Canaccord recently intiated coverage on Taiga Motors (TSX: TAIG), a recently de-SPAC’d company with a buy rating and C$23 price target. Canaccord owns roughly 7.4% of the shares outstanding of the company as the SPAC was owned by Canaccord Genuity.

Taiga Motors is a manufacturer and distributor of electric off-road vehicles and personal watercrafts. The company currently has 1,500 pre-orders, and more than 750 dealer applications received which Derek Dley says implies a >$1 billion run rate. Of those pre-orders, roughly 225 or 15% of them are to large customers such as ski hill operators. Dley says, “Over the next two years, we believe Taiga will focus on increasing its exposure to fleet customers given the substantial savings available to a commercial user. We estimate that approximately 60% of product sales will be directed to the fleet channel in the near term.”

Dley breaks down six of the key investment drivers:

- Leading the electrification of powersports

- Strong initial demand pipeline supports electrification adoption

- Ability to move into adjacent markets

- Robust revenue growth expected as manufacturing capacity ramps up

- Well aligned management team with strong operational experience

- Inexpensive valuation versus both combustion and EV peers

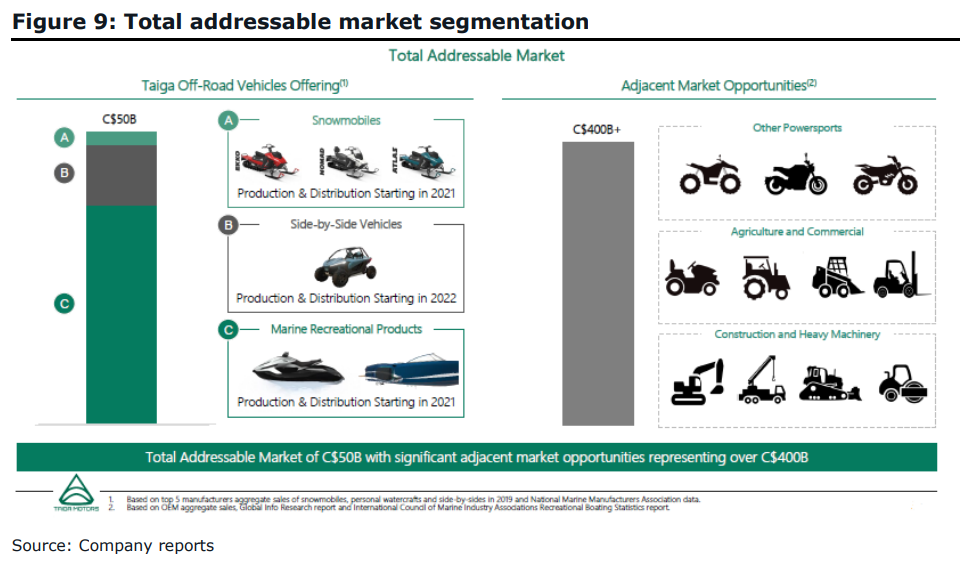

For the first point, Dley points out that the electrification of Powersports represents a $50 billion market. With Taiga having first movers advantage, which Dley writes “we believe should allow the company to develop a leading position as electric Powersports vehicle adoption accelerates.”

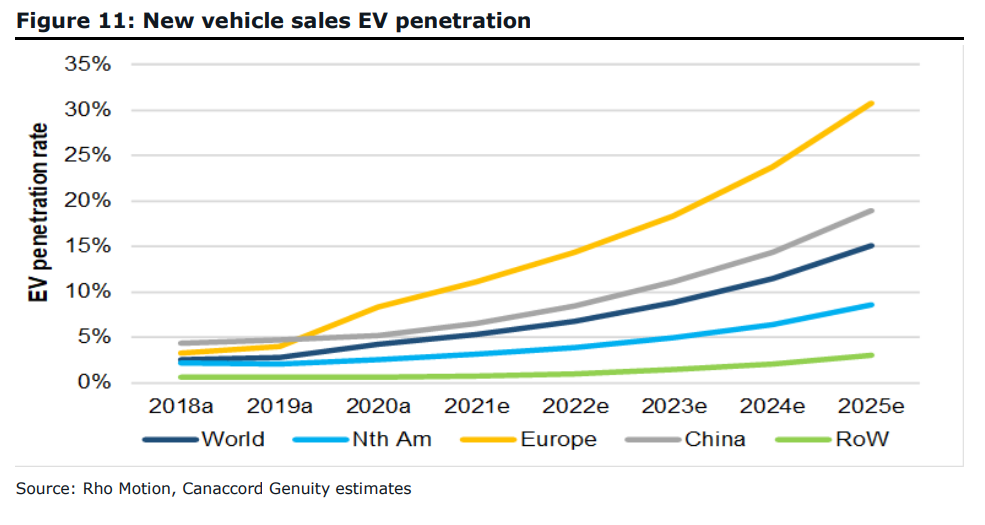

The demand for these electric vehicles has had insane growth during COVID-19, which Dley believes the demand will stick and is structural. He says in 2020 the powersports industry in North America grew 30% year over year, with roughly 35% of the buyers upgrading to new powersports. Dley writes, “Looking ahead, we believe this new larger market TAM should allow for new disruptive competitors, such as Taiga, to successfully enter the powersports market and challenge the existing industry players.”

