Sundial Growers (NASDAQ: SNDL) reported its third quarter financials after the bell today, recording revenues of $33.5 million for the quarter. Revenues were up 74% on a quarter over quarter basis, largely from its cannabis operations which netted $28.0 million for the three month period ended September 30, 2019.

Cannabis revenues was the largest segment within Sundial’s sales mix, with unbranded flower, or wholesale, generating the bulk of revenues at $17.5 million. Winterized oil was the second largest sub-segment at $8.2 million, followed by branded flower sales of $2.3 million. The remaining $5.5 million in revenue was from Sundial’s UK-based plant and herb business which is in the process of converting to hemp and cannabis.

Gross margin before biological adjustments during the quarter amounted to $8.6 million, while expenses totaled out at $27.1 million. The largest of which was general and administrative at $14.5 million, followed by share-based compensation at $8.3 million. Net loss for the quarter came in at $97.4 million, helped in part by a $59.5 million loss on financial obligations – an obligation which was paid to a company controlled by the executive chairman of Sundial. The obligation was in relation to a royalty owed on all cannabis produced at the firms Olds, Alberta facility that was bought out during the quarter. The buyout was in the form of shares and cash, including a $9.5 million cash component.

Average selling prices took a slight hit on a per gram basis, with wholesale product generating on average $4.03 per gram versus $4.46 in the second quarter. Branded product prices also saw a retreat during the quarter, declining to $6.34 per gram gross from that of $6.53. On a net basis, branded flower averaged $4.89 per gram. Average net selling price per milligram of oil was $0.03. Sundial sold 7,944 kilogram equivalents of cannabis during the third quarter, while harvesting 11,668 during the same time period. Sundial currently has 9,462 kilograms of harvested cannabis in inventory.

In terms of cost of sales, costs per gram amounted to $1.91 during the quarter, which saw a marked improvement from $2.20 in the second quarter. However, the figure was impacted by the costs of having excess inventory converted to winterized cannabis as a means of “managing inventory levels”. The firm also destroyed 500 kilograms of cannabis that were “control samples of inventory” during the quarter.

Looking towards the balance sheet, as of September 30 Sundial had $141.8 million in cash, bolstered in part by the IPO that took place during the quarter. Accounts receivable amounted to $22.5 million, while inventory sits at $28.4 million. Total current assets amounted to $230.2 million.

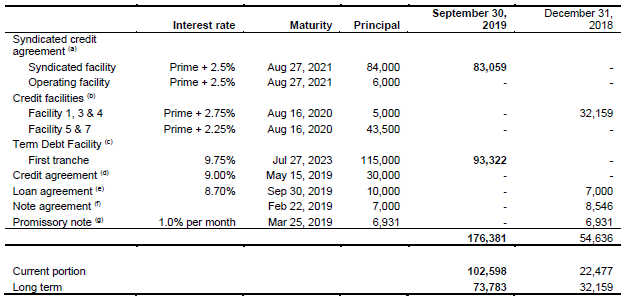

In comparison, accounts payable and accrued liabilities currently sits at $61.3 million, while the current portion of long-term debt amounts to $102.5 million. Convertible notes are also due within the year, to the tune of $18.6 million, while contingent consideration sits at $21.1 million. Total current liabilities in all amounts to $204.4 million.

It also appears that Sundial is having trouble meeting certain supply agreements, as the firm has been subjected to financial penalties payable in the amount of $3.2 million. The fee must be paid in either cash or product in-kind. It’s unclear whom the third party purchasers were.

Sundial Growers closed today’s session at $3.61 on the Nasdaq.

Information for this briefing was found via Sedar and Sundial Growers. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.