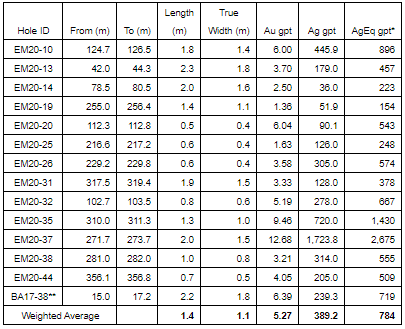

SilverCrest Metals (TSX: SIL) this morning announced the discovery of a new zone at its Las Chispas Property in Sonora, Mexico. Referred to as the El Muerto Zone, the new area of mineralization is located in the northwest portion of the Babicanora Vein. Hihglight values from the new zone include 1.5 metres true width of 12.68 g/t gold and 1,723.8 g/t silver, or 2,675 g/t silver equivalent.

The new zone of mineralization is currently estimated to have a strike length of roughly 500 metres, with the mineralization being located below the current resource contained at the Babicanora Vein. Mineralization was hit 100 to 200 metres below this level, with a weighted average to date being 5.27 g/t gold and 389.2 g/t silver, or 784 g/t silver equivalent, from this new zone.

Notably, SilverCrest indicated that while drilling this new zone several intercepts were made in unnamed veins. Further work as a result is scheduled in the region for potential new vein discoveries.

Five drills are currently turning at the Las Chispas project, with two ongoing at the El Muerto Zone, two at the Babi Vista Vein, and the final one at the Amethyst Vein. The company currently intends to conducted drilling with six to eight drill rigs over the next twelve months, which has been already budget for.

Finally, the feasibility study for Las Chispas is said to be progressing, with final release currently anticipated to occur in late December or Early January 2021.

SilverCrest Metals last traded at $11.80 on the TSX.

Information for this briefing was found via Sedar and SilverCrest Metals. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.