On July 28, Sigma Lithium Corporation (TSXV: SGML), which owns 100% of the Grota do Cirilo hard rock lithium project in Brazil, announced that it is working with Bank of America to coordinate discussions with companies interested in acquiring it.

The level of third-party interest in Sigma may be substantial; Sigma CEO Ana Cabral Gardner has been holding meetings for at least four months with companies that have approached it, according to Reuters. Presumably, the potential suitors include electric vehicle manufacturers and battery makers.

In February, Bloomberg reported that Tesla, Inc. (NASDAQ: TSLA) was considering making a bid for Sigma. No bid has yet been announced. Another huge automaker, General Motors Company (NYSE: GM), has made a substantial investment (US$650 million in January 2023) in Lithium Americas Corp. (TSX: LAC), another lithium miner, but GM’s investment was for a minority interest in the company in exchange for the right to buy all lithium output, roughly 40,000 tonnes per year, from its Nevada-based Thacker Pass mine when it opens in 2026.

While it is uncertain whether Sigma will reach a deal which it deems acceptable for its shareholders, the large quantity of inbound serious inquiries is a positive sign not just for Sigma but for other start-up lithium miners as well. Sigma shipped its first quantity of battery-grade lithium from Grota do Cirilo just a few days ago. About 25% of the mined lithium is sold under contract to the battery maker LG Energy Solution; the balance is sold on the spot market.

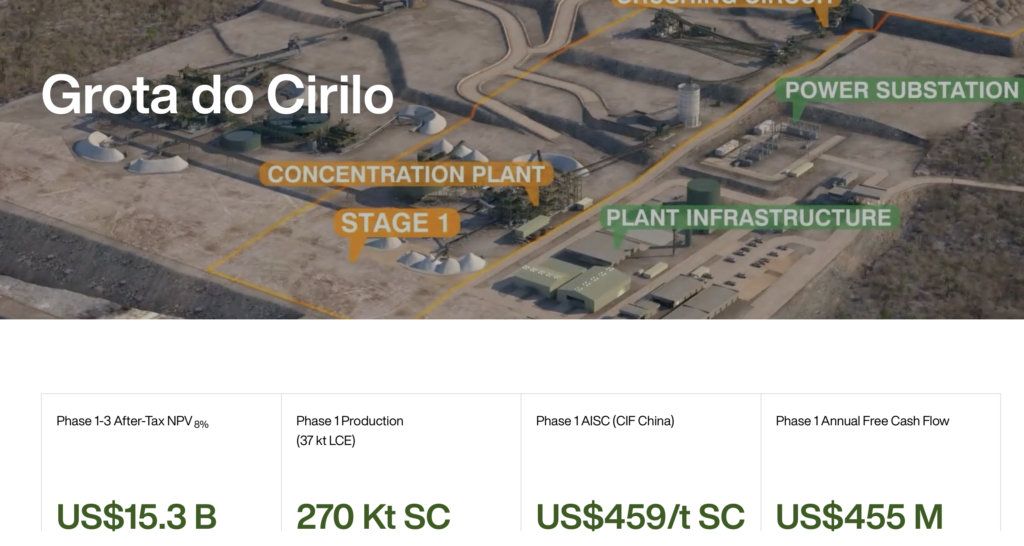

Sigma’s Brazil project is expected to produce about 37,000 tonnes of lithium on an annualized basis during Phase 1 production. The lithium mine may generate annual free cash flow of around US$450 million based on current estimates.

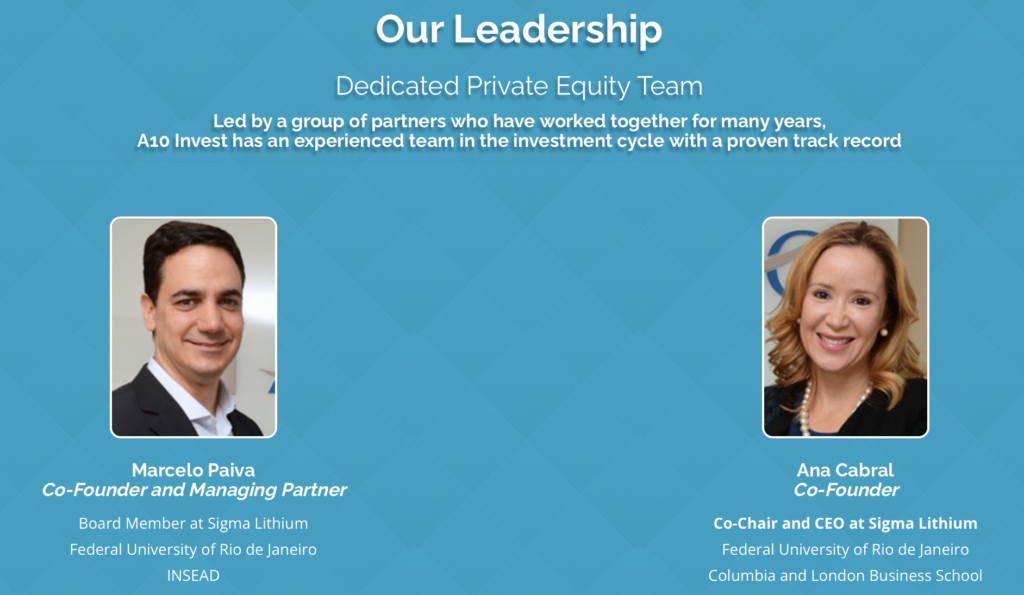

Sigma’s CEO Cabral Gardner may be more motivated to find an acquiror than many CEOs of lithium miners. She is also Co-Founder of the Sao Paulo, Brazil-based private equity firm, A10 Investimentos, which has a 44% stake in Sigma.

Sigma Lithium Corporation last traded at $51.70 on the TSX Venture Exchange.

Information for this briefing was found via Sedar, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.