In the US and here in Canada, when we were locked down everyone traded memestocks like they were binge watching a Netflix show. In other parts of the world, they had to get creative with things like crypto and find ways for people who either had no access to trading and some savings, or had no money to participate but were willing to work to be a part of the hoopla.

Today’s story unfolds in the Philippines during the Great Pandemic of the early 2020’s, where people suddenly became infatuated with what can only be described as the bizarre lovechild of Pokémon, Q-Bert, and CryptoKitties known as Axie Infinity. This game was like your high school relationship – complex, requiring investment, time, and everyone seemed to be doing it to be cool.

Axie had its own currency, and NFTs were more crucial to players than avocados to a hipster’s breakfast.

Just to play the game cost roughly a $1000 entry fee. You’re probably asking, “How could Filipinos afford to play this game, where the average household income is about $400 per month?” Well, that’s where the scholarship program sailed in – think of it as the financial aid for aspiring digital swashbucklers.

It allowed players, with no money, but access to a phone and internet, to lease Axies from the digital landlords of the game, fight digital duels, and profit share the booty.

The game exploded. Although I’m skeptical over the origins of who was leasing out most of the Axies. or as I call them, the landlords. Still, at it’s highest height the game saw millions of daily active users creating a bubble of sorts within the ecosystem.

And then it took a crazy turn. The North Koreans showed up as digital pirates. According to the Wall Street Journal, they posed as recruiting firms, as Canadian IT consultants, Japanese blockchain experts – you name it, they pretended to be it. Or at least found someone that would play the part, to get them on the inside. They’d hack into computers through the clever use of Trojan Horses disguised as job applications with documents that were filled with malicious software.

This keeps going. North Korea’s end goal? To fund their missile programs, no less! We’re talking about nukes.

Today we’re going to get into the story of how Axie Infinity grew to be a household name in the Philippines, creating hope for many that they would get to make a living playing a Q-bert knock off, only to end in tears and giving North Korea a stronger missile program.

Let’s dive in.

Origins and gameplay

Axie Infinity’s story begins in 2017, when Nguyen Thanh Trung conjured up this virtual realm. Nguyen was spellbound by CryptoKitties, one of the original blockchain-based NFT games and decided, “Hey, I can do better!” And thus, Axie Infinity was born.

This pet battle fantasia, designed as an educational way to introduce the world to blockchain technology, quickly gained traction. In this game, players would breed, battle, and trade creatures known as Axies.

Fast forward to 2021, and the user numbers were more inflated than a pufferfish on steroids, with asset prices skyrocketing over 650% in a single month.

Of course, it wasn’t all sunshine and rainbows. There were murmurs about Axie Infinity being a pyramid scheme. Cheap labor, they said, was the fuel to its fire. But with a 2.7 million peak monthly player count that would fill up an entire country, Axie Infinity had the growth numbers to gain interest with VCs.

Sky Mavis, the Vietnamese studio behind Axie Infinity, raised a cool $157.5 million over the course of the year, backed by the likes of Mark Cuban and Andreessen Horowitz. The game was racking in NFT transactions like a vacuum cleaner in a confetti factory with $3.5 billion in trading volume in 2021 alone. The game accounted for more than two-thirds of the volume within the blockchain gaming space.

Scholarships and stories of success

Now, I know you’re thinking, “Where do I sign up?” But hold your digital horses, because Axie Infinity was mainly all the rage in places like the Philippines, Argentina, and Venezuela. Which sounds odd given the entrance fee.

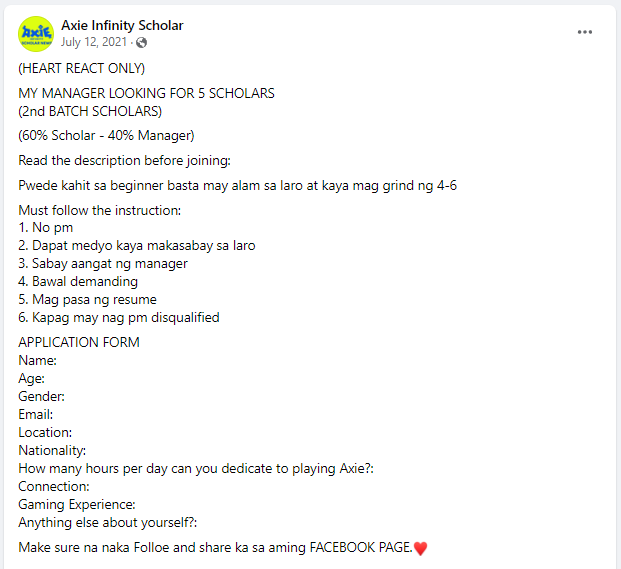

At its peak, the cheapest Axies that had good battle skills and cards cost around $350. Since you needed a team of three Axies, at the time the initial cost of starting an Axie Infinity team was around $1050. To combat this problem, Axie Infinity created the fairy godmother of gaming – the scholarship system.

The program effectively let players in dire straits borrow a team of Axies from a “manager.” These scholars had to work like digital Cinderella’s – forfeiting up to 90% of their earnings and toiling away for up to 10 hours a day. All in the quest for some digital pumpkin-turned-carriage glory.

And with a country in lockdown, people were buying in. Facebook, Telegram, and Discord were the streets of this digital gold rush, where desperate gamers scurried around looking for scholarships like they were Willy Wonka’s Golden Tickets. And like any good pump, heroes started to emerge.

