FULL DISCLOSURE: This is sponsored content for Silver47 Exploration.

What do you get when you mix together rising precious and base metals prices, with an executive order to clear a pathway for domestic production of minerals, and a polymetallic project in Alaska?

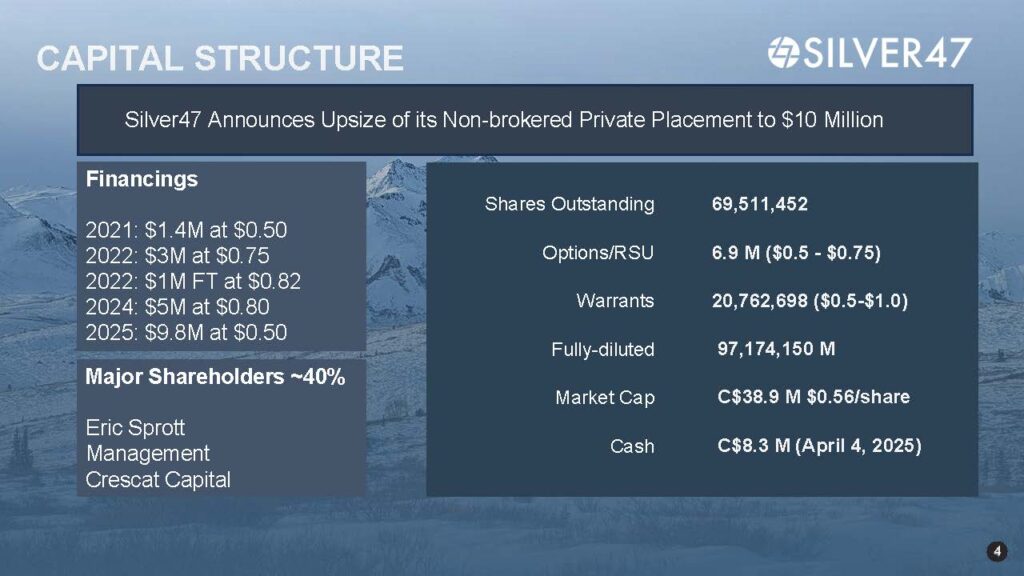

Well, you get an explorer that recently set out to raise $3 million in hard dollars that ends up raising close to $10 million. Which is also known as Silver47 Exploration (TSXV: AGA).

Lets dive in.

The High Level

Silver47 is an Alaska-focused explorer hard at work in America’s far north. As per the company, their main goal is to establish an explorer that has a billion ounce silver equivalent resource. For those of you that prefer gold equivalent as a metric, that’s about a 10 million ounce gold equivalent deposit, using simple figures of $3,000 gold and $30 silver.

