Once again, the political theatrics surrounding America’s ballooning debt problem are back— and, as always, it’s the same old story: the Democrats are fighting tooth and nail to raise the ceiling, whilst Republicans turn the charade into an ultimatum to slash federal spending.

With the clock ticking closer and closer to the doomsday default, US President Joe Biden is turning up the hysteria, warning that America’s reputation will be “damaged in the extreme” if it fails to pay its bills, and such a default cannot be on the table. Appearing before reporters following a congressional meeting, the president asserted that the Democrats and Republicans had a “productive” meeting, whereby they agreed to create a “path forward to make sure America does not default” on its astronomical pile of debt.

.@SenSchumer speak to media after meeting with President Biden on #DebtCeiling: "We explicitly asked Speaker McCarthy, would he take default off the table. He refused. President Biden said he would…" pic.twitter.com/FAkOEEcmkD

— CSPAN (@cspan) May 9, 2023

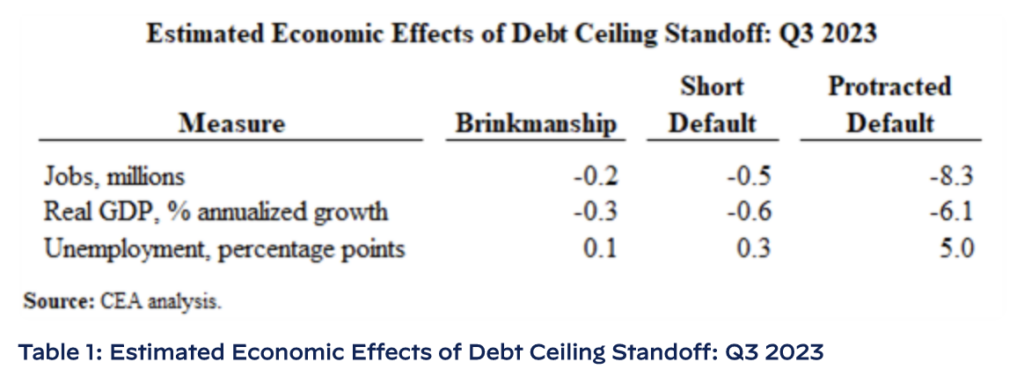

“Our economy would fall into a significant recession. It would devastate retirement accounts, increase borrowing costs,” he explained, adding that “nearly eight million Americans would lose their jobs” as well as “our international reputation would be damaged in the extreme.” Biden continued, referring to the debt as “the single most important thing that is on the agenda,” and that “America isn’t a deadbeat nation” therefore it’s imperative that Congress raises the debt ceiling to avert a default.

The president’s address comes in light of heightened debate between America’s two political parties over the country’s never-ending debt pile, with Republicans arguing government spending needs to be significantly curtailed before they’ll agree to raise the borrowing threshold. The Biden administration said it’s willing to make budget adjustments, but not “under the threat of default.”

Treasury Secretary Janet Yellen, meanwhile, continued the baton of catastrophic rhetoric, cautioning that a default on Washington’s $31.4 trillion worth of arrears would not only trigger a global economic downturn, but also put the US in a weak geopolitical position. “[It] would also risk undermining US global economic leadership and raise questions about our ability to defend our national security interests,” she explained to reporters at a press conference before last week’s G7 gathering in Japan. “A default is frankly unthinkable. America should never default. It would rank as a catastrophe.”

Indeed, such a hypothetical debt default would be catastrophic, but hyperventilating about the Republicans’ and Democrats’ doomsday prophesies are nothing new— in fact, they have become routine each year. The Congressional Budget Office along with the Treasury warn that financial markets would face significant disruptions, millions of jobs would be lost, and economic conditions would substantially deteriorate.

