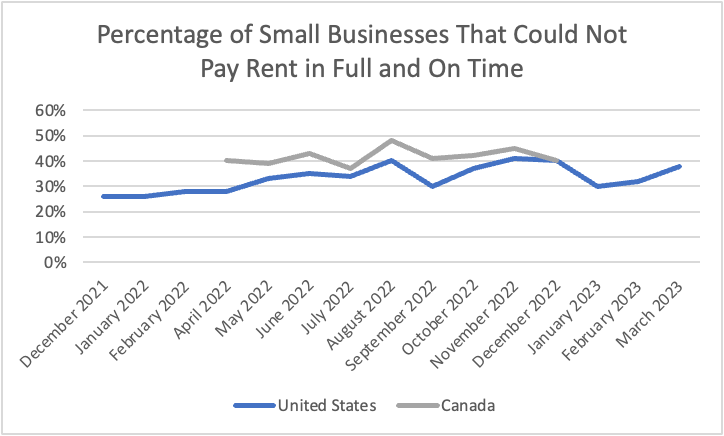

One of the first tangible impacts of the 2023 banking crisis, coupled with the effects of the Federal Reserve’s now year-long series of rate increases, may be a spike in rent delinquencies among small businesses.

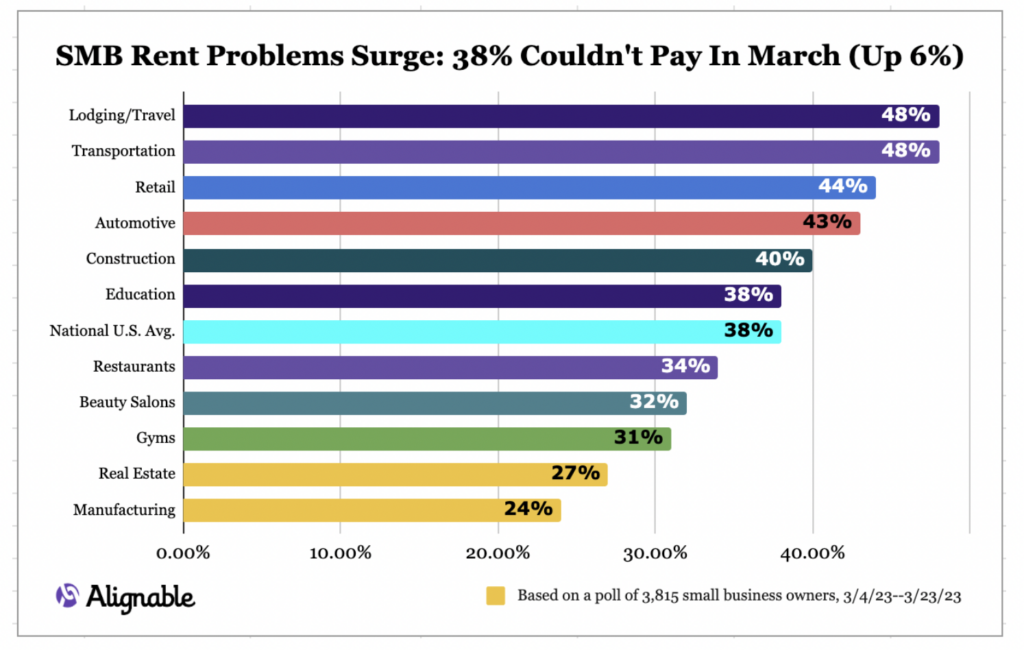

According to a survey of more than 3,800 randomly selected small business owners conducted over the period March 4 through March 23, 38% of U.S. small business owners said they could not pay their rent in full and on time in March, up from 32% in February and 30% in January. Alignable, a small business referral network with clients across North America, conducted the poll.

The March delinquency figure represents a return to the uncomfortably high (about 40%) delinquency levels observed in the 4Q 2022 period. From December 2021 through April 2022, only 26% to 28% of small businesses could not meet the terms of their rental contracts.

| % of U.S. Small Businesses Which Could Not Pay Rent in Full and On Time | % of CANADIAN Small Businesses Which Could Not Pay Rent in Full and On Time | ||

| March 2023 | 38% | ||

| February 2023 | 32% | ||

| January 2023 | 30% | ||

| December 2022 | 40% | 40% | |

| November 2022 | 41% | 45% | |

| October 2022 | 37% | 42% | |

| September 2022 | 30% | 41% | |

| August 2022 | 40% | 48% | |

| July 2022 | 34% | 37% | |

| June 2022 | 35% | 43% | |

| May 2022 | 33% | 39% | |

| April 2022 | 28% | 40% | |

| March 2022 | no data | no data | |

| February 2022 | 28% | ||

| January 2022 | 26% | 33% | |

| December 2021 | 26% | 33% |

The reasons cited for the March 2023 difficulties in making required rent payments were varied, but about three quarters of respondents noted that persistently rising interest rates are either already impacting their businesses or soon will be. Remarkably, 47% of small business owners which started their businesses before March 2020 said they were earning half, or even less, of what they made prior to the COVID pandemic. That proportion was up from 38% in January 2023 and 34% in October 2022.

Only 33% of surveyed small businesses reported they were earning in March 2023 as much or more as they did in pre-COVID days. That 33% figure is down from 38% in January, but up from 24% in October 2022.

All this has cut into the size of the emergency funds held by small businesses. About one-third of small business respondents reported having just one month or less of cash reserves available. Two months ago, 26% of small businesses faced such a tight squeeze.

Manufacturing and real estate small businesses are faring the best in covering rent payments, while lodging/travel and transportation companies are generally facing the greatest obstacles.

Very little of the Alignable small business survey represents good news. Unfortunately, things could get worse: some days included in the March 2023 survey were days before news of the Silicon Valley Bank and Signature Bank collapses and therefore did not reflect the uncertainties caused by those events. In turn, the April 2023 survey may show even higher rent delinquency readings.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.