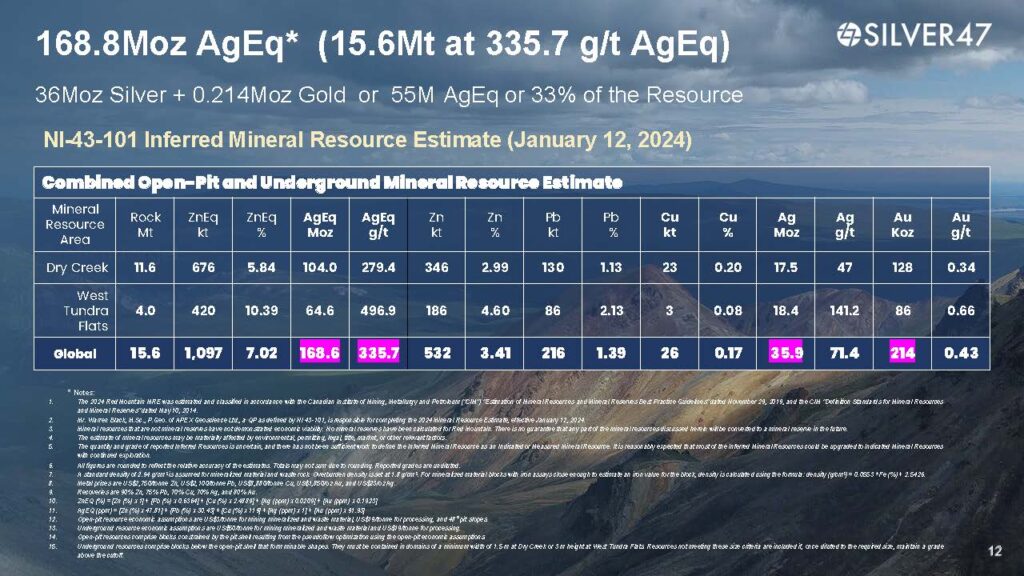

In other words, Silver47 has massive aspirations, but they’re well on their way to hitting their target, with three large properties within their portfolio. A January 2024 resource estimate completed on their Red Mountain VMS project outlined an inferred mineral resource of 168.6 million ounces of silver equivalent, with the project boasting an average grade of an impressive 335.7 g/t silver equivalent.

This figure of course excludes recent exploration work, with the study itself including drilling conducted through to 2021 – which means that recent exploration work conducted on the property has been excluded, with last year’s drill program likely to add further ounces to the estimate.

Oh, and the property has known occurrences of antimony and gallium, two critical minerals which are in high demand following China cutting off their supply to the west.

The company meanwhile is led by Gary Thompson, an experienced junior mining executive, who has assembled a team of seasoned veterans within the industry that boasts extensive experience in mine building, project management, and exploration financing.

And that experience in capital raising has treated them well. Despite Silver47’s status as an explorer, they’ve managed to secure major industry names, with Crescat Capital and legendary mining financier Eric Sprott as major shareholders, which when combined with management, own a 30% stake in the company.

The Flagship Asset

Okay, so lets take a look at core of any explorer, their assets.

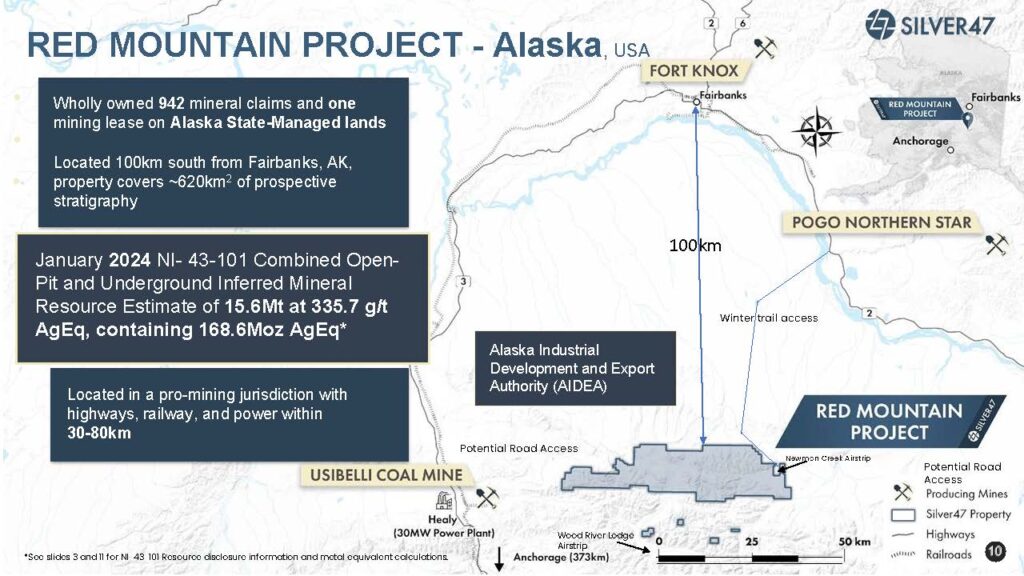

Silver47’s flagship asset is known as the Red Mountain VMS project. Found 100 kilometres to the south of Fairbanks as the crow flies, the project amounts to 942 mineral claims covering 620 square kilometres of prospective ground.

