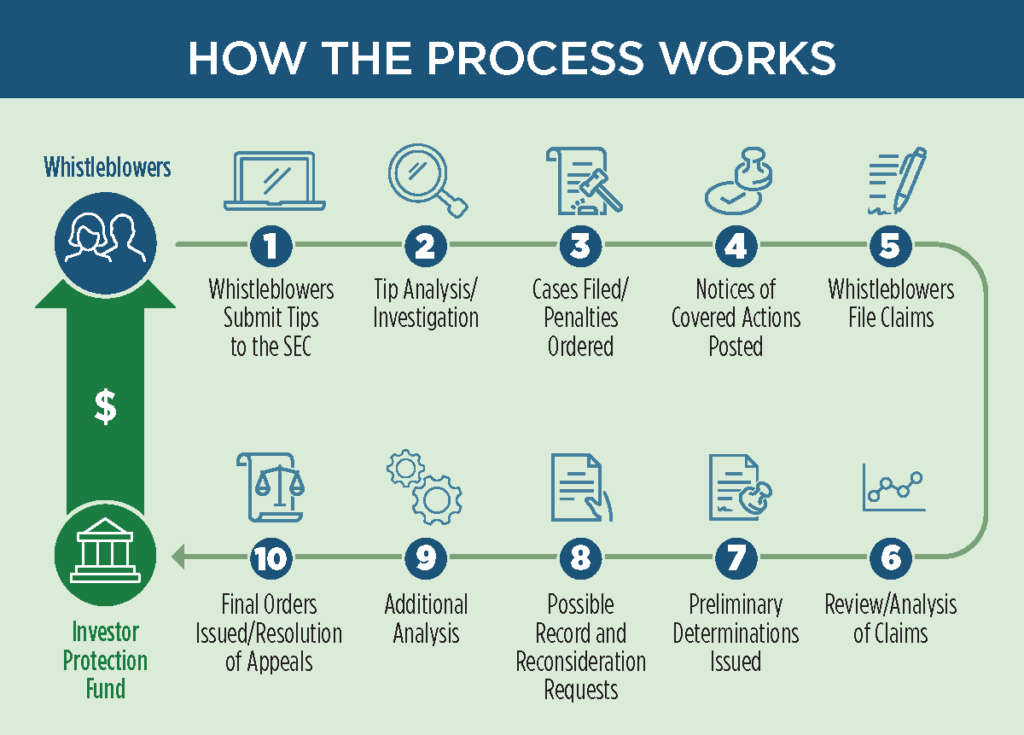

The Securities and Exchange Commission has set a new record for a whistleblower award. The agency this morning reported that it has more than doubled the previous record of $114 million under a new award given to a whistleblower.

The award handed out this morning amounted to an eye-popping $279 million.

“The whistleblower’s sustained assistance including multiple interviews and written submissions was critical to the success of these actions. While the whistleblower’s information did not prompt the opening of the Commission’s investigation, their information expanded the scope of misconduct charged,” commented Creola Kelly, Chief of the SEC’s Office of the Whistleblower.

In line with the nature of the award, details on whom received the award, or for which file it was awarded, were not disclosed.

Whistleblower awards are said to range from 10% to 30% of the money collected on sanctions exceeding $1.0 million, however what percent this record was awarded at was also not disclosed.

“The size of today’s award – the highest in our program’s history – not only incentivizes whistleblowers to come forward with accurate information about potential securities law violations, but also reflects the tremendous success of our whistleblower program,” commented the director of the SEC’s Division of Enforcement, Gurbir S. Grewal.

The award marks the third such award that exceeds $100 million in value. The prior record of $114 million was issued in October 2020. Over $1.0 billion in awards have been granted since the program’s inception in 2011.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.