Dley additionally believes that the company will slowly branch out into adjacent markets with the introduction of marine or commercial equipment and believes the companies powertrains would be attractive to, “a whole host of potential partners and well suited to commercial applications outside of the powersports industry.”

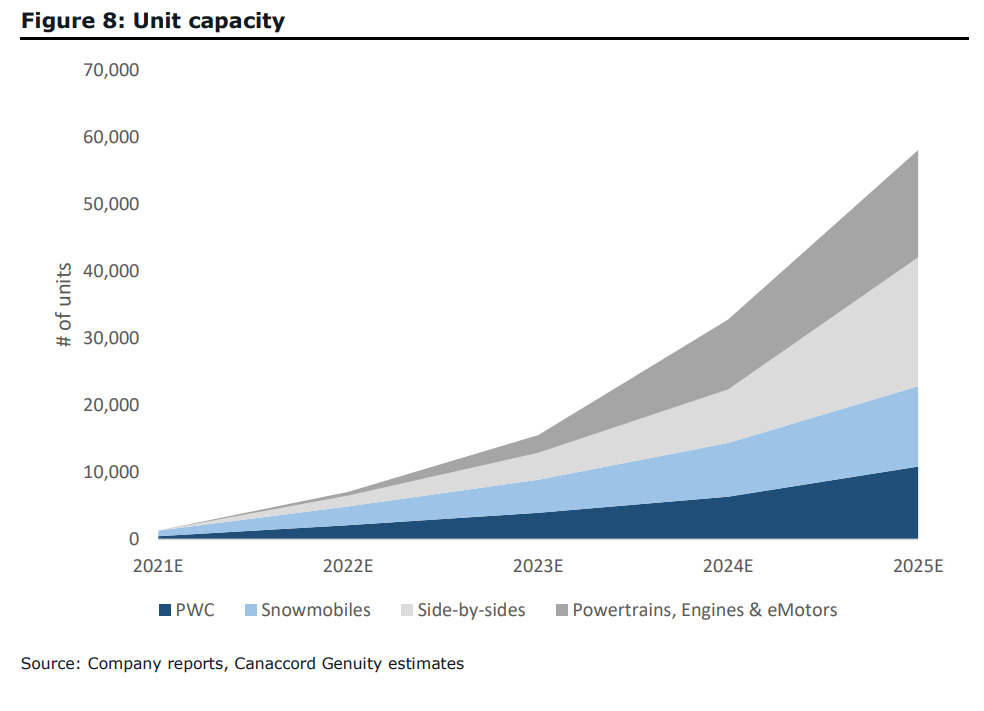

Currently, Taiga has a 50k sq ft facility which Dley expects to be able to produce about 2,000 units per year, with the majority of the ramp-up hitting during the third quarter of this year. The company has announced that it plans on building out a massive 340k sq ft facility that is expected to be online by 2022, and by 2025, the location will hit peak production of 60k units.

