As the coronavirus pandemic continues to put financial pressure on Canadians, the latest data released by Equifax suggests that the strong housing market recovery along with abundant loan deferrals has caused consumer debt to rise.

The second quarter of 2020 saw consumer debt to grow to $1.991 trillion, which points to a 2.8% increase compared to the same time a year prior. The rise in mortgage balances has in turn caused per capita debt to expand by 2.2% since the second quarter of 2019 to an average of $73,532. Moreover, the strong rebound in home sales along with a spike in refinancing activity has pushed average home prices up.

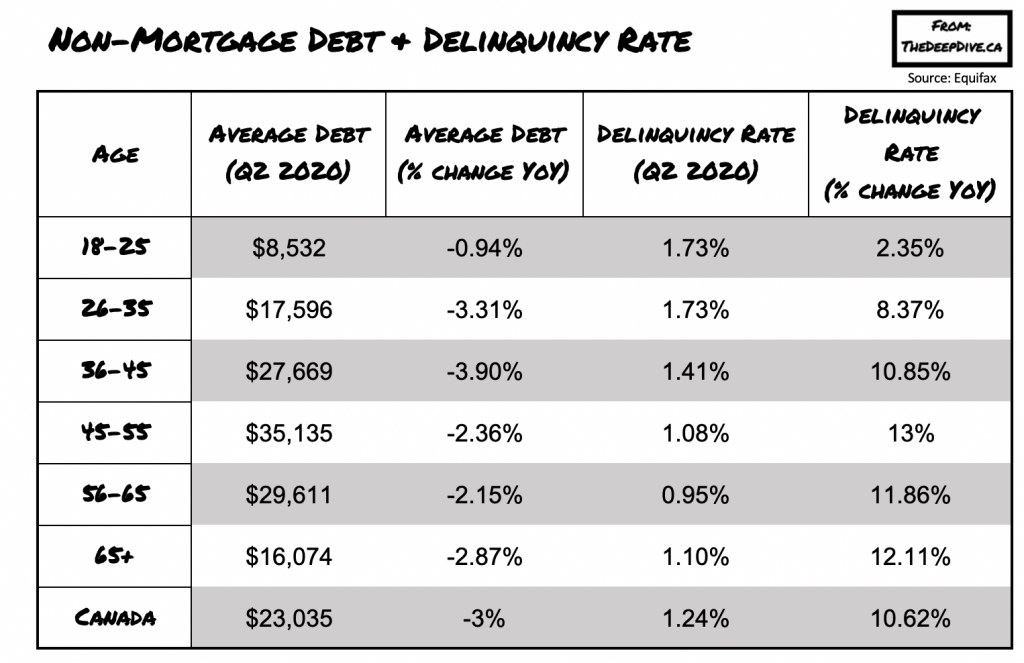

However, not all types of debt has increased in the second quarter. Non-mortgage debt has declined compared to last year’s second quarter, as stringent lockdown measures forced Canadians from using their credit cards or purchasing new vehicles. The unprecedented financial volatility has caused many to resort to payment deferrals, especially among those aged between 35 and 44.

The 90-day delinquency rate for non-mortgage debt has risen 10.6% since the prior year, currently sitting at 1.24%. According to Equifax, one in every five people that took advantage of payment deferrals reported that they were already facing financial hardships even before the pandemic. However, now that debt-alleviating mechanisms are being phased out, those individuals may soon find themselves struggling to gain a foothold.

Information for this briefing was found via Equifax. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.