Well slap me across the ass and call me George, GameStop is running again.

Roarin’ Kitty is back. Andrew Tate is in. Ditto for Portnoy. And rumours are a blaze the shorts are burnin’.

Of course, this doesn’t have to do with anything to do with fundamentals. This is about stickin it to the man. Ignore the nerds, because it’s not just GameStop, AMC is running too.

Lets dive in.

Memestocks are moving

The move in the memes began Monday morning, when the all-time classic, GameStop, jumped by 38% following the aforementioned tweet by Roaring Kitty.

That’s right. A bonafide bricks-and-mortar business saw the value of its equity increase 38% in pre-market trading because some guy that goes by the pen name of Roaring Kitty posted a picture to Twitter.

Maybe rates need to go higher yet?

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

But the nuttyness didn’t end there. The equity ended up halting nine times yesterday morning before trading began to cool off. At one point the equity was up an insane 118% before it leveled off with a 74% gain on the day. The equity did over 22 times its normal daily volume, trading around 176 million shares on the day OR over 6 billion in dollar terms.

This, of course, had some follow-on effects to the other classic memestocks.

While BBBY may no longer be with us, AMC is still around to catch some wind – and boy did it. While it may not have set a new 52 week high, it did jump as much as 102% on the day and somehow managed to post a bigger gain in percentage terms than GameStop did, finishing the day up 79%.

The return of Roaring Kitty

Again, this action was all predicated on a single tweet by Roaring Kitty, who’s real name is Keith Gill. Gill established himself as a daytrader after previously working for the Massachusetts Mutual Life Insurance Co, or MassMutual.

During the pandemic, he and other investors banded together in Reddit groups like r/WallStreetBets, leading to the creation of “memestocks,” which included names such as GameStop, AMC and retailer Bed Bath & Beyond and led to the bafflement of professional investors in Wall Street.

READ: Roaring Kitty Makes a Comeback — But Did He Really?

Credited as one of the original forces behind the memestock craze in 2021, Gill’s financial career was top ticked by a virtual hearing he was involved in before the House Financial Services Committee in relation to that insane price action on GameStop.

The Alpha and Portnoy

And then there is the Alpha. Andrew Tate has seemingly entered fray, asking his followers yesterday morning if he should drop a million dollars on Gamestop.

Apparently he’s new to the whole trading thing though, claiming that “the entire system is a scam” upon the first halt in trading from volatility. Despite the claims of rigged markets, an hour later he was proclaiming that he would never sell his position and that he has “Diamond hands until I’ve stopped breathing.”

Buy 1,000,000 usd of game stop?

— Andrew Tate (@Cobratate) May 13, 2024

5,000 retweets.

EVERY SINGLE PIECE OF GAMESTOP I BUY, I WILL NEVER SELL.

— Andrew Tate (@Cobratate) May 13, 2024

NO MATTER WHAT.

STOCK UP OR STOCK DOWN.

PERMA DONATIONS TO THE CAUSE AGAINST THE SYSTEM.

DIAMOND HANDS UNTIL IVE STOPPED BREATHING.

And it gets weirder yet. Tate claimed that the entire thing was a “spiritual battle” in a two minute video clip, and that he’d buy every share he could, despite the halts which “he was working around” by using “multiple brokerages in different countries and different banks.” Because he’s an alpha.

And it’s all some vaccinated dudes fault. And Tate thinks he has a small Johnson.

Anyways, the Alpha seemed to be in a bit of a manic state, with a slew of random tweets to follow.

WE MUST UNITE AGAINST THE MATRIX. $GME

— Andrew Tate (@Cobratate) May 13, 2024

GAMESTOP OR DEATH.

JOIN THE ARMY: https://t.co/RcFaV7GWek pic.twitter.com/HbVYHFkweb

Dave Portnoy tells us he was disappointed the missed out on the fun. And that Superman wishes he had roarin kitty’s super powers.

