Starr Peak Exploration (TSXV: STE) is set to actively commence drilling in January, with a drill program for at least 5,000 meters deep into areas that have known mineralization. In theory there is less risk of disappointing investors with it’s plans, given that Starr Peak has confirmed grades and favourable historic results for the area about to be drilled.

The company has identified a number of drill targets, based on a release issued late last year. Investors can likely expect announcements for these drilled holes to be released in the coming months, with Starr Peak now fully primed to take advantage of their close-ology to that of the neighbouring Amex Exploration (TSXV: AMX).

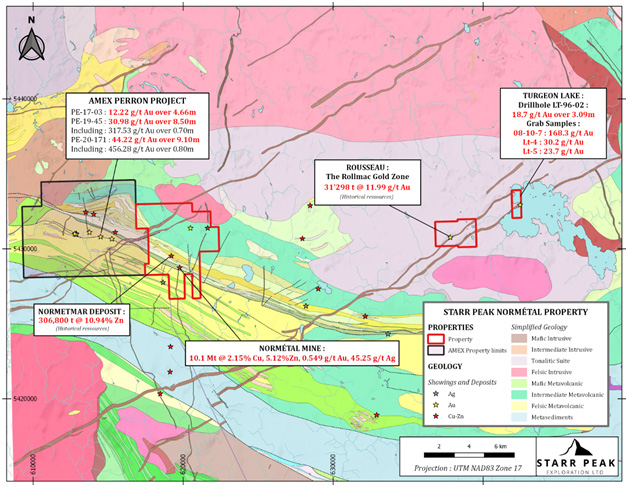

The anticipation of positive results for Starr Peak stems from the neighbouring Perron Property, which was acquired in 1996 by Amex Exploration. However, the Eastern Gold Zone in question was only discovered in December of 2017 during a regional exploration drilling campaign. At the time AMEX stock was trading at about $0.35. Following the discovery, AMEX stock trades well north of $3.00 with a 52 week high of $4.19., a 10x or 1000%+ increase – a formidable performance from a neighbouring mining company. With any luck, gold investors can anticipate such interest rubbing off positively to that of Starr Peak.

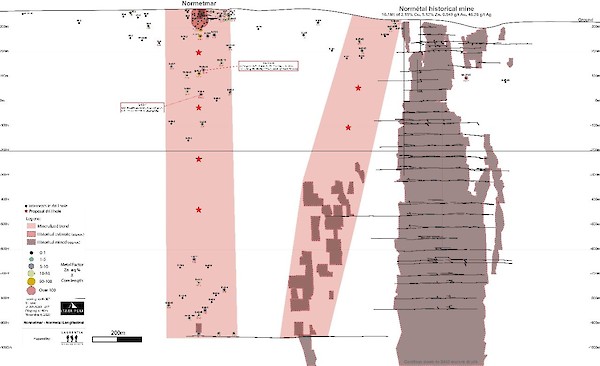

What originally brought AMEX to the Abitibi greenstone belt area of Quebec, Canada was that of a past producing mine referred to as the ‘Normetal Mine’. The mine in the spotlight is located just 8+ kilometers to the NW of the village of Normetal, and approximately 110 kilometers North of the town of Rouyn-Noranda. With the announcement that Starr Peak secured a diamond drill rig for its drilling program, Starr Peak identified that it is targeting drilling in the area of the Main Bloc which consists of the areas surrounding the Normetal Mine.

“With a drilling contractor now secured, we are ready to initiate our 2021 drilling program on our highly-prospective Newmétal property, neighbouring Amex Exploration’s Perron project.”

Johnathan More, Chairman and CEO of Starr Peak

The Normétal mine was discovered in 1925 and exploited from 1929 to 1975. During its lifetime, the mine processed ~10.1M tonnes of ore containing roughly 2.15% copper, 5.12% zinc, 0.549 g/t gold, and 45.25 g/t silver. However, during the historical production, the main focus was on copper, as gold was treated as a secondary product with price ranging around US$30/oz to US$200/oz. Comparatively, 2021 kicked off the year with the price of gold above US$1850/oz amid hyper inflation fears. Gold now remains front and center for both Starr Peak & AMEX.

The Normetal Mine itself was acquired in August 2020, following the initial acquisition of the surrounding property back in June 2019. At the time of the initial acquisition, Starr Peak’s stock was trading about $0.33. The NewMetal Property consists of 74 mineral claims covering 2,279 hectares, and is located in the Abitibi Greenstone Belt of Quebec, along the Chicobi Deformation Zone. Comparatively, Amex’s Perron property consists of 117 adjacent claims that cover a total area of 4,560 hectares, while having a two year head start to that of Starr Peak.

Fast forward to 2021 and Starr Peak is now in the midst of drilling in the direct area of the Normetal Mine. Notably, Starr Peak is using the exact same exploration and geologist team that Amex Exploration used at its Perron Properrty, Laurentia Geophysics. The company is heavily focused on project development, having recently completed geophysical programs, marked by the completion of it’s airborne VTEM over the Company’s Newmétal project. This area is also the home of the Normetmar zinc deposit.

The main attraction for Amex Exploration was without a doubt the past producing Normetal Mine which is now the main attraction of Starr Peak Exploration. While historical resources are relevant to give investors a ballpark estimate of the potential on the property, Starr Peak is showing no signs that they expect drilling results will disappoint as it continues it’s rapid development of the property.

Finally, just last month AMEX Exploration continued to announce positive drilling results in the area. Results came from the Denise area of the Eastern Gold Zone, with highlights from the results including hole PE-20-199, which intersected 81.50 metres of 1.51 g/t gold as well as hole PE-20-204, which intersected 187.00 metres of 0.66 g/t gold.

With Starr Peak estimating a drilling start date of January 19th 2021. The anticipation of the announcement of results only mount higher each passing day. As with the advent of any positive drill results, investors of Starr Peak can expect that the company will only continue to garner significant interest from the mining community.

Starr Peak Exploration last traded at $1.78 on the TSX Venture.

FULL DISCLOSURE: Starr Peak Exploration is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Starr Peak Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.