Our hero from the Philippines? A 22-year old John Aaron Ramos who took to social media to announce that he bought two houses from profits earned playing Axie Infinity alone.

John started playing in November 2020 as a ‘scholar’ and claimed to play it for just two to three hours a day. In a post, Ramos attributed his home purchases to the surging price of Axie’s in-game token Smooth Love Potion (SLP), which rallied 940% from $0.035 on April 24, 2021 to $0.364 on May 2, 2021 (8 days).

“I believed in AXIE’s ability to lift us up, I held an SLP, paid attention to the trend of AXIE Community and did some research then I played with the price of SLP to have enough funds to buy two houses and one team,” Ramos said in a statement.

Interesting to note, that his original post was taken down as of the time of writing.

Sky Mavis, the puppet master behind Axie Infinity, was raking in the dough, too. Every trade had a 4.25% transaction fee, essentially greasing Sky Mavis’ palms. By March 2022, they had increased the transaction fee to 5.25%. It was like a concession stand charging an extra fee for the popcorn you already overpaid for.

And it didn’t stop there, the managers got greedier, and the terms of scholarships turned ludicrous, mirroring the script of a low-budget dystopian movie. As the market got saturated with wannabe crypto moguls, the scholars were left holding worthless digital beans instead of the golden goose.

As for Sky Mavis – the company garnered a cool $3 billion valuation on the backs of these users being paid peanuts.

The crash

And then came the crash.

In late July 2021, SLP plummeted from $0.42 to just $0.0034.

As restrictions from the pandemic started to ease, the scholars found more promising ways to generate an income and left Axie behind. Axie’s creators tried to patch the hole by eliminating SLP farming and allowing players to toss SLP into tournament prize pools.

But the winds were not in their favor, and this was just the start of trouble.

The hack

And then it took a bizarre turn. Enter North Korea and the crafty Lazarus Group, who, like pirates in the night, decided to plunder Axie’s treasure.

The hack to the Ronin Network took place on March 23, 2022. Using a hoax job ad, a fake recruiter, and a PDF file with the cunning of a Trojan horse, they managed to con an engineer from Sky Mavis. With complete access to Sky Mavis’ code base and an RPC backdoor, they had all the keys to the treasury. After two major withdrawals, Axie was robbed of 173,600 Ether and 25.5 million USDC tokens.

The value of the hack? Around $625 million.

Fast forward to March 29th, 6 days after the hack, and the air is buzzing in Los Angeles at the NFT LA convention. Axie Infinity’s co-founder, Jeff “The Jiho” Zirlin, is the keynote speaker and he’s ready to bring down the house. The crowd is popping bottles and wallets alike as they eagerly anticipate his address.

But then, plot twist! Thirty minutes before Jeff goes on stage, Axie Infinity drops a blog post spilling the beans. Zirlin, who had been riding the high of fan adoration, is now serving as the bearer of bad news, claiming he only got the news at 2:00 AM that very morning.

And guess what? The Axie team did what anyone does when their cash gets snatched up in the crypto world – they called CZ. By April 2022, Sky Mavis raised another $150 million from Binance.

But as with all crypto shenanigans, it didn’t end there. In July 2022, Bloomberg reported that the CEO of the company had moved $3 million worth of AXS – the native token of Axie – to Binance before announcing the hack incident.

The aftermath

So what’s the damage here?

Apart from immediate nose dives in value, hacks leave a sour taste in investor’s mouths. Just ask the folks who lost their savings betting on Axie. Reddit stories reek of regret as they bemoan their lost fortunes.

One man in the Philippines, Owen Convocar, hustled hard but ultimately saw his earnings wiped out. He heard murmurs about Axie’s earning potential for months in early 2020 before he decided to enter the game as a scholar. In 15 days, he earned $487. He soon invested $1,200 to buy his own Axie monsters, splitting the total cost 60/40 with his mom. Today after investing over $8,000 in the eco-system he figures he’s left with around $1,600.

It’s like classic a stock market bubble story, for the developing world.

Wrapping it up

So let’s wrap it up.

When it comes to Axie Infinity, I’m left with more questions than answers.

- Are the North Koreans really sophisticated enough to hire a useful idiot who gives them the keys to the treasury via malware?

- Binance is known for laundering money for sanctioned countries, what role did they really play?

- And who owned the majority of the Axies that were being leased out to scholars?

We had money coming in from the global crypto eco-system but also money from the VC community and of course there is nothing VCs love more than daily active users. Was the VC funding going towards paying for daily active users, in hopes of an eventual go public? If so, it almost seemed like a half brilliant multi-level marketing scheme utilizing cheap labour, greed, and capital flowing like crazy into the stock market.

But, like all multi-level marketing schemes, it requires more players to keep bringing in money, and once that stops, it collapses like a house of cards. And that’s exactly what happened here. Whether it was a function of the overall crypto market decline, a North Korean hack, or just a lack of VCs willing to keep shoveling in money is up for debate.

But mark my words, in a world where technology only gets more globalized and equity markets are flowing, stories like Axie Infinity will only become more common. They managed to make it so everyone could participate so long as they had a smart phone.

And as for the hack, colour me skeptical that the North Koreans hacked anything here. This reeks of Binance chasing dollar signs while putting the world at risk. But hey, maybe you guys want to trust the man who’s currently under investigation by the SEC, CFTC and DoJ.

Sam Bankman-Fried did, and that worked out great for him!

Information for this story was found via CoinDesk, The New York Times, Wall Street Journal, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.