The Securities and Exchange Commission is pushing corporations to clarify their exposure to distressed crypto entities in a new guidance announced Thursday, requiring companies that issue securities to disclose to investors their exposure and risk to the cryptocurrency market.

“The Division of Corporation Finance believes that companies should evaluate their disclosures with a view towards providing investors with specific, tailored disclosure about market events and conditions, the company’s situation in relation to those events and conditions, and the potential impact on investors,” the agency said in its website.

The move comes after SEC Chair Gary Gensler defended the agency against accusations that it has failed to prevent crypto firms from misusing customer funds–stemming from the implosion of one of the world’s largest cryptocurrency exchanges, FTX. The now-bankrupt crypto firm was revealed that have loaned its sister hedge firm Alameda Research from customer funds to place risky bets.

READ: FTX Shows Over $3 Billion In Unsecured Debt To 50 Creditors

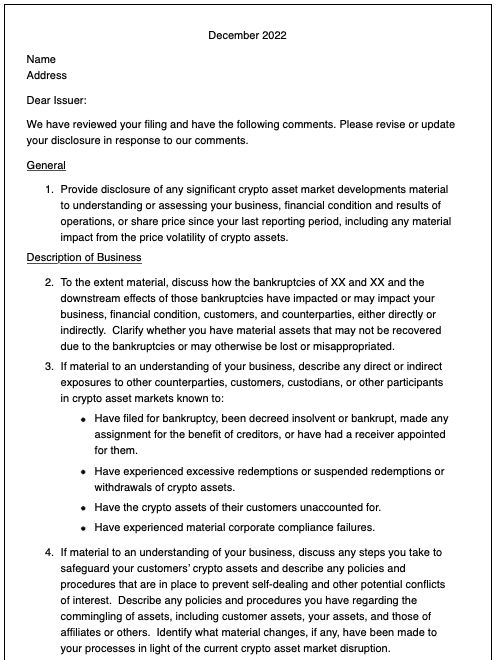

Companies may have disclosure obligations related to the direct or indirect impact that recent crypto bankruptcies may have had on their businesses, the SEC relayed. It provided a sample list of questions that agency staff may ask specific issuers based on their circumstances.

The sample questionnaire “contains sample comments that the Division may issue to companies depending on their particular facts and circumstances.”

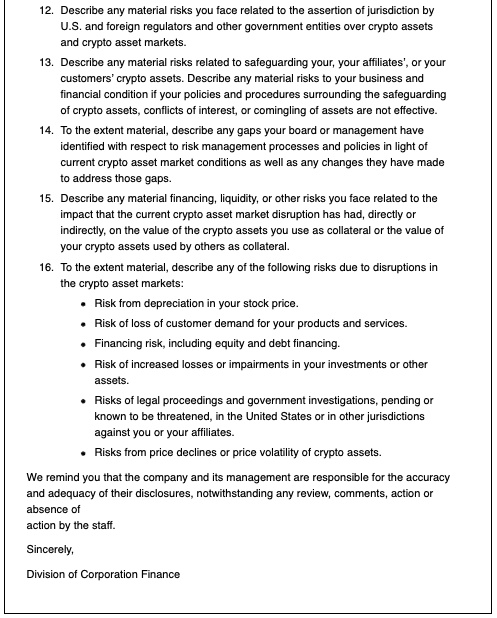

Some of the SEC’s inquiries focused on the counterparty risk that public firms may have to crypto market participants who have declared bankruptcy, incurred massive redemptions, or suspended consumer withdrawals.

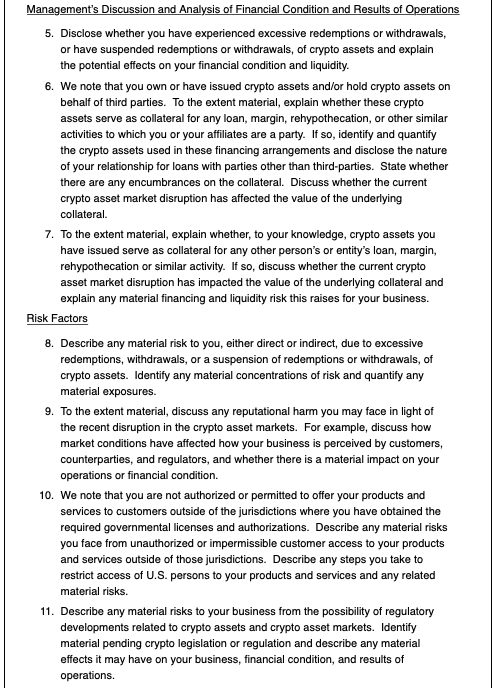

“We note that you own or have issued crypto assets and/or hold crypto assets on behalf of third parties,” one of the sample questions said. “Explain whether these crypto assets serve as collateral for any loan, margin, rehypothecation or other similar activities to which you or your affiliates are a party.”

Source: SEC

One of the items in the letter asks the issuer to describe how company bankruptcies and their subsequent effects “have impacted or may impact your business, financial condition, customers, and counterparties, either directly or indirectly.” Another item requests a description of “any material risk to you, either direct or indirect, due to excessive redemptions, withdrawals, or a suspension of redemptions or withdrawals, of crypto assets,” asking to further determine any material risk concentrations and quantify any material exposures.

The SEC’s corporate finance division encouraged companies to follow these guidelines when preparing documents “that may not typically be subject to review by the Division before their use.”

Many publicly traded companies have little or no exposure to cryptocurrencies, which have largely been excluded from the traditional financial system. However, a small number of companies have their businesses somewhat tied to crypto assets; among them are trading platform Coinbase Global, bitcoin miner Marathon Digital, and crypto-focused bank Silvergate Capital.

Tech firm Microstrategy still holds the most amount of bitcoin in its balance sheet among publicly traded non-crypto firms.

Information for this briefing was found via The Wall Street Journal, CNBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.