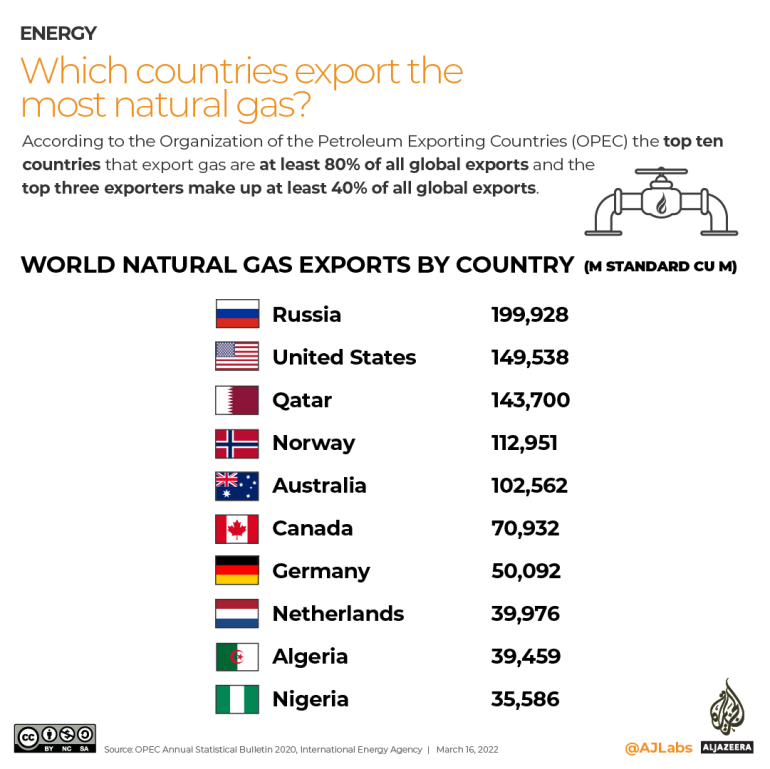

Russia is the world’s biggest natural gas exporter to date. But Canada is looking at putting a dent in this. Minister Jonathan Wilkinson said on Thursday that the country plans to increase its oil and gas exports this year by up to 300,000 barrels per day.

“Our European friends and allies need Canada and others to step up,” said Wilkinson. “They’re telling us they need our help in getting off Russian oil and gas in the short term, while speeding up the energy transition across the continent. Canada is uniquely positioned to help with both.”

Information for this briefing was found via Bloomberg, DW and Euractiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.