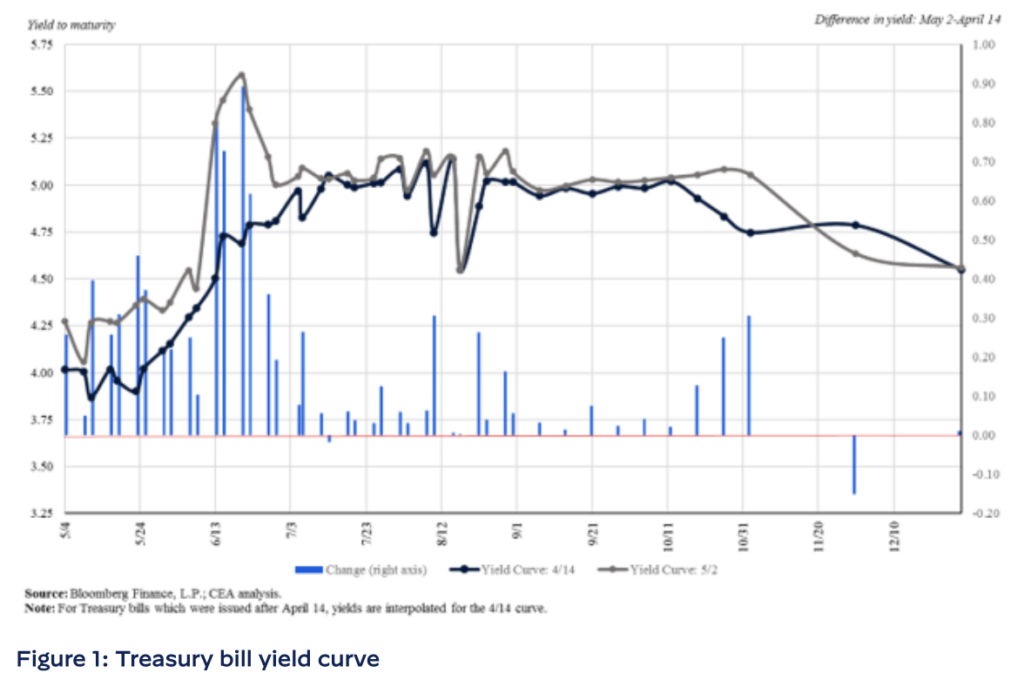

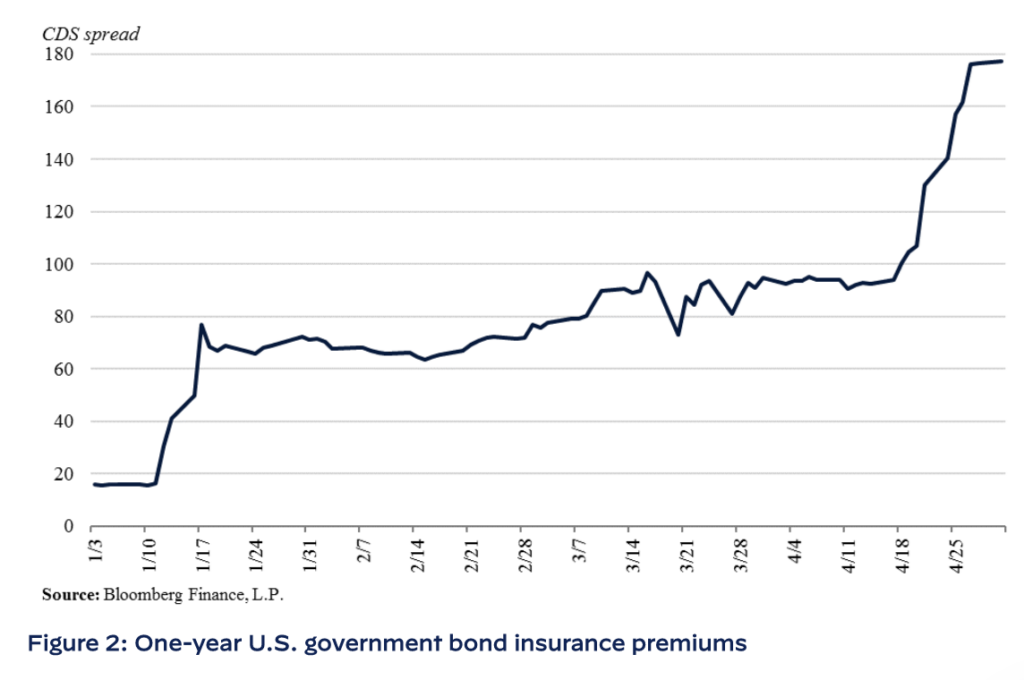

With the “X-date” of when the US can no longer pay its bills soon approaching, the CBO is already bracing for impact, illustrating that Treasury yields with maturity dates near doomsday have already risen considerably, with credit default swap spreads, too, increasing significantly in April.

“The closer the U.S. gets to the debt ceiling, the more we expect these market-stress indicators to worsen, leading to increased volatility in equity and corporate bond markets and inhibiting firms’ ability to finance themselves and engage in the productive investment that is essential for extending the current expansion,” the report postulated.

But, consider for a moment, what would actually happen should Congress fail to raise the debt ceiling. Would Treasuries collapse and a global financial meltdown ensue? Certainly not, because consider what happened in the past when mere careless fiscal policies led to government shutdowns— there wasn’t any panic, government services eventually resumed and everyone got to see payday— even “non-essential” government workers.

Indeed, that is the precise reason a financial crisis such as the one Yellen and Biden are angst about won’t materialize into anything more than a political theatre: every one of the federal government’s programs has a body of representative voters across the political spectrum. No doubt— some members of Congress would like to see a smaller government, but at the end of the day, each one of them wants a comfortable retirement for themselves and their friends— a goal only achieved in the presence of a sizeable government that provides unlimited employment opportunities for politicians that don’t want to be politicians anymore.

In other words, politicians love spending money— especially money that isn’t theirs, so sooner rather than later the White House and Congress will come to unison, raise the debt ceiling, and spending will proceed.

Information for this briefing was found via the sources mentioned within the article. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.