Bitcoin prices have risen almost exponentially over the last nine months. Reflexively, stocks in many Bitcoin miners have appreciated at almost the same pace. In this frenzy, we believe that investors are not fully factoring in substantial increases in Bitcoin mining industry costs. Investors interested in speculating on Bitcoin may be better served focusing on the currency itself than derivative plays such as miners.

Mining Rigs Are Very Pricey

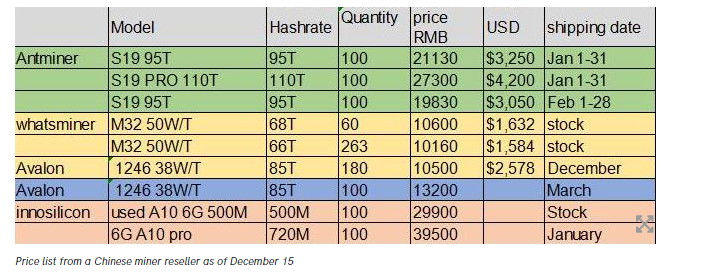

The prices of the latest generation mining rigs have soared 35% in just the last months, according to HASHR8. (Note that most efficient mining equipment consumes the least energy measured in Joules per tera hash of computing power.) Furthermore, Bitmain and MicroBT, two of the main mining computer manufacturers, are reportedly sold out until May 2021.

A further illustration of the scarcity value of this equipment, and therefore the prices that Bitcoin miners must pay to compete: some customers who are set to receive Bitmain’s Antminer S19 Pro and S19 for list prices of US$2,387 and US$1,770, respectively, are attempting to resell these devices for about twice the price they have paid for the not-yet delivered computers.

Bitcoin Mining Profitability Per Unit of Computing Power Has Dramatically Diverged from Bitcoin Prices

The increasing cost of mining equipment, coupled with persistently rising Bitcoin network difficulty levels and the May 2020 Bitcoin halving event, has drastically cut the typical Bitcoin miner’s revenue per tera hash (TH) of computing power. It is particularly instructive to consider this parameter over two time frames – year to date, encompassing nearly the entirety of 2020, and the last three-year period.

Current profitability per unit of computing power is about the same as it was at the start of the year – even though Bitcoin prices have more than tripled since then. When viewed over a longer period, this measure of profitability has all but disappeared versus levels seen just 32 months ago.

If Bitcoin continues to climb, we urge investors to consider carefully the fundamentals and financial strength of Bitcoin miners like Hut 8 Mining Corp. (TSX: HUT) and HIVE Blockchain Technologies Corp. (TSXV: HIVE). Many Bitcoin miners’ stocks have appreciated dramatically, and the operating risks associated with them seem to exceed the risks of the underlying commodity, Bitcoin.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.