Another day, another headscratcher in the court cases pertaining to FTX and Sam Bankman-Fried, or SBF as he’s come to be known as.

The latest drama surrounding the case pertains to the matter of Robinhood Markets (NASDAQ: HOOD) shares that were recently seized from the holdings of Emergent Fidelity Technology Ltd, an entity in which SBF is a 90% owner. Gary Wang, co-founder of FTX and Alameda alongside SBF, owns the remaining 10% of the entity. The holdings, consisting of 56.3 million shares, represents a 7.6% interest in the public company.

A filing was made yesterday by SBF’s counsel in opposition of a motion by the FTX Debtors to enforce an automatic stay in relation to the seizure of the Robinhood shares. In objecting to the motion, SBF argued that the debtors are “advancing an argument for a preliminary injunction but have failed to carry their heavy burden of establish that such an extraordinary remedy is warranted.”

At the core of the argument from SBF’s perspective, is the fact that Emergent was not one of the hundreds of entities involved with the bankruptcy filing of FTX and Alameda. The argument is that there is no legal claim to these shares as a result of Emergent not being involved within the bankruptcy.

The $648 million used to purchase the stake in Robinhood was obtained by SBF and Wang via a set of four promissory notes entered into between the two individuals and Alameda Research. Given that the shares are owned in a separate entity not involved in the bankruptcy filing, and four promissory notes related to the funds exists, the FTX debtors as a result would need to advance a fraudulent transfer claim, as per Bankman-Fried’s counsel. SBF’s counsel as a result argues that the debtors are suggesting funds were transferred under suspicious circumstances without commencing such a claim.

“[The FTX Debtors] make only general allegations regarding Mr. Bankman-Fried’s alleged inattention to financial recordkeeping at other companies, but they ignore the fact that the transaction at issue was documented,” writes the counsel. “..it is improper for the FTX Debtors to ask the Court to simply assume that everything Mr. Bankman-Fried ever touch is presumptively fraudulent.”

The counsel then argues that the debtors would need to demonstrate that the transfer of funds related to the promissory note was made “with actual intent to hinder, delay, or defraud,” or that Alameda Research “received less than a reasonably equivalent value.”

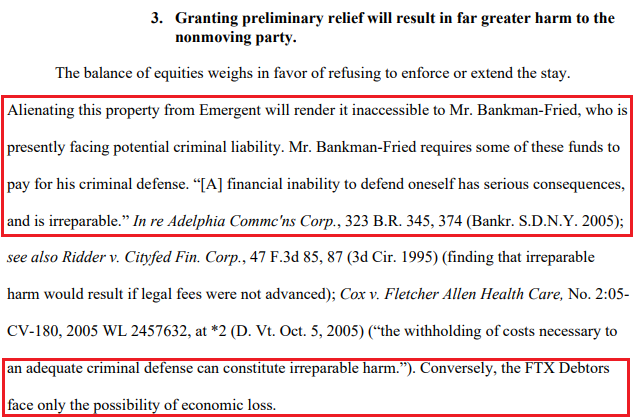

The kicker, for those who have lost funds as a result of the actions of Bankman-Fried, is the argument then put forth by SBF’s counsel as to why the shares should not be removed from Emergent’s ownership.

“Alienating this property from Emergent will render it inaccessible to Mr. Bankman-Fried, who is presently facing potential criminal liability. Mr. Bankman-Fried requires some of these funds to pay for his criminal defense.”

“Conversely, the FTX Debtors face only the possibility of economic loss.”

In making the obscene argument that funds “borrowed” from Alameda (which inherently came from customer deposits) should be permitted for use in the defense of SBF and his actions, counsel highlights that as per Acierno v. New Castle Cnty., “Economic loss does not constitute irreparable harm.”

Based on this SBF “respectfully requests that the Court deny the Stay Motion.”

Twitter, arguably, is not taking the obscene argument overly well.

i sympathize with him here. there've been so many episodes where i've "stolen" things and been shamed and made to feel like i've done something wrong. don't these people understand their losses are only economic? why can't they think of my wellbeing for once?

— tomsk (@levogyre10) January 6, 2023

Soooo…he stole money, but should not be required to give it back because he needs the money for his legal defense for stealing the money?

— Elon's Musk 🇺🇸 🇺🇦 (@jackfro69234272) January 6, 2023

Bro got “loaned” over $3bn in customer funds and that’s still not enough for him

— @BennettTomlin@mstdn.social (@BennettTomlin) January 6, 2023

Information for this briefing was found via Court Listener and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.