While yes, this is Alaska, it’s not as remote as you would think from an infrastructure perspective, which bodes well for the potential for future development of a mine. Highways, rail lines, and high capacity power are all found within 30 to 80 kilometres, which for Alaska, is worth writing home about. Oh, and it’s in a pro-mining jurisdiction, with a coal mine just a stones throw away.

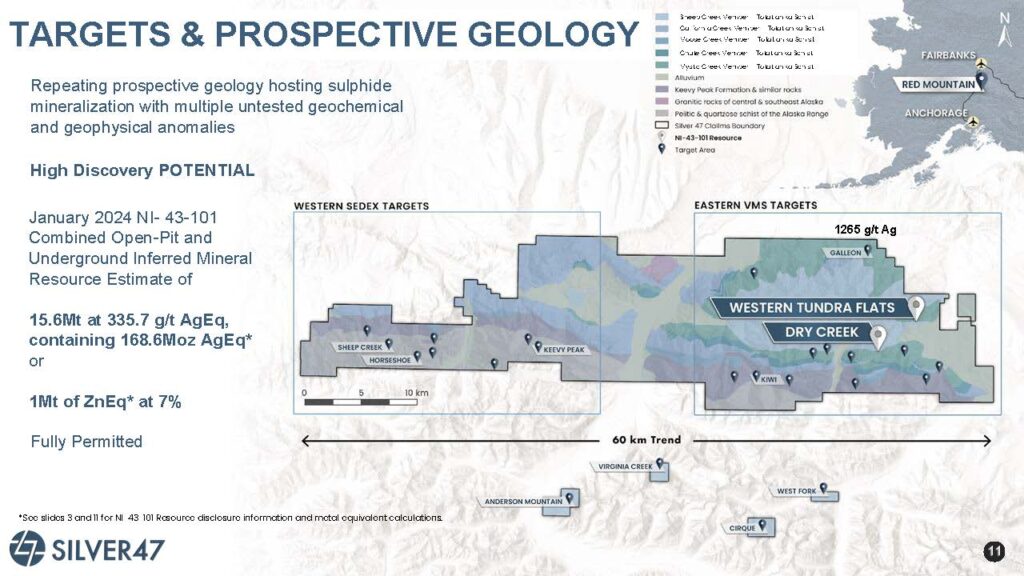

Red Mountain is comprised of basically two parts. It’s western half consists of Sedex targets, where eight different targets exist that warrant further exploration. While the eastern half consists of VMS targets, where 14 targets are present, including the two main deposits, Dry Creek and the Western Tundra Flats. A couple of satellite claims meanwhile have four other targets that warrant further exploration as well.

Amid all these targets, only two have been sufficiently explored to warrant a mineral resource estimate, which is where those aforementioned 168.6 million ounces of silver equivalent come from. Dry Creek is the bulk of the resource here, accounting for 104 million silver equivalent ounces at 279.4 g/t, while West Tundra Flats accounts for 64.6 million equivalent silver ounces, but at a much higher grade of 496.9 g/t.

It should also be noted here that that equivalent figure consists of zinc, lead, copper, silver and gold. Precious metals specifically account for about 33% of the entire resource, with 36 million ounces of silver and 214,000 ounces of gold equating to an estimate of 55 million silver equivalent ounces.

Both of these zones remain open for further discovery as well, with the presence of both antimony and gallium being noted in recent drill core, the further evaluation for which is currently underway.

