On March 1st, Eguana Tech (TSXV: EGT) reported its first fiscal quarter of 2022. The company announced revenues of $1.3 million, down from $2.3 million a year ago. They note that this decline is due to a global resin shortage that is impacting their ability to complete production. Additionally, the company saw its gross margins drop to $10.4 thousand or a 0.8% margin from $189.9 thousand or 8.2% margin last year. They say that this decrease in margins is due to additional supply chain-related costs.

Additionally, the company saw its operating losses remain flat year over year at $2.42 million. The company also noted that they have over $17 million in backorder products and are sitting on $2.8 million of cash on hand.

Eguana Technologies currently only has 2 analysts covering the stock with an average 12-month price target of C$0.73, or a 99% upside to the current stock price. Both analysts currently have a buy rating on the stock with the street high sitting at C$0.75 from Raymond James.

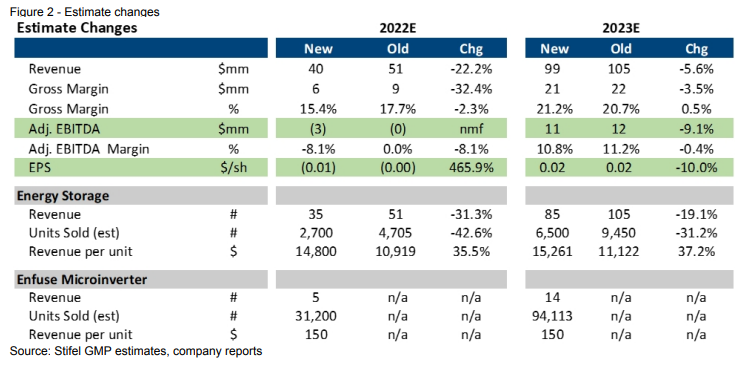

In Stifel-GMP’s note, they reiterated their buy rating on Eguana but lower their 12-month price target from C$0.85 to C$0.70, saying that they continue to believe that the second calendar quarter of 2022 is when there will be a “material change in the cadence of sales.” Additionally, they believe that the second half of 2022 is when investors will see a ramp-up in microinverter sales, “which has a promising outlook that could exceed our forecasts.”

They believe that between now and the release of the company’s calendar Q2 financial results, the stock could stay range-bound, unless additional new larger commercial agreements are announced.

For the results, Stifel-GMP was expecting Eguana to report $2.6 million in sales, $0.4 million in gross margins. They reiterate the companies message that this quarter was weak primarily on the fact that they are having issues sourcing resin and elevated shipping and raw material costs hitting gross margin.

On the company business update, Eguana announced that there is a new testing station currently being installed at Omega which would add an additional capacity of 300 units per month. They also announced two distribution partners in Sonepar and ABC Supply, which adds roughly 1,500 new locations. This brings their total locations available to carry Eguana products to 2,000. Stifel-GMP adds that this is a positive development and indicates that there is additional demand for Equana products.

Below you can see Stifel-GMP’s updated estimates. They say that the estimates are being changed to reflect managements commentary and first quarter results.

FULL DISCLOSURE: Eguana Technologies is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Eguana Technologies on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.