FULL DISCLOSURE: This is sponsored content for Temas Resources.

Temas Resources (CSE: TMAS) is a junior mining company, which like a lot of plays with a resource, has an arbitrage opportunity between the worth of the resource ‘in-situ’ (i.e. what’s in the ground), and what it might be worth if brought into production.

What does that arbitrage do for the Temas share price now and in the future? Well, it all comes down to the ‘Lassonde Curve.’ Where they actually are on it – and where the market perceives them to be on it.

It can be argued that the Lassonde Curve has not treated Temas Resources with kindness with respect to its share price. Once a company has outlined a resource and is moving from ‘feasibility stage’ to ‘construction stage,’ it can be a tough place to find new investors as mining speculators flee to their natural habitat.

The question to ask here is this: What can be said to show Temas is ready to start move up the construction/institutional investment curve?

Temas in a nutshell

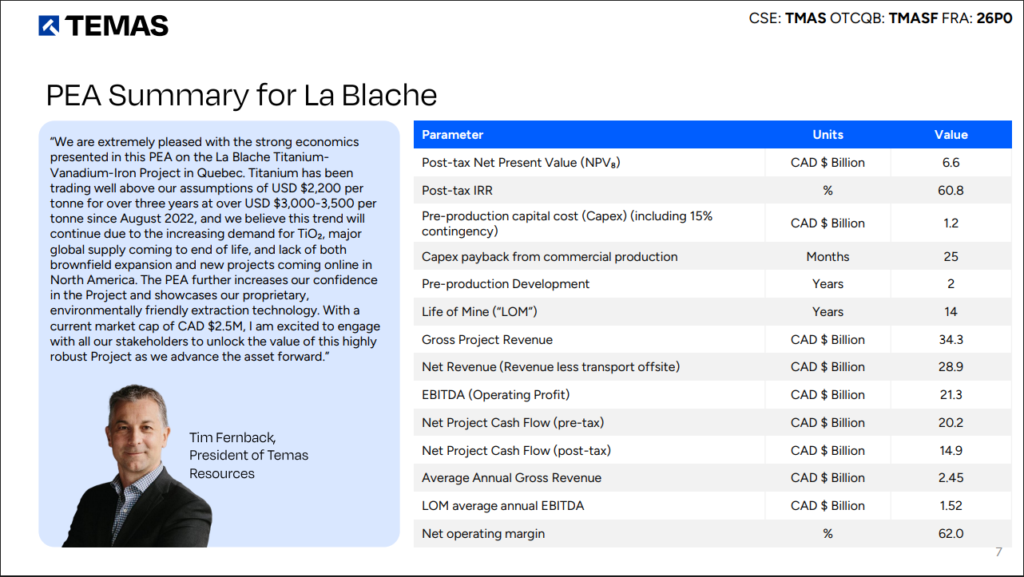

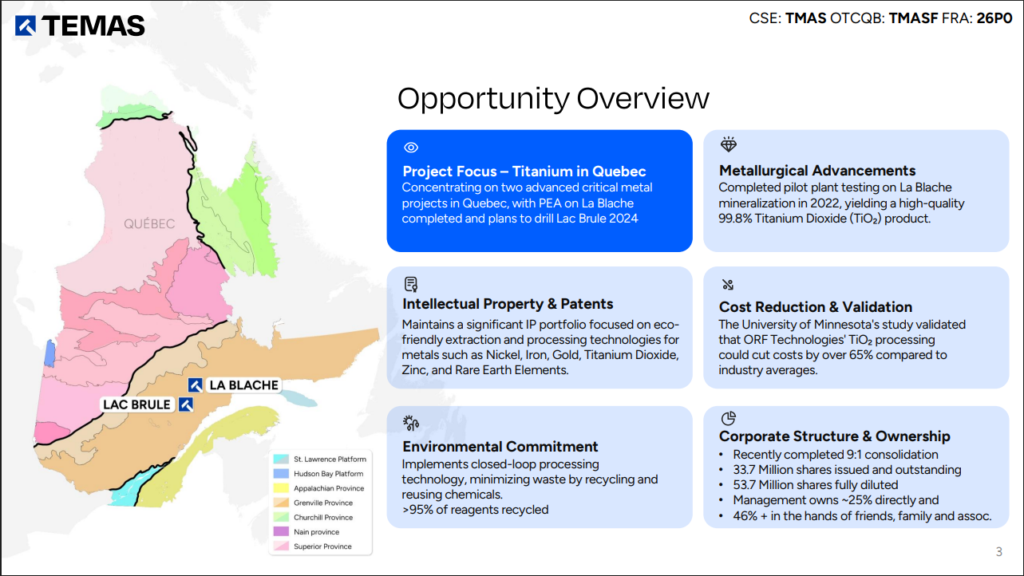

Temas Resources is primarily focused on advancing the La Blache Titanium project in Quebec, which boasts a resource of 208.5 million tonnes at 16.7% titanium oxide equivalent on an inferred basis. A preliminary economic assessment completed in 2024 outlined the project as having a net present value of $6.6 billion and an internal rate of return of 60.8% on an after-tax basis, using an 8% discount rate.

Temas also owns a suite of advanced green mineral processing technologies which it is applying to the project. The suite of technologies reduces the environmental impact and carbon footprint of metal extraction through advanced processing and patented leaching technologies.

Greener pastures in Australia

While boasting strong economics within a preliminary economic assessment, Temas faces the same challenges as any junior name looking to develop a project: funding. The company last month managed to secure $525,500 in Canada from a financing conducted at $0.075 per unit, but for real project development, further funding is obviously needed.

But Temas has a plan, as announced two weeks ago: they’re heading to Australia and the ASX, where they have proposed a new listing. Temas has engaged PAC Partners Securities, a full service brokerage firm with offices in Melbourne Sydney and Perth for an Australian Stock Exchange listing.

WATCH: $6.6 Billion NPV: Temas Resources’ Titanium Project Explained

