The Sprott Physical Uranium Trust (TSX: U.UN) is looking to add further physical uranium to its holdings. The firm late last night indicated it intends to raise further funds to purchase physical uranium via an at-the-market financing.

The program will see the fund issue up to US$1.3 billion in additional trust units via an at-the-market offering, a method of which the firm has used repeatedly in the past to raise further cash. Sales of units under the offering are to occur directly on the Toronto Stock Exchange.

Proceeds from the financing are to be used to purchase further physical uranium, subject to investment and operating restrictions.

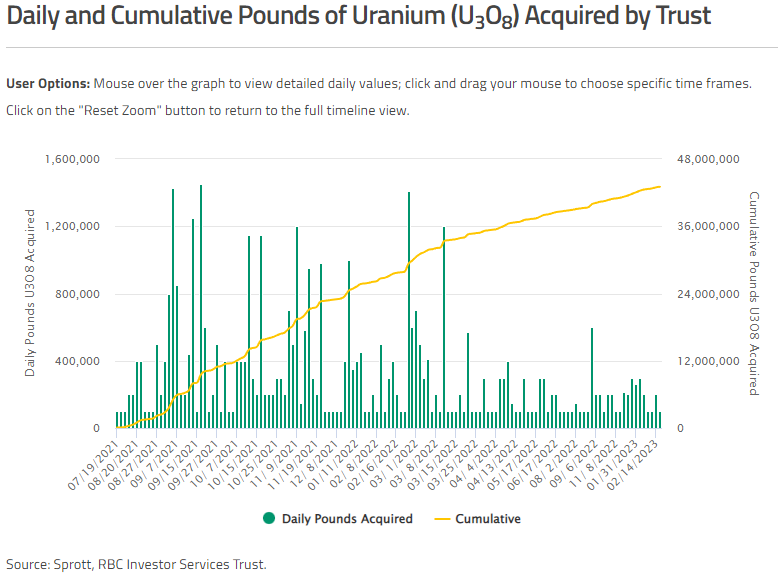

To date, the fund has acquired a total of 61.2 million pounds of U3O8, with total net assets valued at US$3.17 billion, making it the largest physical uranium fund that exists. The fund has been acquiring physical uranium in a routine manner for months as it continues to grow its stockpile.

With annual uranium production pegged at roughly 140 million pounds of U3O8, the stockpile represents a significant portion of the market.

Uranium demand meanwhile is currently believed to by in the neighbourhood of 200 million pounds, a figure which is only expected to grow as more nations move to reduce their carbon footprint while adding reliable base load power to their electrical grids.

The Sprott Physical Uranium Trust last traded at US$12.82 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.