The world’s largest mining companies and metal traders are warning that a massive shortfall of copper could occur as early as 2025, which could hold back global growth, stoke inflation and impact global climate goals.

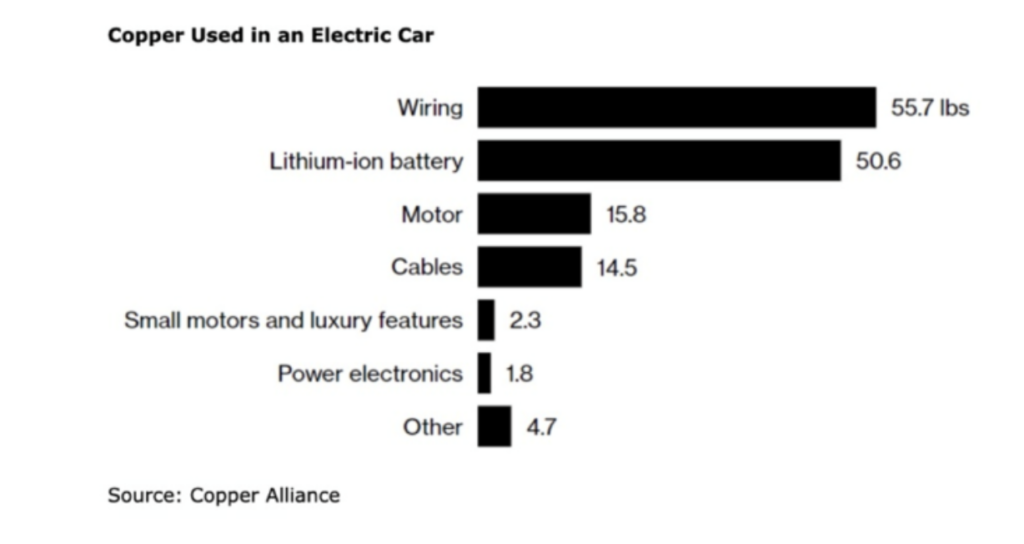

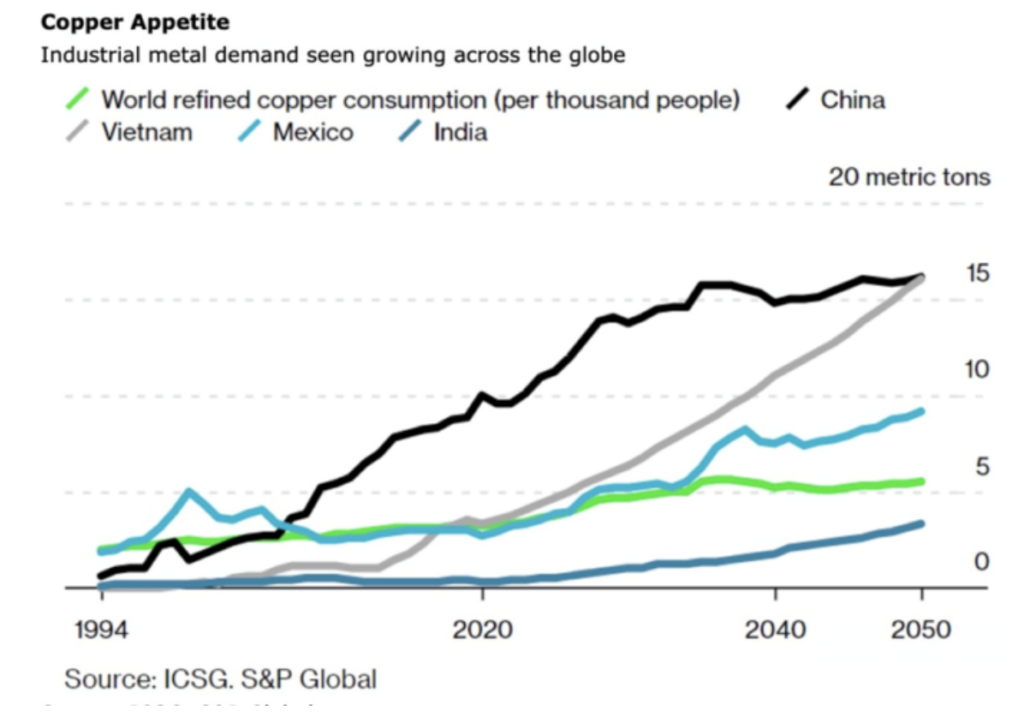

According to a recent report by S&P Global, copper demand is expected to double to 50 million tonnes annually by 2035 as the world moves towards a green economy encompassing electric vehicles and renewable energy, whereby millions of feet of copper wiring will be needed to strengthen power grids around the world, as well as build wind and solar farms. The increased demand comes in addition to copper’s traditional uses that include wiring, plumbing, communications, and power electronics.

“The energy transition is going to be dependent much more on copper than our current energy system,” S&P Global vice chairman Daniel Yergin said, as cited by CNBC. “There’s just been the assumption that copper and other minerals will be there. … Copper is the metal of electrification, and electrification is much of what the energy transition is all about.” Come 2050, that demand is forecast to increase to over 53 million metric tons, which amounts to the entire global consumption of copper between 1900 and 2021.

The copper supply problem

Meanwhile, thanks to more stringent government regulations and lack of meaningful capital inflows into the commodity, new copper mining projects are becoming sparse. According to BloombergNEF, mine supply growth is forecast to reach its peak by 2024, meaning copper is slated for an unprecedented shortfall of around 10 million tons a decade later. Analysts at Goldman Sachs suggest that mining firms will need to allocate approximately $150 billion into new mining projects over the next 10 years to address the widening deficit.

However, building new copper mines is not a quick and easy task. According to the International Energy Agency, it takes an average of 16 years from the time exploration begins to copper production. As per the International Copper Study Group, there have only been two major copper mines brought to production between 2017 and 2021; however other existing mines are forecast to undergo output declines, particularly in Chile, where declines of 5.8% are expected in 2023.

READ: Copper Prices Hit 7-Month High As Peru Protests Chokehold Supply

At the same time, the quality of ore is deteriorating globally, meaning output either slips or more rock has to be processed to produce the same amount. Benedikt Sobotka, the CEO of Eurasian Resources, expects a 10-20% rise in base metal prices this year due to surging demand for copper and supply concerns. Goldman Sachs predicts that copper prices will average around $9,750 this year, before skyrocketing to $12,000 come 2024.

Still, the potential for a recession still exists, which would subdue demand for all metal commodities, including copper. But, such a broad decrease in commodity prices could also exacerbate current supply problems by choking off cash flow and chilling investments. Still, BloombergNEF notes that such a recession wouldn’t actually reduce consumption, but rather only delay demand.

Information for this story was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.