Silvergate Capital (NYSE: SI) has reported its Q4 2022 financials, topbilled by a staggering $1.0 billion net loss. This compares to a net income of $40.6 million in Q3 2022 and a net income of $18.4 million in Q4 2021.

“During the fourth quarter of 2022, the digital asset industry experienced a transformational shift, with significant over-leverage in the industry leading to several high-profile bankruptcies. These dynamics created a crisis of confidence across the ecosystem and led many industry participants to shift to a ‘risk off’ position across digital asset trading platforms,” the company said in a statement.

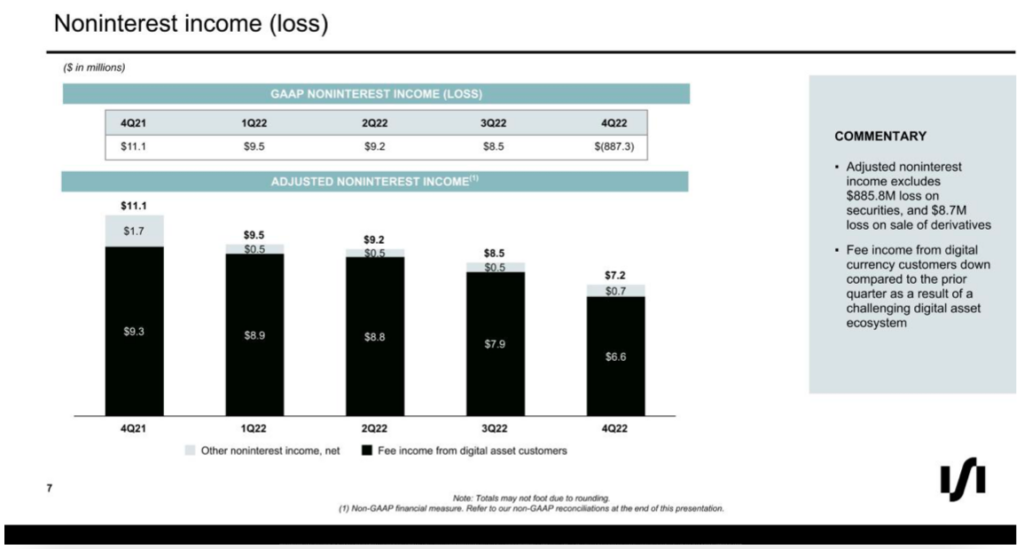

The loss mainly stemmed from a net loss on securities amounting to $885.8 million, which in turn came from losses on securities of $751.4 million and losses on derivatives of $8.7 million resulting from sale of $5.2 billion of debt securities. Furthermore, the company took a $134.5 million impairment charge relating to an estimated $1.7 billion of securities that it expects to sell in the first quarter of 2023 to decrease borrowings. All securities formerly classed as held-to-maturity had also been transferred to available-for-sale as of December 31, 2022.

Earlier in the month, the bank announced preliminary results for the quarter, declaring $718 million from the sale of debt securities. Share prices dropped by as much as 40% following the news.

But this time, despite reporting the extent of the company’s losses, Silvergate shares rallied by nearly 22% as of this writing when the markets opened.

On an adjusted basis, noninterest income ended at $14.5 million, excluding the loss on securities and derivatives sale.

“We believe in the digital asset industry, and we remain focused on providing value-added services for our core institutional customers. To that end, we are committed to maintaining a highly liquid balance sheet with a strong capital position,” CEO Alan Lane said.

The firm’s cash position is at approximately $4.6 billion, which is in excess of deposits from digital asset customers, the company said.

Contributing to the billion loss during the quarter is a $196.2 million impairment of intangible assets for developed technology assets purchased from the Diem Group.

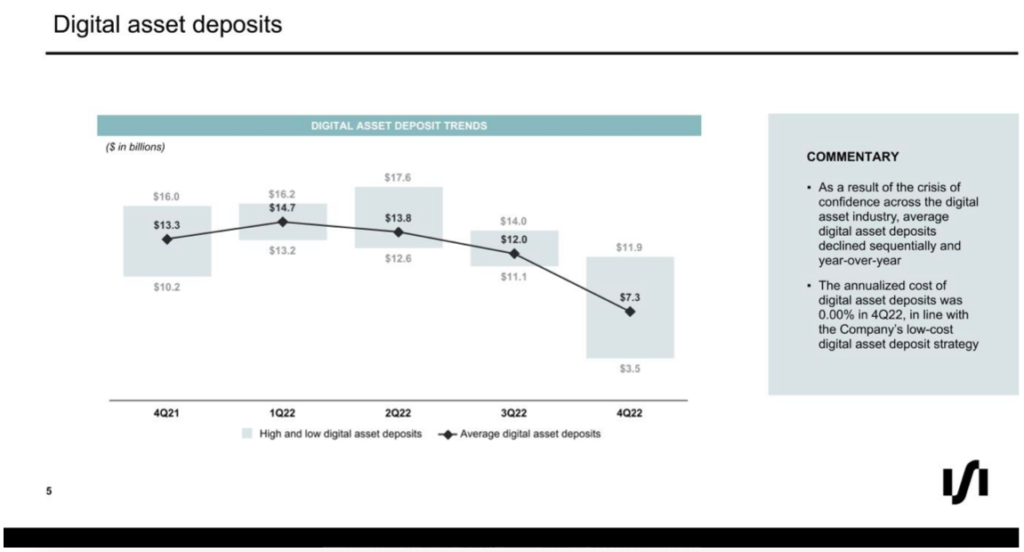

The average of digital asset customer deposits in the fourth quarter of 2022, according to the filing, was $7.3 billion. This is much lower than deposits in the third quarter of 2022, which were over $12 billion.

Moody’s Investors Service cut Silvergate Bank’s rating in response to the circumstances. The rating was downgraded from Baa2, which was deemed “lower-medium grade,” to Ba1, which is termed “junk,” and Moody’s also stated that the outlook for both Silvergate Capital and its bank is negative.

Silvergate serves the crypto industry by accepting deposits and maintaining a network that connects investors to crypto exchanges. Around $1 billion of the bank’s deposits were held by FTX and other entities controlled by its founder, Sam Bankman-Fried.

The fall of the now-bankrupt crypto exchange in November shook the crypto sector and sent Silvergate’s shares plummeting.

Silvergate has come under fire for its dealings with Bankman-Fried’s enterprises, and the collapse of the cryptocurrency market has cast doubt on the bank’s business model’s future. Earlier last week, a panel of federal officials urged banks against becoming overly involved in the cryptocurrency sector.

Information for this briefing was found via Coin Telegraph and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.