If things go according to plan, investors will soon be able to conveniently short their meme stock of choice with just one instrument — an exchange-traded fund (ETF). It’s a little too convenient, and people are asking if it’s even legal, or if there’s even a point.

First of their kind, short single-stock $AMC, $GME, $NKLA, $MSTR and more ETFs, have just been filed by RexShares.

— unusual_whales (@unusual_whales) August 29, 2022

REX Shares, a company that prides itself on providing alternative and “cutting-edge” investment products, has filed to add a series of 10 single-stock ETFs, most of them for meme stocks including GameStop Corporation (NYSE: GME), AMC Entertainment Holdings, Inc. (NYSE: AMC), and Tilray Brands, Inc (NASDAQ: TLRY).

A short $AMC ETF has just been filed. Also a short $GME ETF, as well as $MSTR and a few others from RexShares pic.twitter.com/E9oknt9Kiv

— Eric Balchunas (@EricBalchunas) August 29, 2022

The firm wants to launch these single-stock short ETFs as an instrument for short-term trading. Also called inverse ETFs, these ETFs seek daily results that correspond to the inverse of the performance of an underlying stock. With this ETF, investors can go short on a single stock without needing to sell it short.

But the fund comes with a warning, saying that it is “not suitable for all investors,” and that an investor “could lose the full principal value of his/her investment within a single day.”

According to the filing, the ETF is designed to be used “only by knowledgeable investors who understand the potential consequences of seeking daily inverse (-1X) investment results, understand the risks associated with the use of leverage, and are willing to monitor their portfolios frequently.”

On social media, people are suspicious of the proposed investment product, with some basically saying that it doesn’t make sense.

It blows my mind filing single equity ETF is even allowed. The whole concept of equities ETF is to mitigate risk of a single stock through diversity of equities basket. How in the world a single stock ETF is going to accomplish it?

— MoK (@km12345a2) August 29, 2022

The creation of single stock etfs allows them to borrow the stock to short but cover with cash ..never having to buy the underlying stock – allowing one way downward pressure on a stock – crime by another name

— julian (@julian68072078) August 29, 2022

Meme stocks are notorious for being volatile, and it hasn’t really been a good year for these retail-trader favorites. Bed Bad & Beyond, Inc. (NASDAQ: BBBY) a recent favorite for retail investors, went from $5 to $30 and then fell to about $9 just within August.

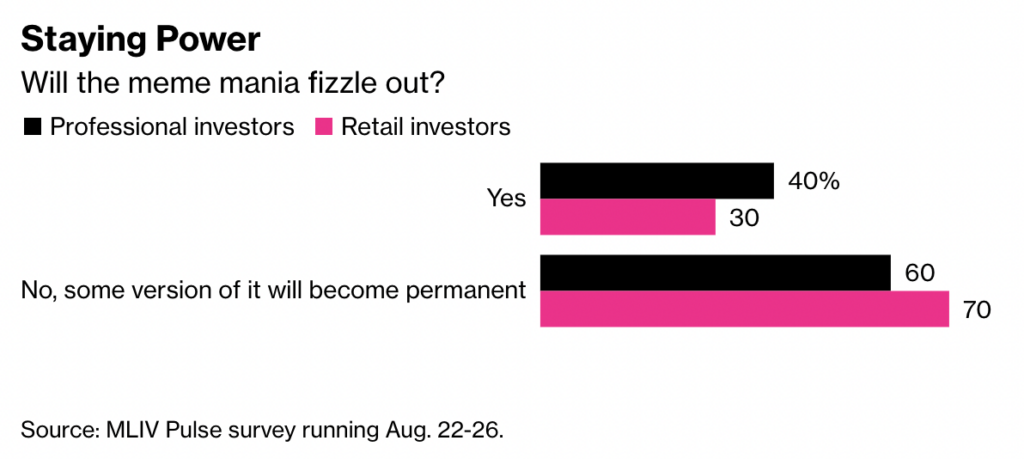

Many of the stocks for the planned inverse ETF are in the same situation. But many also feel that meme stocks are here to stay, according to a recent MLIV Pulse survey.

Information for this briefing was found via the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.