FULL DISCLOSURE: This is sponsored content for Sterling Metals.

Sterling Metals (TSXV: SAG) has exercised an option to fully acquire the Adeline Copper-Silver project in Labrador, Canada. The company going forward will wholly own the project following the exercise.

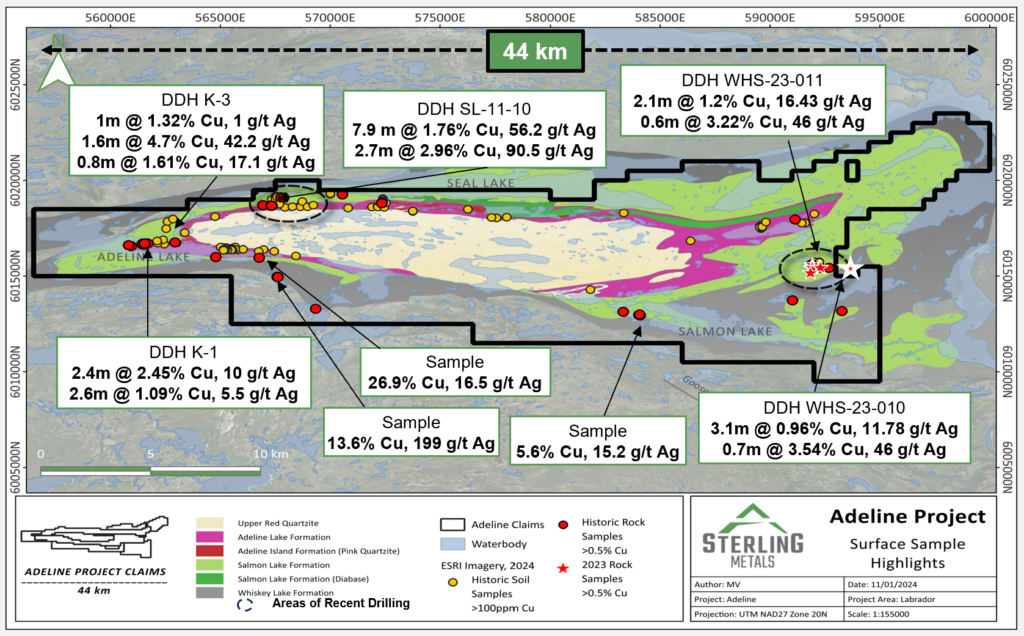

“Since early 2023, we have recognized the significant potential of the Adeline Project, due to its large scale and substantial copper and silver showings across the 44km basin. With the Adeline Project now firmly in our portfolio, we are strategically positioned with two large-scale copper and silver exploration opportunities in Labrador and Ontario, both of which are ranked among the top 10 mining jurisdictions in the world by the Fraser Institute this year,” commented Mathew Wilson, CEO of Sterling Metals.

The project itself covers a basin, which measures 44 kilometres in length and 11 kilometres in width. The project covers the youngest middle Mesoproterozoic volcano-sedimentary sequences. Sediment-hosted stratiform copper deposits are widespread, however economically significant are said to be insignificant, with such deposits accounting for 20% of copper production and reserves globally.

Highlights from drilling at Adeline include intercepts of 1.76% copper over 7.9 metres in hole DDH SL-11-10, along with 2.96% copper over 2.7 metres, among other results.

READ: Sterling Metals Appoints Mining Exec Mark Goodman As Chairman

Sterling has completed an 11 hole drill program at the property, with ALS GoldSpot Discoveries now contracted to conducted a remote sensing interpretation of spaceborne multispectral data. The study is intending to ultimately provide a mineral mapping and structural linework interpretation to identify areas of high prospectivity and exploration potential.

“This acquisition not only enhances our strategic advantage as an explorer but also provides substantial leverage to rising copper and silver prices as we advance work programs on both projects to drive future discoveries,” continued Wilson.

Upon exercising the option to fully acquire the project, Sterling will pay $200,000 in cash and issue 8.5 million shares to Chesterfield Resources. On a post-transaction basis, Chesterfield is expected to hold a 5.46% stake in the company, with total holdings of 12.7 million shares.

Sterling Metals last traded at $0.055 on the TSX Venture.

FULL DISCLOSURE: Sterling Metals is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Sterling Metals. The author has been compensated to cover Sterling Metals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.