Like the prices of many metals which are utilized in the batteries of electric vehicles (EVs), nickel prices have risen significantly over the last few months. Indeed, the silvery-white metal is now trading at a 6+ year high. Nickel is a key element of the cathode of many EV batteries, which itself is the most valuable part of a lithium-ion EV battery.

Furthermore, the nickel composition in the cathode has risen substantially, reaching about 80% now, up from about a third in prior versions. Other metals typically employed in a cathode include cobalt and manganese. (Cobalt mining is considered especially environmentally unfriendly.) Nickel usage is increasing because it has a high energy density and increases storage capacity — at a lower cost than cobalt or manganese.

According to Wood Mackenzie, the worldwide market for nickel should be around 2.5 million tonnes in 2021. About 65% is used to make stainless steel, and another 12% goes to make superalloys or nonferrous alloys. Only a few percentage points of all nickel produced this year will be used in EV batteries.

However, the European Commission and market research company Roskill predict that the global demand for nickel in the EV sector alone will reach 2.6 million tonnes per year by 2040. This projected step change in demand for nickel is best illustrated by a July 2020 quote from Elon Musk of Tesla: “Tesla will give you a giant contract for a long period of time for you to mine nickel effectively and in an environmentally sensitive way.”

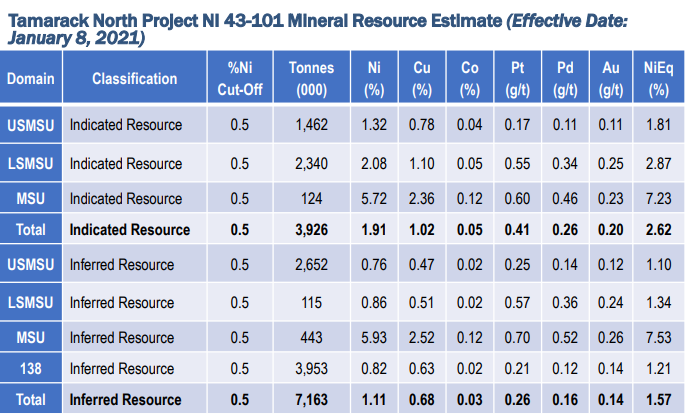

Talon Metals Corp. (TSX: TLO) is a pre-revenue junior nickel miner. Its principal asset is a joint venture (JV) agreement with Rio Tinto on the Tamarack Nickel-Copper-Cobalt Project in the U.S. state of Minnesota. Tamarack, the only undeveloped high-grade nickel project in the U.S., occupies a 31,000-acre land area and has an 18-kilometer strike length. The Tamarack North Project alone contains 3.9 million tonnes of indicated resources with a nickel-equivalent (NiEq) grade of 2.62% and 7.2 million tonnes of inferred resource with a NiEq proportion of 1.57%.

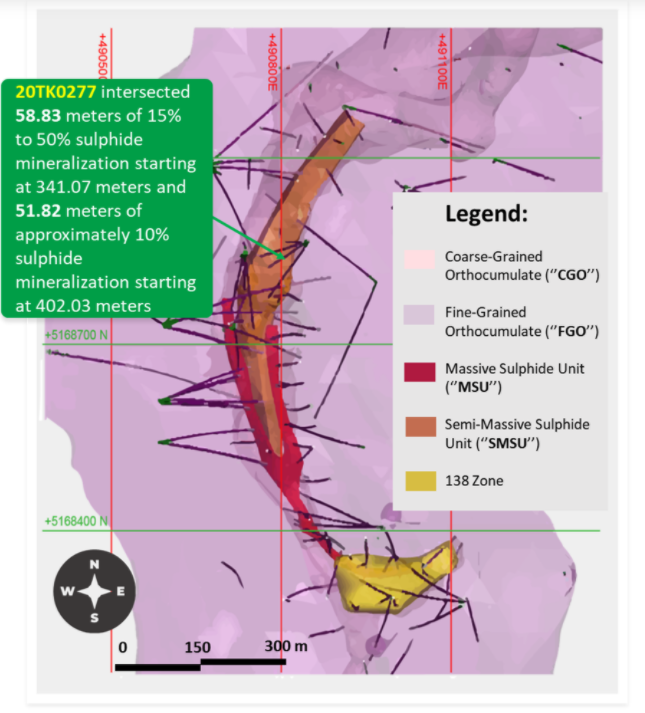

Talon Metals’ drilling on Tamarack has yielded impressive results. On February 9, 2021, the company announced a thick 111-meter intercept of 15-50% sulfide mineralization, including 39 meters of “semi-massive” 50% mineralization.

Talon Metals can earn a 51% stake in Tamarack if, by March 2022, it pays US$6 million in cash and US$1.5 million in Talon Metals shares to Rio Tinto (both of which it satisfied in March 2019); and spends US$10 million on exploration and development (US$9 million already incurred) and pays a further US$5 million in cash to Rio Tinto. Talon Metals can increase its stake a further nine percentage points to 60% if it completes a feasibility study and pays Rio an additional US$10 million by March 2026.

Strong Balance Sheet

As of February 3, 2021, Talon Metals had $15.4 million of cash and no debt, as per the firms website. This cash balance reflects $11.5 million of equity raised in December 2020 and is higher than the $7.1 million of cash shown on its September 30, 2020 balance sheet. The company has controlled its expenses reasonably well over the last five reported quarters; its operating cash flow deficits have averaged about $550,000 per quarter over that period.

| (in thousands of Canadian $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($493) | ($324) | ($542) | $215 | ($532) |

| Operating Cash Flow | ($811) | ($125) | ($646) | ($193) | ($983) |

| Cash – Period End | $7,145 | $5,280 | $2,953 | $7,271 | $10,892 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 555.5 | 534.5 | 494.3 | 494.3 | 494.3 |

If EV adoption were to prove slower than generally expected, or if Talon Metals’ drilling program were not to make additional discoveries, Talon Metals’ stock would be negatively affected. Furthermore, the company is not expected to begin generating cash flow for some time.

If the current lofty projections for EV industry growth prove correct, substantial quantities of new nickel supplies will be needed and the price of nickel could remain robust. Under those circumstances, Talon Metals may become an important nickel supplier, and the Tamarack project could continue to increase in value.

Talon Metals Corp. is trading at $0.84 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Awesome post! Keep up the great work!