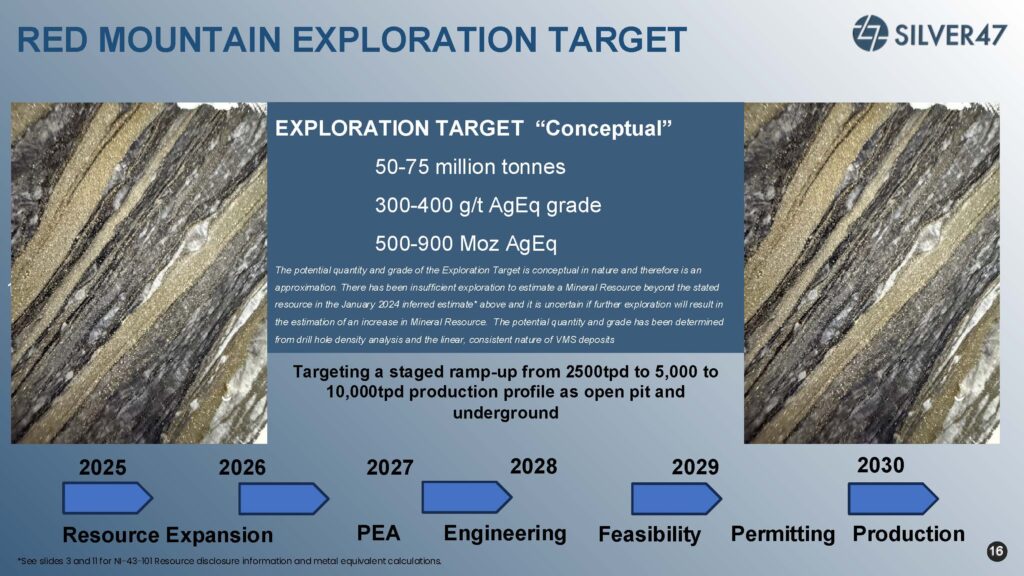

Oh, and as for that target of a billion ounces of silver equivalent, well, the 43-101 filed in conjunction with the mineral resource estimate early last year also identified a conceptual exploration target. Which suggests that Red Mountain could contain between 500 and 900 million ounces of silver equivalent at a grade of 300 to 400 g/t. And thats just at the Dry Creek and WTF zones. So take that as you will.

In terms of development, current plans call for expanded exploration in both 2025 and 2026, leading to a preliminary economic assessment that is to be published in 2027, ahead of production estimated for 2030. Silver47 is currently targeting a staged ramp up that would ultimately results in a 10,000 tonne per day operation that would operate both open pit and underground mines.

In other words, Silver47 is aiming for district scale potential here, and they have a plan on how they’ll get there. Which is more than most junior explorers can claim.

The Other Assets

Outside of their flagship Red Mountain project, Silver47 has two projects that have exploration potential.

The first is the Adams Plateau project, which is also split between sedex and VMS targets, found in southern BC near to Kamloops. The 150 square kilometre project is wholly owned by Silver47, and has about ten targets that warrant further exploration.

Historical drilling here has encountered 4.8 metres of 348 g/t silver, 0.72 g/t gold and 2.7% lead zinc at the Spar Target, while the Lucky target has seen assays that include 3.66 metres of 180 g/t silver and 8.1% lead-zinc. In recent years a property-wide LiDar survey was completed, while last year the company focused on identifying drill ready targets in advance of a campaign that might occur later this year.

And then there’s the Michelle project in the Yukon, which is in an underexplored district said to be analogous to the nearby Keno Hill Silver District. Found in the northcentral region of the territory, Michelle consists of a land package 158 square kilometres in size. The project is said to contain the unique silver-rich mississippi valley type sedex mineralization.

Michelle looks to be extremely prospective, with about 23 different potential targets already having been identified. Historical drilling includes 15 metres of 907 g/t silver at the Silver Matt Zone, and 18.29 metres of 310 g/t silver, 16.75% zinc and 8.66% lead at the Gully Zone among other results. The property is also said to contain numerous critical minerals, including antimony, gallium, vanadium, indium and copper.

The Management

So who’s behind the company?