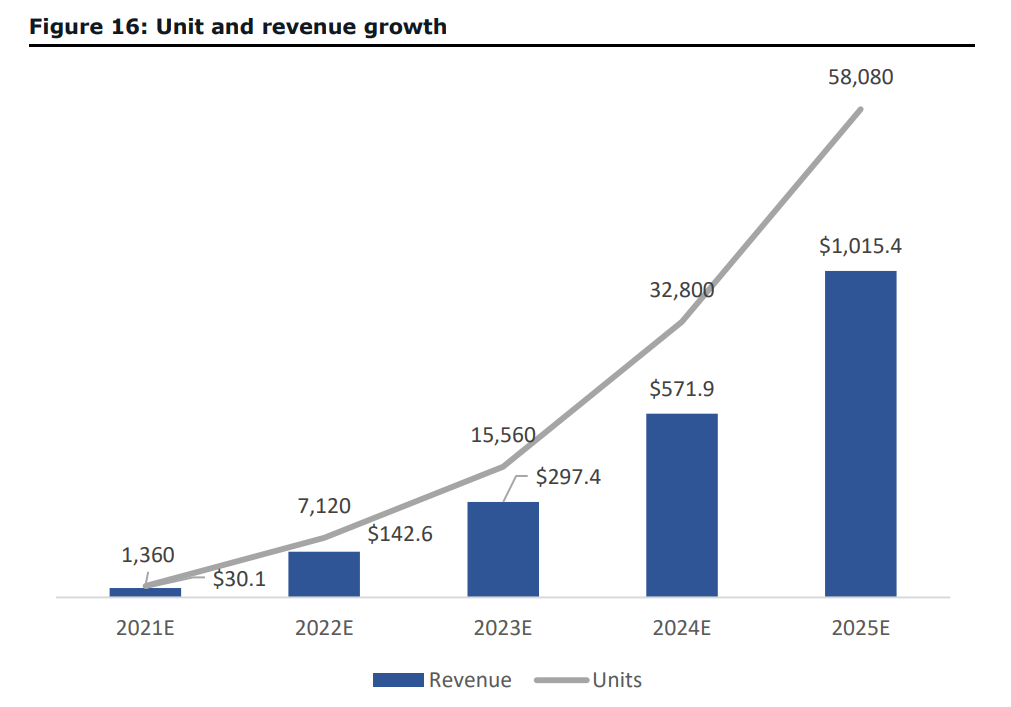

Below you can see Canaccord Genuity’s revenue and unit estimates going out to 2025. They expect units sold to increase 4 fold from 1,360 to 7,120, making revenue grow from $30.1 million to $142.6 million. Inevitably reaching 58,080 units with revenue of over $1 billion by 2025 as the new 340k sq ft facility reaches maximum output.

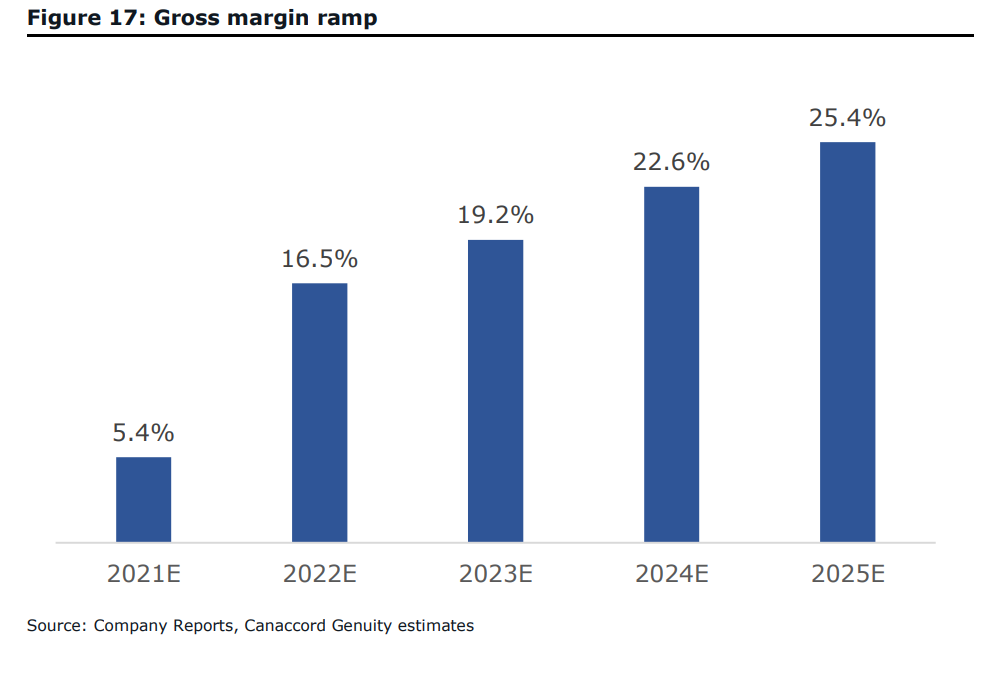

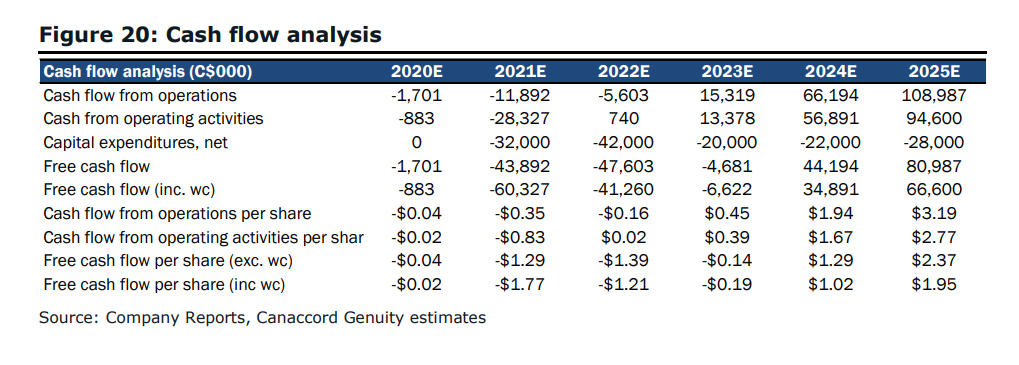

They expect that the companies gross margins will start at 5.4% in 2021 but will grow to 25.4% in 2025 and by 2024 the company will be free cash flow positive.

Dley believes that 2021 and 2022 will have heavy capital expenditures as the company ramps up production and advertising.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Is it possible to receive this presentation?

Thanks!

Thanks for this update! Where do I find the presentation used in the article?