.@TheRoaringKitty is the most powerful person on the internet but he couldn’t have given me a heads up that $GME and $AMC were gonna go ballistic? #DDTG pic.twitter.com/TP9PyE7qBt

— Dave Portnoy (@stoolpresidente) May 13, 2024

The fundamentals

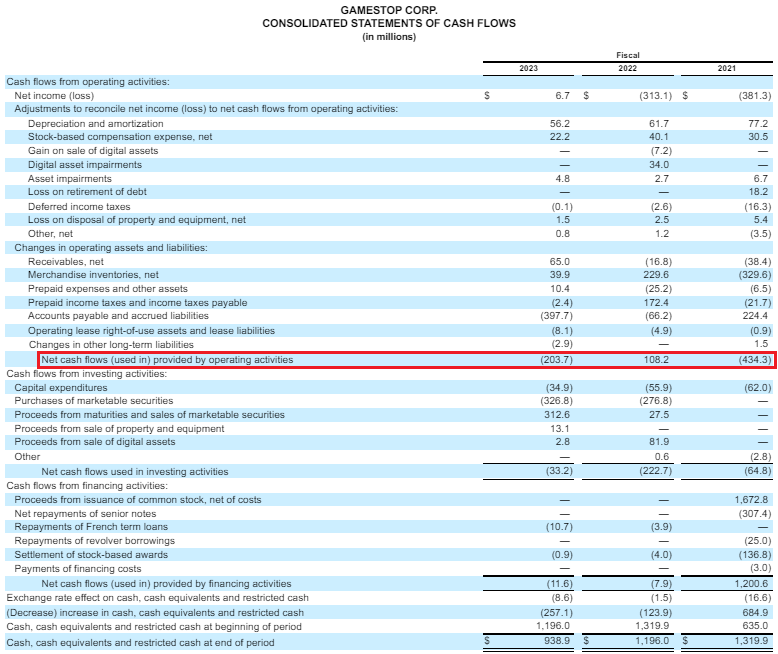

Of course, if you’re interested in the fundamentals of GameStop, which isn’t really the trade here, but still, you may just be curious, the company lost $203M million in operating cash flow over the last reported 12 months. Which tells how much money the company lost on a cash flow basis.

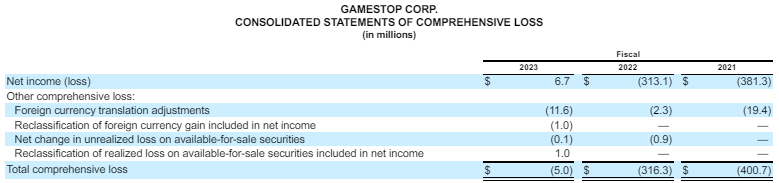

They actually made money on a net income basis, to the tune of $6.7 million. Which was largely thanks to nearly $50 million in interest income from the company’s large cash position and marketable securities.

Now the difference between the operating cash flow and net income largely boils down to GameStop paying down accounts payable. This is largely thanks to the company generating $1.7 billion in equity offerings since the pandemic, all thanks to Roaring Kitty and the memestock traders plowing their money into the stock.

Overall, if you want a fundamental reason to own the stock. You are going to have to look at something forward looking, because it’s not in the historic performance of the company.

Now for a company with a $9.3B market cap, with nearly $1.1 billion of cash and marketable securities and a core business that effectively loses money. You have to look at their ability to leverage the brand into online gaming opportunities and make smart strategic decisions with that remaining cash. A long shot at this valuation.

But that’s not all they have going for them.

They do have a stock that works, which is something, it means they have a cheap cost of capital and the backing of the retail community should they be able to find a smart strategic path forward.

But still… I digress, no one owns GameStop because of fundamentals, they own it because it’s fun and they simply think it’s going higher.

Which might sound insane.

But it’s no different than going to the casino. This is about fun, getting loud on social media, and sticking it to the man. In fact, some accounts on Twitter are reporting that shorts in GME and AMC lost nearly $2B on Monday. Something that is incredibly hard to prove, but could very well be true.

BREAKING: Short sellers have now lost $1.8 BILLION on $GME and $AMC short positions over the last 2 weeks.

— The Kobeissi Letter (@KobeissiLetter) May 13, 2024

Short seller losses on today’s move alone were $1.2 billion. pic.twitter.com/3lJaVMZl9b

Information for this story was found via Reuters, Edgar, X, Reddit and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.