On September 12, Canaccord Genuity initiated coverage on TerrAscend Corp (CSE: TER) with a buy rating and C$4.25 12-month price target, writing, “We believe TER offers a compelling investment due to its exposure to limited license states in which it has secured a full suite of vertical licenses.” They add that the Gage acquisition, which brings in a partnership with Cookies, will allow for the company to leverage partnerships into other states.

TerrAscend currently has nine analysts covering the stock with an average 12-month price target of C$5.25, or an upside of 142%. Out of the nine analysts, four have strong buy ratings, three analysts have buy ratings, and the last two analysts have hold ratings. The street high price target sits at C$8.90 and represents an upside of 310%.

Canaccord says the U.S cannabis sector “continues to trade at depressed multiples,” even though fundamentals have improved over the last quarter and a “plethora of potential growth catalysts that remain ahead.” TerrAscend is currently trading in line with the top MSOs, trading at 6.7x Canaccord’s 2023 adjusted EBITDA estimate versus 6.6x for the top MSOs. Though Canaccord believes that TerrAscend should trade at a higher premium to peers due to the states it is located in and the aligned management and high institutional ownership in the stock.

TerrAscend’s management is aligned with shareholders, especially the company’s chairman, who owns 37.8% of the company, while Canopy Growth (TSX: WEED) currently owns 16% of the company via warrants. As a result, Canaccord believes this means that management is aligned to maximize shareholder returns.

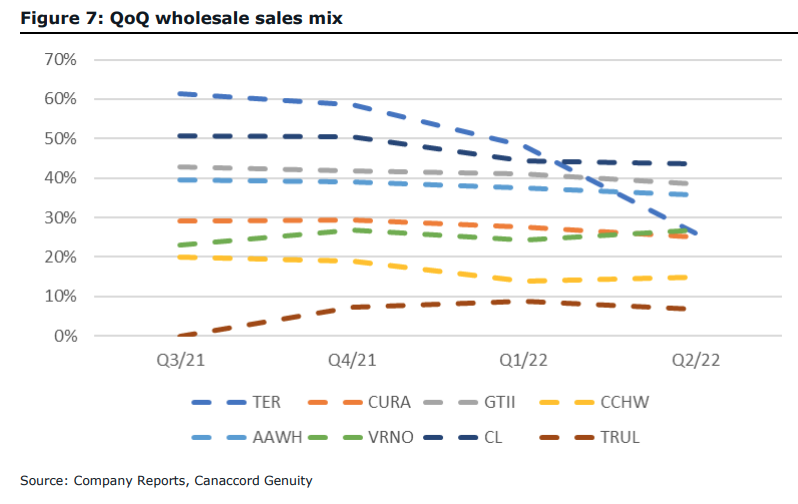

Canaccord comments that the company has had a large focus on the wholesale segment, which helps the company sell its in-house brands, leading to higher margins. However, there was an industry-wide vape recall in Pennsylvania, which led to a dip in revenue and revenue mix during the second quarter.

TerrAscend focuses on creating new distribution partners to drive market share penetration in certain states like New Jersey, Pennsylvania, and Maryland. As a result, TerrAscend’s wholesale mix has grown faster than its peers. One specific state Canaccord mentions is New Jersey, for which TerrAsecnd spent the early months building out capacity, which now allows for the company to sell its product into the recreational market as its peers “struggle to maintain an adequate supply for their own retail.”

Another reason why Canaccord likes TerrAscend is their strategy for entering limited license states are “on the cusp of adult-use reform.” As a result, Canaccord believes that the company, “is now in a position to see meaningful growth from its legacy operations in key regions.” Specifically, Maryland, where residents are expected to vote on adult-use reform in November, and Pennsylvania, which hasn’t formalized adult use, but Canaccord believes that key state officials voicing their support for broader reform means that adult-use could be around the corner.

Canaccord forecasts that TerrAscend will see explosive growth during the second half of the year, due to New Jersey flipping to adult-use and the closing of the Gage acquisition. They expect that TerrAscend has a few more levers that they will be able to pull during the second half of the year in order to help the growth.

Other than that, Canaccord expects the flip from medical to recreational cannabis in Maryland and Pennsylvania to serve as key catalysts for the business, writing, “The company will be one of only eight vertically integrated players in MD and has already established a following in PA that should translate to the recreational market, once approved.”

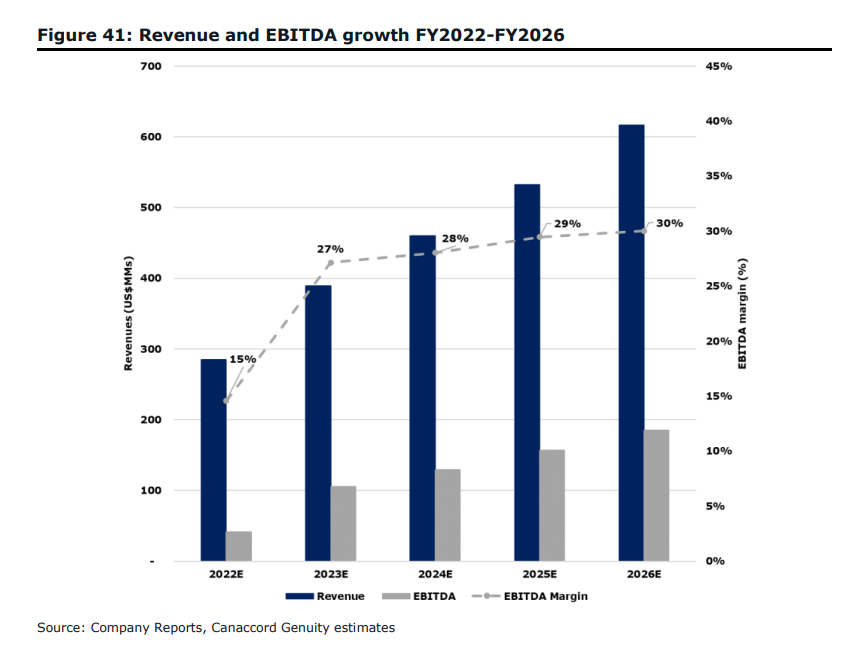

With that, Canaccord expects TerrAscend to grow its revenues by 21% compounded annually, which means growing revenues from $285.5 million in 2022 to $616 million in 2026. They expect EBITDA to grow from $41.6 million in 2022 to $185.2 million in 2026, climbing from an 18% EBITDA margin to a 30% EBITDA margin.

Lastly, they believe that TerrAscend currently has enough cash on hand to meet its needs for the next 12 months even though the company has $49 million in cash on hand and $239.6 million of debt. They state this is because the majority of TerrAscend’s CAPEX spend is now behind them.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.