Gold stocks are all about stories, and since making a story good is all in the timing, we’ve really got to hand it to the team at Skeena Resources (TSXV: SKE), who have managed to trot out a CLASSIC brand name at the exact moment that gold begins its rise up against the century-long oppression of central bankers wielding fiat currency.

This one isn’t a reboot, more of a modern sequel. The original Eskay Creek was set against the backdrop of 1980s gold fever. Promoter Murray Pezim, already a living legend following the successful development of Ontario’s Hemlo gold camp, had a drilling team up in BC’s remote Stikine mountain range drilling in the complicated, faulty volcanic rocks known to host hydrothermal and epithermal gold deposits on behalf of VSE-listed Calpine Resources.

It was tough going. The holes were coming back with all manners of the type of alteration that tends to get geologists excited, because it’s evidence of the heat that could carry gold systems, but the 1988 season yielded no economic mineralization. Un-daunted, Pezim channeled the ever-present hope of his project geologist into a batch of his famous gregarious enthusiasm and raised the money to continue drilling at Eskay Creek when the snow melted in 1989. The second season of drilling at Eskay was going a lot like the first; consistent drill hits on the alteration zone, but never with enough mineralization to make pay grade.

The lore varies about why the field geologist, responsible for calling the shots on the ground, wasn’t around that night to stop the drill. The most popular version has him passed out drunk, but some tell it like a girlfriend had been smuggled into the remote camp. Whatever the reason, a driller who was being paid by the foot saw no reason to stop turning before someone told him to, and when hole 109 returned a 682 foot intersection of massive sulfides grading 0.88 ounce per ton gold, a long way below the target zone, nobody really cared why.

Calpine Resources used the remote high-grade discovery to mount one of the most epic gold stock promotions in Canadian history with perfect timing. Gold wouldn’t trade above its February 1990 peak of $423/oz again until 2004.

After having been operated by Homestake Mining and eventual successor Barrick Gold, Eskay produced high grade material until 2008. Today, it’s what’s known as a “brownfields” project, where exploration can add tonnage to known deposits, and the operators have the advantage of the infrastructure and workings that have already been laid down.

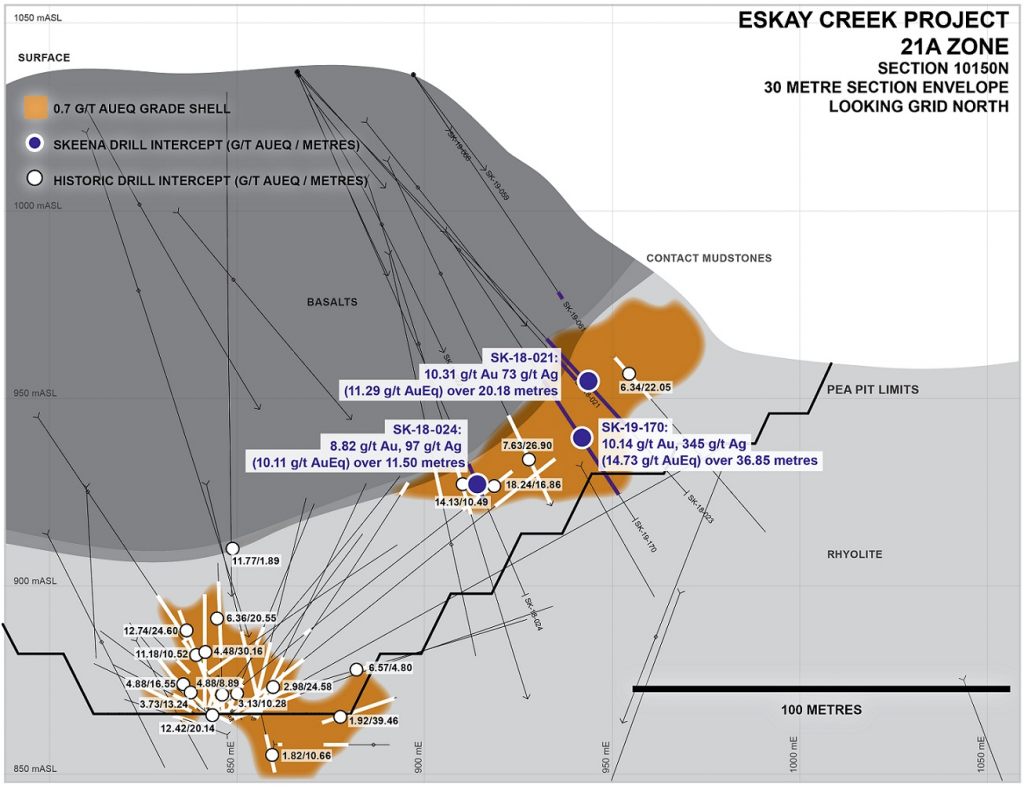

Skeena secured an option to acquire a 100% interest in Eskay for $10 million, a commitment to spend $3 million on exploration, and the assumption of a $7 million surety bond in 2017, and set about using the historic work to produce a mineral resource estimate that came out to a pit-constrained indicated and inferred resource showing 2.8 million ounces of gold, plus 66.1 million ounces of silver in only 26 million tonnes of material.

In November, 2019, they released a preliminary economic assessment that had a 51% IRR and a 1.2 year timeline to payback. Regular readers will be familiar with our immutable law of gold exploration: gold bugs love high-grade.

The 2020 Skeena Sequel to Eskay Creek seeks to build on Canadian mineral exploration’s best origin story in a gold market where multi-year highs haven’t yet got consistent coverage from the mainstream press. Following a $16 million private placement at $0.82, Skeena has 135 million outstanding shares, good for a $135 million market cap at $1.02.

Somewhere, a group of promoters are leaning in and pointing out that that’s a steal for a gold deposit with a $635 million net present value, the “present” in this case being the time at which the PEA was completed, three months ago, when a $1,325/oz assumption was reasonable. Today gold is $1,572/oz. “Do you think it’ll rest here a bit before heading to $1,600/oz, or just plow right on through?”

The $16 million private placement was a flow-through placement; tax pool money that allows the subscribers to write a portion of the investment off against their taxable income. Classically, it’s prudent for investors considering companies with recent flow-through issues to account for the flow-through discount when assessing the cap table. Those 19 million shares have a true cost base closer to $0.45. The flow through discount has been known to be a problem for companies who have trouble generating results from the exploration that the placement has financed, but those companies aren’t generally able to raise a number that size.

There are no truly new stories, because time is a flat circle. Many of the people who partied through the heady days of the 1980s, hauling back ice cold beer in front of a red hot fax machine are no longer with us, and that’s a mixed blessing. Surely, they’d eat up a good chunk of the day burning up the long distance minutes with a story about how they were ahead of the trade on Eskay Creek. “First heard about it from the girl who had gone up there to visit the field geologist…”

Information for this briefing was found via Sedar and Skeena Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.