FULL DISCLOSURE: This is sponsored content for Sterling Metals.

Assays are finally in for Sterling Metals (TSXV: SAG) inaugural drill program at the Adeline project in Labrador, where a 1,930 metre drill program was conducted this past summer.

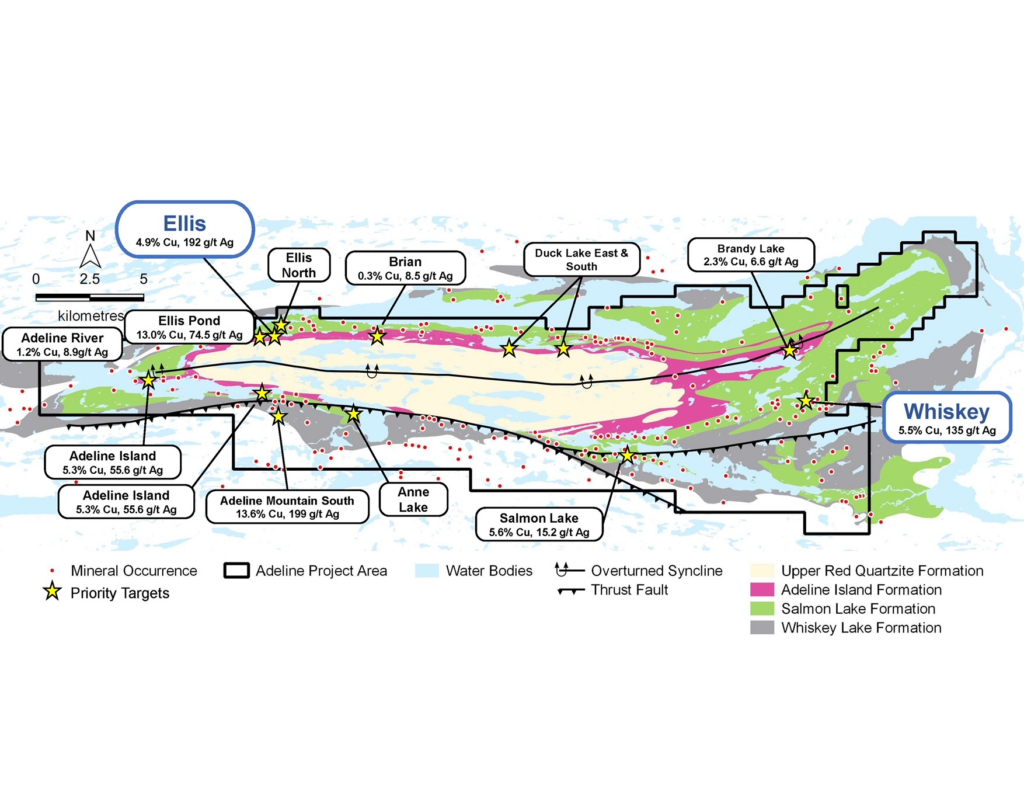

Drilling consisted of 11 holes, which were focused on the Ellis Main prospect and the Whiskey Target, which are found on opposite ends of the basin present at Adeline. The program was designed to test the extents of mineralization in grey beds at Ellis at depth and along strike, as well as the potential blowout of copper mineralization.

“The discovery of a big metal district requires a big metal system, which is exactly what we have at Adeline. The macro environment for copper remains very promising and even more so here at home in Canada. Our aim is to establish a copper project capable of putting Canada back on the copper map and this is just the first step. We are currently evaluating the data to identify a clear path to targeting both at Ellis and across the entirety of the 44km x 7km system,” commented CEO Mathew Wilson.

Highlights from the results incldue:

- ELS-23-007: 25 metres of 0.24% copper and 4.05 g/t silver, including 2.6 metres of 0.87% copper and 11.54 g/t silver

- WHS-23-010: 3.1 metres of 0.96% copper and 11.78 g/t silver, including 0.7 metres of 3.54% copper and 46 g/t silver

- WHS-23-011: 2.1 metres of 1.20% copper and 16.43 g/t silver, including 0.6 metres of 3.22% copper and 46 g/t silver

Hole ELS-23-007 is said to be a standout result after intersecting a wide zone of copper oxide mineralization, which was though to potentially be the top of a flow breccia. Initial drilling at Ellis meanwhile identified that the grey bed mineralization seen at surface and in historical core had disappeared and was replaced by a mafic sill, the top surface of which was mineralized with copper oxide and native copper.

Sterling also identified that the copper zone identified in drill was not consistent with the IP anomaly identified by Noranda previously. Physical properties of the core are currently being examined to determine this discrepancy.

READ: Sterling Metals Extends Heimdall North Zone By 200 Metres Following Recent Drilling At Sail Pond

Going forward, analytical work is currently being conducted to identify the role of hydrocarbons within sedimentary rocks as it relates to copper mineralization. The results may lead to a full survey of the property for new target areas using satellite data. A physical property study is also being conducted on core to assist in geophysical modeling and the designing of future work programs. Finally, the IP study conducted on the property is being reanalyzed to identify conductors for exploration in 2024.

“The extent of the mineralization encountered in this inaugural program serves as a clear indication that there is much more to Ellis than we have seen so far – let alone across the entirety of this project. [..] While the grey beds did not continue at Ellis and the IP did not correlate to a large breccia zone, hole 7 did establish itself as having potential to represent the top of a flow breccia. The native copper in quartz veins and rock type are similar to the zones in the Keewenawan peninsula which provided a large source of copper for the U.S. in the 1900s. The grades and style of mineralization suggest we are potentially in proximity stronger copper zone,” commented SVP Exploration and Evaluation Jeremy Niemi.

Sterling Metals last traded at $0.07 on the TSX Venture.

FULL DISCLOSURE: Sterling Metals is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Sterling Metals. The author has been compensated to cover Sterling Metals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.