Sundial Growers Inc. (NASDAQ: SNDL) has had a somewhat busy M&A news week this week, with the company on Tuesday announcing that they have taken a 10.1% stake in Valens with a cost basis of $2.67. The next announcement was Wednesday morning when the company announced they would be acquiring Inner Spirit Holdings, a cannabis retail store chain, for $131 million via a combination of both cash and shares for total consideration of $0.39 a share.

Sundial currently has only five analysts covering the company with a weighted 12-month price target of $0.90. Two analysts have hold ratings, two analysts have sell ratings, and one analyst has a strong sell rating. The street high comes from Cowen and Company with a $1.50 price target, while the lowest sits at C$0.45.

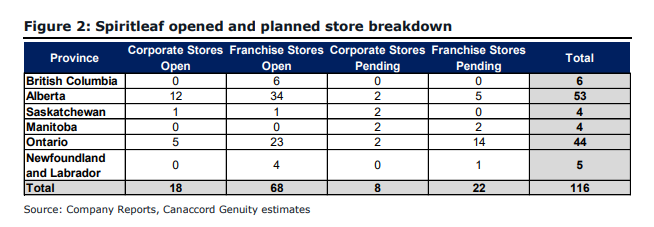

In Canaccord’s note to investors, Matt Bottomley, their analyst, reiterated his $0.65 price target and sell rating on the company and raised concerns about the financial synergies from the transaction, but believes that the value out of this acquisition will be the leverage Sundial gets. Spiritleaf, the firms retail brand, has 86 branded dispensaries with 28 of those opened in Ontario and the company expects to reach 100+ stores by mid-2021.

Canaccord is not too bullish on the synergies between the two companies. Bottomley writes, “we see limited financial synergies arising from the transaction.” For the most part he believes that the most value that comes out of this transaction will be Sundial now having access to a more granular retail dataset which will help shape its Canadian roll out. Bottomley writes Sundial, “can leverage the Spiritleaf retail infrastructure to increase budtender education on its in-house brands, while utilizing point-of-sales data to make informed SKU optimization decisions, ultimately driving end-user sales for its products.”

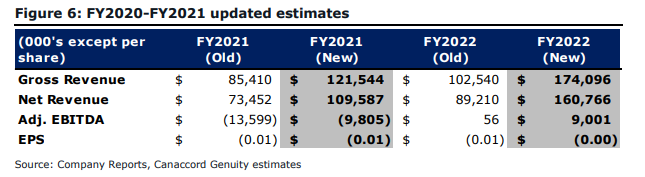

Below you can see Canaccord’s new 2021 and 2022 estimated for Sundial.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.