Earlier this month, WELL Health Technologies (TSX: WELL) reported their second quarter financials, with quarterly revenue coming in at $10.6 million, a 43% growth year over year, and an EBITDA loss of $0.5 million. After the financial release, four analysts have raised their price targets while each reiterated their buy rating on WELL Health.

- Laurentian Bank raises target price to C$5.25 from C$3.50

- PI Financial raises target price to C$4.90 from C$3.50

- Haywood Securities raises target price to C$5.50 from C$3.90

- Stifel raises target price to C$5.35 from C$4

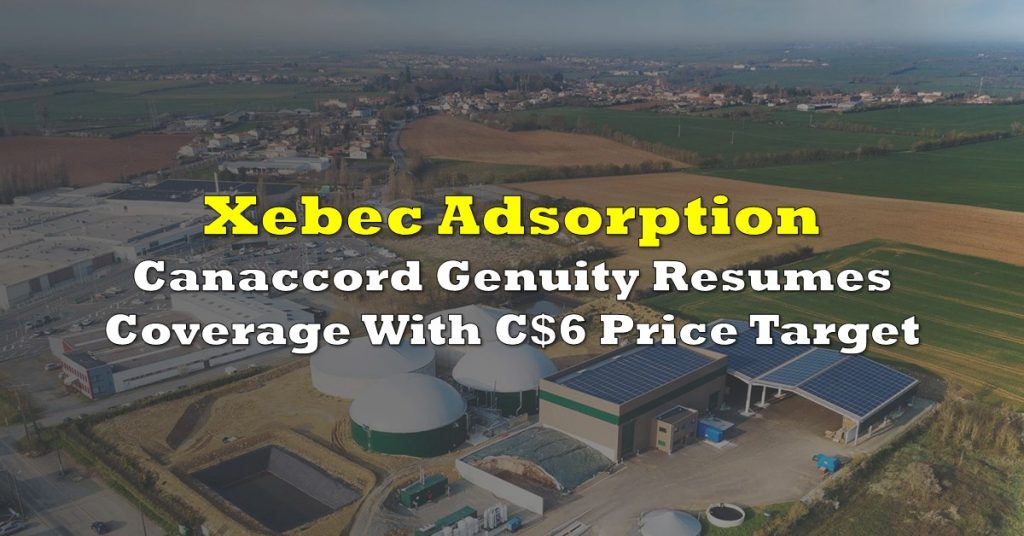

There are ten analysts with ratings and price targets on WELL Health. Three have strong buys while the other seven have buy ratings. The mean 12-month price target is C$5.00, or a 13% upside. The highest price target comes from Haywood Securities with a C$5.50 price target, and the lowest comes from Kinyip Gabriel Leung from Beacon Securities with a C$4.50 price target. Both have buy ratings on WELL Health.

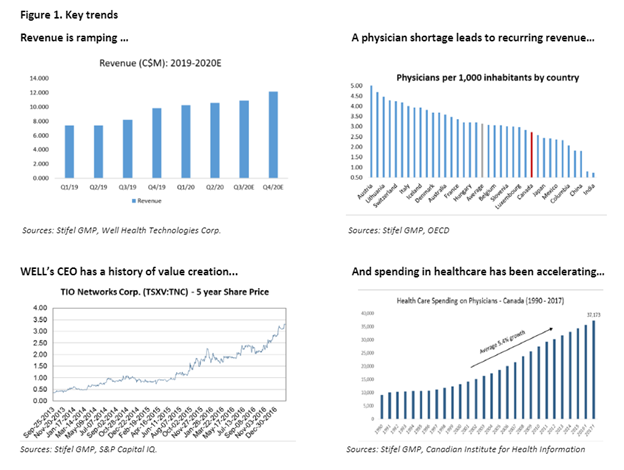

Stifel GMP analyst Justin Keywood commented on the earnings, stating, “Overall, we see Q2 as showing solid execution by management, who are well aligned. We forecast high growth to continue over the next several quarters, driven by M&A but also organic initiatives.” Revenue was slightly ahead of Stifel’s forecast of C$9.5 million, and gross margins increased from 30% to 40%, which “gives a more significant path to profitability.”

Keywood provides further comment, referring to the company as a “unique business model still in high growth phase,” and adds that WELL has the competitive advantage with a ~15% electronic medical records (EMR) market share in Canada, where new offerings are hard to replicate. Keywood states that the acquisition pipeline also remains healthy and robust as roughly 100 assets are being evaluated, with ten of these acquisitions in late-stage due diligence, while WELL Health has C$25 million in cash on hand to deploy into any of these assets.

Stifel currently forecasts that WELL Health will do C$44 million in sales for 2020 and C$55 million sales in 2021, due to a current doctor shortage, and comments that “repeat revenue generally warrants a higher premium.” Keywood also puts up a case that the clinical assets could be attractive to a private equity firm with an electronic medical record customer base, which would imply a higher multiple in a takeout.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.