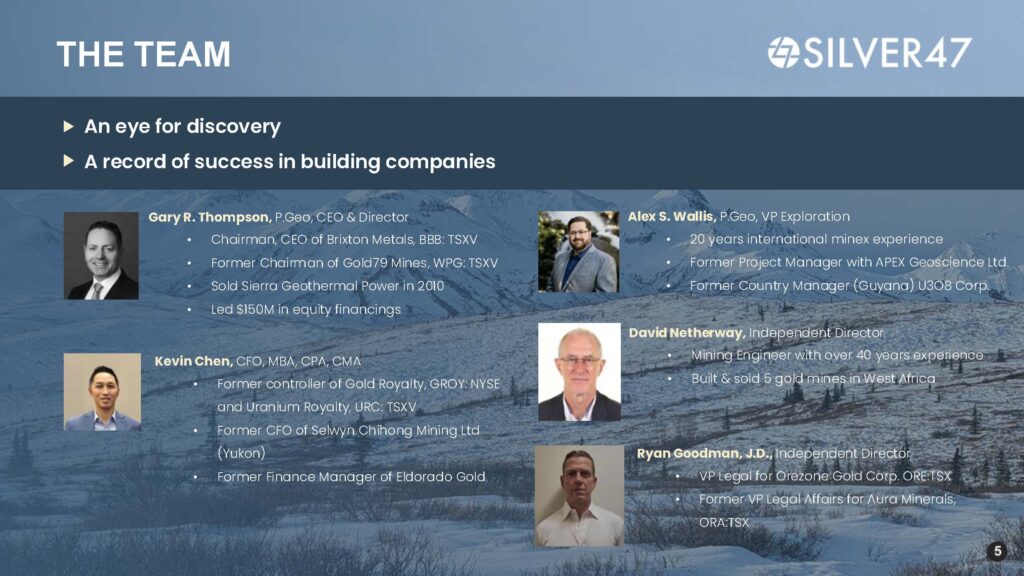

Silver47 is led by Gary Thompson, who has extensive experience across both junior mining and capital markets. Thompson also serves as the Chairman and CEO of TSX Venture listed Brixton Metals, and is the former chairman of Gold79 Mines. He’s been responsible for raising over $150 million in capital markets, and was behind Sierra Geothermal Power, which was sold off back in 2010.

Leading exploration efforts meanwhile is Alex Wallis, whom is VP of exploration. Wallis has over two decades of experience within the mining industry, having previously served as a country manager for U3O8 Corp and as a project manager for Apex Geoscience.

Notable names on the firms board meanwhile include David Netherway, who has been responsible for constructing five separate mines across Africa and has four decades of experience under his belt. And Ryan Goodman, whom is formerly of producer Aura Minerals, and is currently the VP of Legal for Orezone Gold.

The leadership team has been strong enough to entice two major investors place their money alongside management into the venture, with both Crescat Capital and mining legend Eric Sprott owning a stake in the company. Combined with management, they collectively own about a third of the 66 million shares outstanding in Silver47.

We should add here that those positions by all accounts appear to have been well paid for. Despite Silver47 going public just last fall, the company hasn’t conducted a financing below the 50 cent level in the last four years, with all of its funding to date having been raised in the 50c to 82c range. Which in terms of junior exploration, is unheard of.

Wrapping It Up

All right, lets wrap things up here.

Silver47 is a resource-estimate stage explorer that appears to be doing all the right things. They’ve raised capital at appropriate prices, management is invested alongside retail investors, and they have a strong goal and a path to get there.

What’s more, despite having a mind boggling target of a billion ounces of silver equivalent, they’re well on their way to get there, despite going public just last fall. And their current assets by all means appear to support the potential for achieving that insane target.

What more could you ask for from a junior?

FULL DISCLOSURE: Silver47 Exploration is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is long the equity of Silver47 Exploration. The author has been compensated to cover Silver47 Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.