Early during the week of January 17, 2022, Carlos Tavares, CEO of Stellantis N.V. (NYSE: STLA), the automotive conglomerate formed in 2021 by the merger of Fiat Chrysler Automobiles and France’s PSA Group, made some comments in an interview with a number of European newspapers that appear to throw some degree of cold water on the pace of electric vehicle (EV) development in North America. This, coupled with the fairly modest size of the luxury car market in the U.S., could call into question the validity of the stock market’s lofty EV growth expectations.

Mr. Tavares’ main point seems to be that, across much of the world, “electrification is a technology chosen by politicians,” not by the auto industry and not necessarily by consumers. This notion may be at least partially validated by recently released car industry data. According to EV-volumes.com, full year 2021 EV unit sales in the U.S. totaled 656,866, equivalent to just 4.4% of the year’s total 14.9 million passenger vehicle sales.

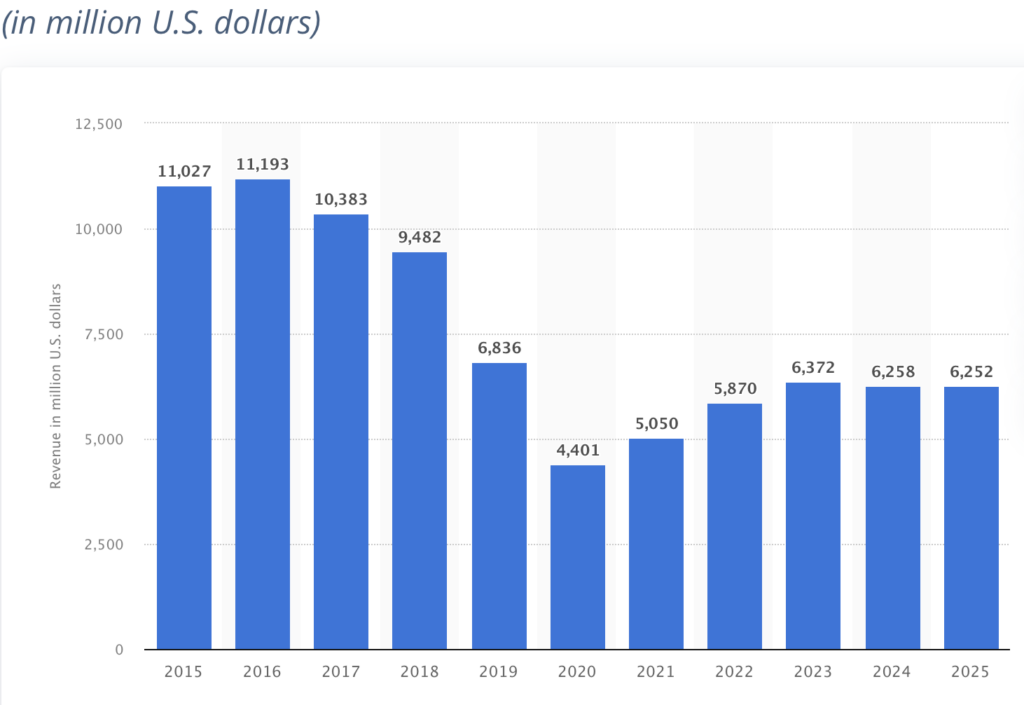

A related issue is that the total U.S. market for luxury cars was just over US$5 billion in 2021 and is expected to grow only modestly over the next few years. To put this into perspective, many EV models which have recently launched or are expected to do in 2022, like Lucid Group, Inc.’s (NASDAQ: LCID) Lucid Air and General Motors Company’s (NYSE: GM) Hummer, would be considered luxury vehicles. If Lucid were to manufacture 20,000 Lucid Airs in 2022 (with a base sticker price of US$77,400), as it forecasted it would at the time of its SPAC merger and sell 75% of those to U.S. customers, that by itself would represent US$1.2 billion of luxury car sales equal to about 20% of the market — up from essentially zero in 2021.

Presumably these sales have to displace other luxury vehicle sales, some of them other EV models. The real question is: are there sufficient buyers for all these new luxury vehicles?

Mr. Taveras also reiterated a claim he made about two months ago that EVs cost about 50% more to build than conventional internal combustion vehicles. It will be impossible to raise sticker prices enough to overcome these costs without making the cars unaffordable for all but a very small percentage of the public.

The Stellantis CEO similarly seemed to question the orthodoxy that introducing what will be a wide selection of EVs into the market will translate into fairly rapid carbon emission reductions. Given Europe’s overall electricity fuel mix (which does not differ markedly from North America’s), Mr. Taveras says that a new electric or hybrid vehicle must be driven 44,000 miles before it begins to offset the additional carbon footprint created by its manufacturing process.

From all this, an investor could conclude that Stellantis is leading an effort to keep cars powered by internal combustion engines in place and to push off any widespread introduction of EVs. Indeed, unlike other legacy car manufacturers like GM, Stellantis has not committed to becoming a fully electric manufacturer by a certain date. GM comparatively has said it will sell nothing but zero emission vehicles by 2035.

However, back in July 2021, Stellantis announced plans to invest at least US$35 billion in vehicle electrification and new software and technologies through 2025. For example, Stellantis plans to introduce the Ram 1500 EV pickup to the U.S. market in 2024. It is very difficult to explain the incongruity between Stellantis’ US$35+ billion EV budget and the CEO’s seemingly less-than-optimistic view on the EV industry.

Stellantis N.V. last traded at US$20.24 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.