Key to the arrangement is a concurrent capital raise that will be done on a best efforts basis, which aims to raise between A$6.0 million and A$15.0 million, with PAC to serve as the lead manager on the financing. Funding from this will be utilized to advance the La Blache project, alongside further development of Temas’ mineral processing tech and IP.

The Aussie advantage

PAC Partners looks to serve the vast audience for ASE listed stocks. This firm is one of the leading independent Australian firms in the junior/microcap mining exploration space. Over the past few years, Aussie companies are everywhere – and that includes Canada. This is due to the fact they are finding the money needed to compete with the world in junior mining exploration.

There’s an argument to be made that the Aussie Exchange in recent years has put the two junior Canadian exchanges to shame when it comes to the overall investor audience and the class of investors. In fact, just today somebody talking to this writer said that in junior mining the Aussies were much more “sophisticated,” and that’s after describing Canadian players as mere “renters” of stock. Maybe not everyone’s view point, but definitely it’s out there.

The argument can also be made that due to the above, not only does there exist a substantial arbitrage between Canadian and Aussie listings – but that there is substantial more capital to be had in the land of Oz in the current market.

And Temas seems to have the same idea in mind. Commenting on the listing, CEO Tim Fernback stated, “Listing a mining company on the ASX offers quite a few new benefits to Temas shareholders like access to capital, enhanced capital markets profile, and increased institutional ownership. The ASX resources sector is the largest by number of listings and that brings a sophisticated Australian and global institutional and retail investor base that can provide added capital and liquidity. The Australian capital markets ecosystem for resources is deep and well developed, and PAC Partners offers strong research coverage and global capital support.”

In many cases the path for a company from resource delineation to production is a long road – and in the majority of cases, honestly speaking, it’s a road that never ends. In the case of Temas, it is a big vote of confidence that a leading Australian brokerage to the junior exploration community has taken such a strong stance and commitment toward them. It is sure to bring a new audience of potential investors to the table as they outline their path along the Lassonde Curve.

FULL DISCLOSURE: Temas Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Temas Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.